IRS Announces Recall Of Fired Probationary Employees For Mid-April Return

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IRS Announces Recall of Fired Probationary Employees for Mid-April Tax Return Rush

The Internal Revenue Service (IRS) has made the surprising announcement that it is recalling hundreds of recently fired probationary employees to help manage the anticipated deluge of tax returns expected in mid-April. This unexpected move comes amidst growing concerns about processing delays and potential backlogs as the tax filing deadline approaches.

The IRS has faced intense scrutiny in recent years regarding its efficiency and ability to handle the annual tax season rush. This year, the situation is further complicated by ongoing staffing shortages and increased complexity in tax laws due to pandemic-related changes and new legislation. The agency has been working to address these issues, but the sheer volume of returns expected in the final days before the deadline necessitates urgent action.

Why the Recall? Addressing the Impending Tax Return Flood

The decision to recall these probationary employees is a direct response to projections indicating a significant surge in tax filings during the critical mid-April period. The IRS anticipates a higher-than-usual volume due to several factors:

- Last-minute filers: Many taxpayers leave filing until the last minute, creating a bottleneck in the system.

- Increased complexity: Changes in tax laws and credits related to pandemic relief and other economic measures have made tax preparation more complex this year.

- Backlog from previous years: The IRS is still working through a backlog of returns from previous years, adding to the pressure.

Who's Returning? Focus on Essential Processing Roles

The recalled employees are primarily those who were let go recently, and whose training focused on essential processing roles within the IRS. This strategic decision ensures a rapid integration into the existing workflow, minimizing disruption and maximizing processing capacity. The IRS emphasizes that the recall is a temporary measure, focused solely on managing the peak filing period.

Impact on Taxpayers: What to Expect

While the recall is a positive step, taxpayers are still urged to file their returns as early as possible to avoid potential delays. The IRS is providing additional resources and support to aid taxpayers in navigating the complexities of this year’s filing season.

Looking Ahead: Long-Term Staffing Solutions

While this recall offers temporary relief, the IRS acknowledges the need for long-term solutions to address its persistent staffing challenges. The agency is actively working on strategies to attract and retain skilled employees to improve its efficiency and ensure a smoother tax filing process in future years. These strategies may include:

- Competitive compensation and benefits packages: Attracting top talent in a competitive job market requires offering attractive employment terms.

- Improved training and development programs: Investing in employee development can boost morale and efficiency.

- Modernization of technology and systems: Upgrading outdated technology can streamline processes and reduce workload.

The IRS's recall of probationary employees is a significant development, highlighting the agency's efforts to meet the demands of the upcoming tax season. While temporary, this measure reflects a proactive approach to addressing challenges and ensuring the timely processing of tax returns. Taxpayers should remain vigilant and file their returns early, but this move offers a glimmer of hope for a smoother-than-anticipated filing period.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IRS Announces Recall Of Fired Probationary Employees For Mid-April Return. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Financial Markets Plunge Why You Shouldnt Panic Sell

Apr 08, 2025

Financial Markets Plunge Why You Shouldnt Panic Sell

Apr 08, 2025 -

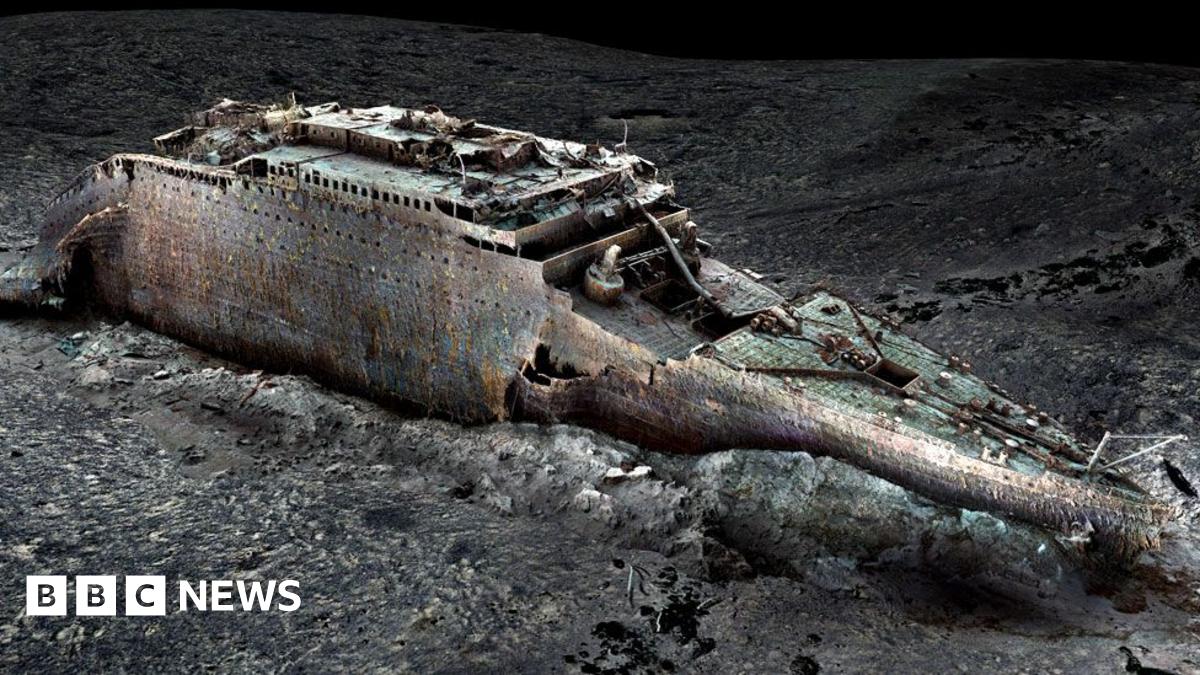

Revolutionary Sonar Scan Provides Unprecedented Look At Titanics Demise

Apr 08, 2025

Revolutionary Sonar Scan Provides Unprecedented Look At Titanics Demise

Apr 08, 2025 -

Fha Residency Requirements Key Changes For 2024

Apr 08, 2025

Fha Residency Requirements Key Changes For 2024

Apr 08, 2025 -

Snow Showers Expected Tuesday Mountain Areas Most Affected

Apr 08, 2025

Snow Showers Expected Tuesday Mountain Areas Most Affected

Apr 08, 2025 -

Hobart Stadium Witness The Agonocratic Spectacle

Apr 08, 2025

Hobart Stadium Witness The Agonocratic Spectacle

Apr 08, 2025