IRS Announces Recall Of Probationary Employees: Mid-April Deadline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IRS Announces Recall of Probationary Employees: Mid-April Deadline

The Internal Revenue Service (IRS) has issued a significant announcement impacting hundreds of probationary employees recently let go. Facing a critical staffing shortage, the agency is recalling these employees, setting a mid-April deadline for their return. This unexpected reversal comes as the IRS gears up for the peak tax season and faces intense scrutiny over its ability to handle taxpayer inquiries and process returns efficiently.

A Sudden Shift in IRS Hiring Strategy

The initial layoffs, which occurred late last year, were attributed to budgetary constraints and a perceived over-hiring. However, the IRS now acknowledges that this decision severely hampered its operational capacity. The agency is scrambling to catch up on a backlog of tax returns and address the rising volume of taxpayer calls and inquiries, leading to extended wait times and frustration among taxpayers.

This recall isn't just a simple reinstatement. The IRS is implementing stricter training programs and performance evaluations for these returning probationary employees. The agency recognizes the need to ensure that its workforce is adequately prepared to handle the complexities of tax season.

What this means for recalled employees:

- Swift Return: Recalled employees are expected to report back to their designated offices by mid-April. Specific return dates will be communicated directly to affected individuals.

- Intensive Training: The IRS is emphasizing a comprehensive retraining program to bolster employee skills and address any knowledge gaps. This includes updated training on tax codes, software applications, and customer service protocols.

- Performance Monitoring: The agency will implement robust performance monitoring systems to evaluate the recalled employees' productivity and effectiveness. This will be crucial in determining future staffing needs and strategies.

- Potential for Full-Time Positions: Successful completion of the probationary period, following this recall, could pave the way for permanent employment opportunities.

Addressing the IRS Staffing Crisis

The recall underscores the ongoing staffing challenges facing the IRS. The agency has been consistently underfunded, leading to a significant decline in its workforce over the years. This, coupled with an increase in taxpayer complexity and a greater reliance on digital services, has put immense pressure on existing employees.

The IRS has publicly acknowledged the need for increased funding and resources to address this long-standing issue. They are actively lobbying Congress for additional budgetary support to improve infrastructure, hire and train more personnel, and enhance their technological capabilities.

Looking Ahead: Impact on Tax Season and Taxpayers

The recall of probationary employees is a crucial step in the IRS's efforts to improve its service delivery during the current tax season. While this move is welcomed by many, the true impact remains to be seen. Taxpayers are still urged to file their returns early and to be prepared for potential delays. The IRS continues to encourage the use of their online services, which can help expedite processing times. This situation highlights the critical need for ongoing investment in the IRS to ensure efficient and effective tax administration for all American taxpayers. Keep an eye on the IRS website for official updates and further announcements regarding this recall.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IRS Announces Recall Of Probationary Employees: Mid-April Deadline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dow Futures Dive 1000 Points Tariff Worries Deepen Market Crisis

Apr 07, 2025

Dow Futures Dive 1000 Points Tariff Worries Deepen Market Crisis

Apr 07, 2025 -

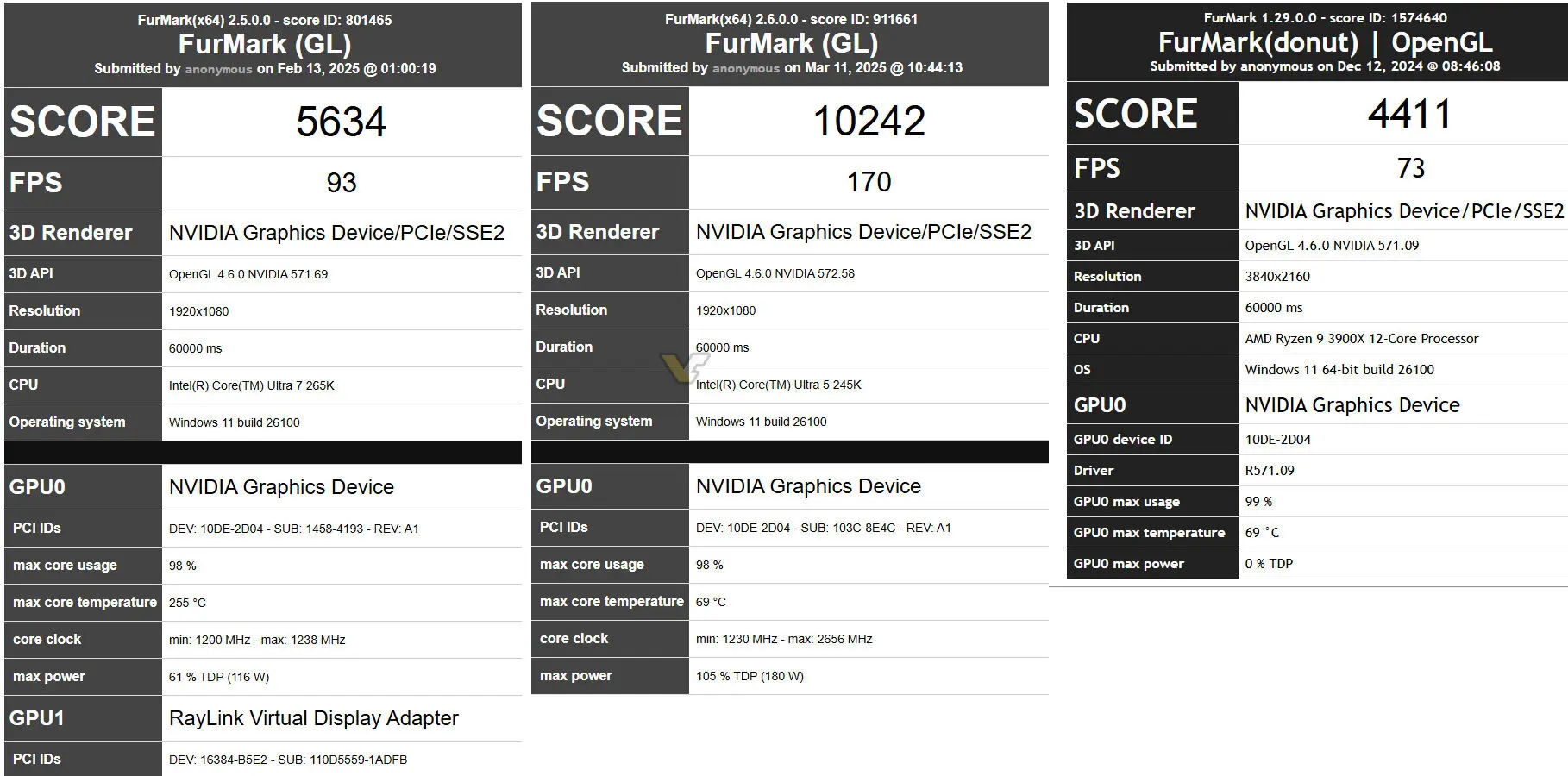

Fur Mark Database Leaks Nvidia Rtx 5060 Ti Performance At 180 W Tdp

Apr 07, 2025

Fur Mark Database Leaks Nvidia Rtx 5060 Ti Performance At 180 W Tdp

Apr 07, 2025 -

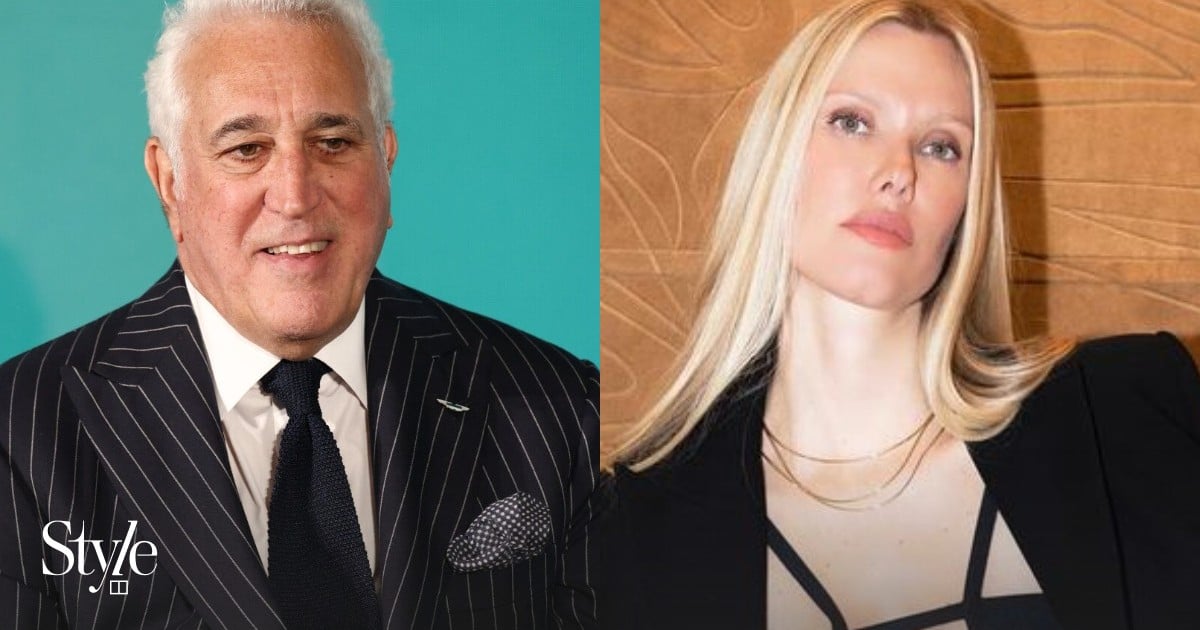

Raquel Stroll Design Lifestyle And Marriage To Lawrence Stroll

Apr 07, 2025

Raquel Stroll Design Lifestyle And Marriage To Lawrence Stroll

Apr 07, 2025 -

Dana Kaget Hari Ini Minggu 6 April 2025 Cara Dapat Saldo Gratis

Apr 07, 2025

Dana Kaget Hari Ini Minggu 6 April 2025 Cara Dapat Saldo Gratis

Apr 07, 2025 -

Crafting A Unicorns Death A Directors Perspective

Apr 07, 2025

Crafting A Unicorns Death A Directors Perspective

Apr 07, 2025