Investor Concerns: Examining The Reasons For Tesla's Share Price Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investor Concerns: Examining the Reasons for Tesla's Share Price Decline

Tesla, the electric vehicle (EV) giant, has experienced a significant drop in its share price recently, leaving investors wondering about the future of the company. While Tesla remains a leader in the EV market, several factors contribute to this decline, prompting serious concerns among shareholders. This article delves into the key reasons behind Tesla's fluctuating stock performance and explores the implications for investors.

Elon Musk's Influence and Twitter Acquisition:

One of the most significant factors impacting Tesla's stock price is the actions and pronouncements of its CEO, Elon Musk. His controversial acquisition of Twitter, coupled with his subsequent management decisions and frequent public pronouncements, has diverted attention and resources away from Tesla. This has led to investor uncertainty regarding the company's strategic direction and future growth potential. Musk's erratic behavior on Twitter, including controversial tweets and policy changes, has also raised concerns about his leadership and its impact on Tesla's brand image. This is a major reason for the declining investor confidence.

Increased Competition in the EV Market:

The electric vehicle market is rapidly evolving, and Tesla is facing increasing competition from established automakers like Ford, General Motors, and Volkswagen, as well as emerging EV startups. These competitors are releasing new models with competitive features and pricing, eroding Tesla's market share and impacting its profitability. The intense competition is forcing Tesla to lower prices, impacting its profit margins and consequently affecting investor sentiment.

Economic Headwinds and Global Uncertainty:

The global economic landscape is currently facing significant challenges, including inflation, rising interest rates, and recessionary fears. These macroeconomic factors negatively affect consumer spending, reducing demand for luxury goods like Tesla vehicles. Investors are becoming more risk-averse in this uncertain climate, leading to a sell-off in many growth stocks, including Tesla.

Production and Delivery Challenges:

Tesla has also faced challenges in meeting its production targets and delivering vehicles on schedule. Supply chain disruptions, factory closures, and logistical issues have all contributed to production delays, impacting revenue and investor confidence. These operational hurdles highlight potential vulnerabilities in Tesla's production capacity and its ability to meet growing demand.

Regulatory Scrutiny and Safety Concerns:

Tesla continues to face regulatory scrutiny related to its Autopilot and Full Self-Driving (FSD) systems. Investigations into safety incidents involving these advanced driver-assistance systems (ADAS) have raised concerns about the technology's reliability and potential liabilities. Negative publicity surrounding these investigations can impact consumer confidence and negatively influence the stock price.

What Does the Future Hold for Tesla?

Despite these challenges, Tesla remains a dominant player in the EV industry with a strong brand and innovative technology. However, the company needs to address the concerns outlined above to regain investor confidence. This includes improved communication strategies from Elon Musk, a more focused approach to its business operations, and a clear demonstration of its ability to navigate the increasing competition and economic headwinds. The future success of Tesla and its share price hinges on its ability to effectively address these critical issues. Only time will tell if Tesla can successfully overcome these hurdles and regain its position as a market leader.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investor Concerns: Examining The Reasons For Tesla's Share Price Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Netflixs Risky Move Season 3 Renewal For Poorly Received Drama

May 12, 2025

Netflixs Risky Move Season 3 Renewal For Poorly Received Drama

May 12, 2025 -

Chaos Erupts At Tina Arena Show Audience Members Clash

May 12, 2025

Chaos Erupts At Tina Arena Show Audience Members Clash

May 12, 2025 -

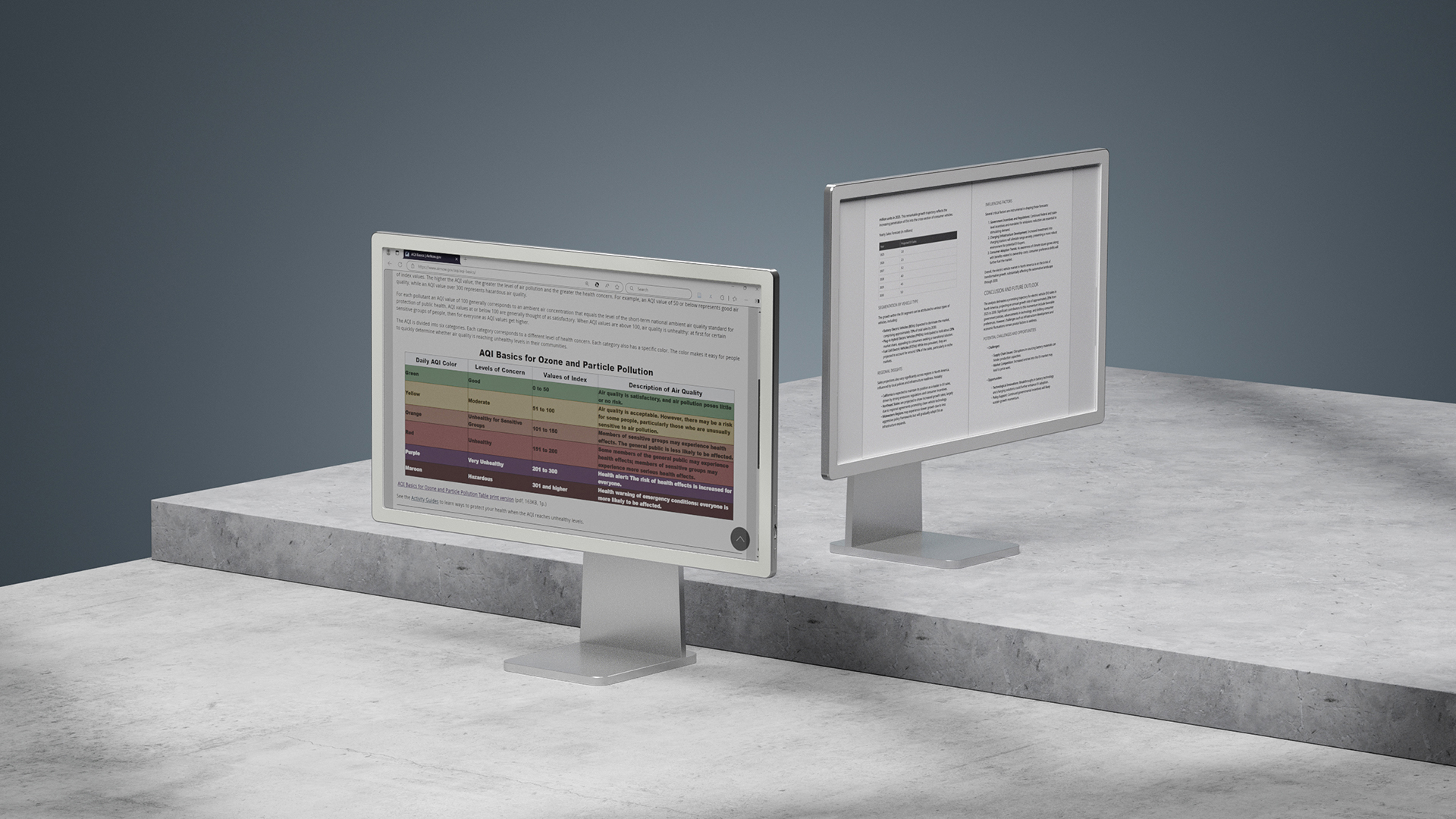

High Resolution E Ink The Cost And Benefits Of A 25 Inch Color Screen

May 12, 2025

High Resolution E Ink The Cost And Benefits Of A 25 Inch Color Screen

May 12, 2025 -

West Brom Must Avoid This Ex Swansea Boss Expert Advice

May 12, 2025

West Brom Must Avoid This Ex Swansea Boss Expert Advice

May 12, 2025 -

Analisis Del Juego De Sorloth Implicaciones Para La Estrategia Del Atletico En El Mercado De Fichajes

May 12, 2025

Analisis Del Juego De Sorloth Implicaciones Para La Estrategia Del Atletico En El Mercado De Fichajes

May 12, 2025

Latest Posts

-

Australian Politics Live Coalition Leadership Race Heats Up Victorian School Funding Cuts Announced

May 12, 2025

Australian Politics Live Coalition Leadership Race Heats Up Victorian School Funding Cuts Announced

May 12, 2025 -

Italian Open 2025 Jannik Sinner Faces Jesper De Jong Match Preview And Prediction

May 12, 2025

Italian Open 2025 Jannik Sinner Faces Jesper De Jong Match Preview And Prediction

May 12, 2025 -

Taylan Mays Nrl Return Imminent A Look At His Recovery

May 12, 2025

Taylan Mays Nrl Return Imminent A Look At His Recovery

May 12, 2025 -

Whats New In Entertainment Ginny And Georgia I Know What You Did Last Summer And More

May 12, 2025

Whats New In Entertainment Ginny And Georgia I Know What You Did Last Summer And More

May 12, 2025 -

Unravel Nyt Connections Hints And Answers For Game 700 May 11

May 12, 2025

Unravel Nyt Connections Hints And Answers For Game 700 May 11

May 12, 2025