IRS Compliance For U.S. Expats: A Six-Week Opportunity For A $1,400 Refund

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IRS Compliance for U.S. Expats: Six Weeks to Claim a $1,400 Refund!

Are you a U.S. expat struggling with IRS compliance? Don't miss this limited-time opportunity to potentially reclaim a significant tax refund. The IRS offers a crucial window for many Americans living abroad to rectify past tax filing issues and potentially receive a substantial refund. For some, this could mean a significant windfall of up to $1,400 – but time is running out! This six-week opportunity demands immediate attention.

Understanding the Foreign Earned Income Exclusion (FEIE)

Many U.S. citizens and resident aliens working overseas are unaware of the Foreign Earned Income Exclusion (FEIE). This powerful tax break allows you to exclude a portion of your foreign income from U.S. taxation. However, claiming this exclusion requires meticulous record-keeping and accurate filing – a process many expats find daunting. Failure to properly claim the FEIE could mean you've been overpaying your taxes for years.

The Streamlined Procedure: Your Path to IRS Compliance

The IRS's Streamlined Foreign Offshore Procedures offer a lifeline for expats who have unintentionally fallen out of compliance. This program allows qualifying individuals to become current with their tax obligations without facing penalties for past non-compliance. However, it's a limited-time offer with strict deadlines. This year, the opportunity is closing soon!

Who Qualifies for the Streamlined Procedure?

To qualify, you must meet certain criteria, including:

- Three years of non-compliance: You must have failed to file U.S. tax returns for at least three consecutive years.

- No intent to defraud: The IRS must be convinced that your non-compliance was unintentional.

- Complete current and past tax returns: You must file all outstanding tax returns, along with the necessary forms such as Form 2555 (Foreign Earned Income) and Form 8938 (Statement of Specified Foreign Financial Assets).

Why You Could Receive a $1,400 Refund (or More!)

The potential for a $1,400 refund stems from the combination of several factors:

- Unclaimed FEIE: As mentioned, failing to claim the FEIE results in overpayment of taxes. The amount you're eligible to exclude can significantly reduce your taxable income.

- Foreign Tax Credits: You may be entitled to foreign tax credits, further reducing your U.S. tax liability.

- Unclaimed deductions and credits: Many other deductions and credits exist that can help reduce your overall tax burden.

The actual refund amount will vary significantly based on individual circumstances, including income level, tax rates, and specific deductions and credits claimed. For some, the refund could exceed $1,400 considerably.

Act Now: Time is of the Essence!

This six-week window is incredibly short, and the complexity of international tax law demands professional assistance. Don't delay! Contact a qualified tax professional specializing in expat taxation immediately. They can help you navigate the intricacies of the Streamlined Procedure, ensure accurate filing, and maximize your potential refund.

Key Takeaways:

- Limited-time opportunity: The Streamlined Procedure window closes soon!

- Potential for significant refunds: Many expats can reclaim thousands of dollars.

- Seek professional help: A qualified tax advisor is crucial for navigating this complex process.

Don't let this opportunity slip away. Take control of your tax situation and reclaim what's rightfully yours. Contact a tax professional today!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IRS Compliance For U.S. Expats: A Six-Week Opportunity For A $1,400 Refund. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

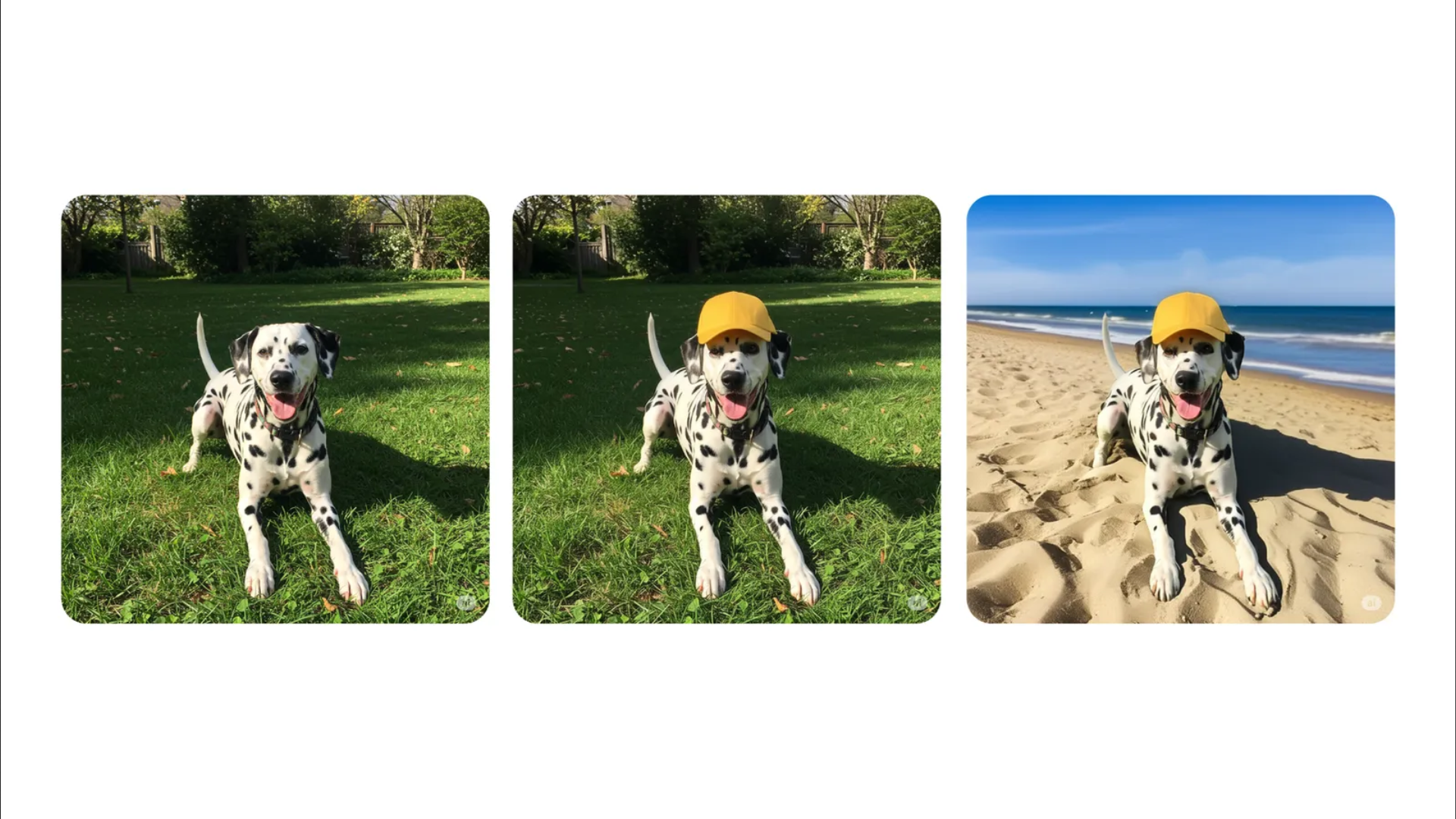

Direct Image Editing Now Available In Gemini A Users Guide

May 08, 2025

Direct Image Editing Now Available In Gemini A Users Guide

May 08, 2025 -

Contest Alert Win Tickets To Shadow Forces Show

May 08, 2025

Contest Alert Win Tickets To Shadow Forces Show

May 08, 2025 -

Kris Bryants Back Ablation Procedure Confirmed

May 08, 2025

Kris Bryants Back Ablation Procedure Confirmed

May 08, 2025 -

India Pakistan Tensions Kashmir Airports Shut Down Unprecedented Calm Descends

May 08, 2025

India Pakistan Tensions Kashmir Airports Shut Down Unprecedented Calm Descends

May 08, 2025 -

George Pickens Trade Rumors Heat Up Potential Destinations And Impact

May 08, 2025

George Pickens Trade Rumors Heat Up Potential Destinations And Impact

May 08, 2025

Latest Posts

-

Denver Nuggets Defeat Oklahoma City Thunder May 5 2025 Game Recap

May 08, 2025

Denver Nuggets Defeat Oklahoma City Thunder May 5 2025 Game Recap

May 08, 2025 -

2025 Nba Season Denver Nuggets Vs Oklahoma City Thunder May 7th Game Report

May 08, 2025

2025 Nba Season Denver Nuggets Vs Oklahoma City Thunder May 7th Game Report

May 08, 2025 -

Denver Nuggets At Oklahoma City Thunder Game 1 Analysis And Betting Odds

May 08, 2025

Denver Nuggets At Oklahoma City Thunder Game 1 Analysis And Betting Odds

May 08, 2025 -

Fact Check Pakistan Ministers Claim Of No Terror Camps Faces Scrutiny

May 08, 2025

Fact Check Pakistan Ministers Claim Of No Terror Camps Faces Scrutiny

May 08, 2025 -

35 Unit 42 U Racks A Us Vendors Choice Of Amd Epyc 4005 Mini Pcs For High Density Computing

May 08, 2025

35 Unit 42 U Racks A Us Vendors Choice Of Amd Epyc 4005 Mini Pcs For High Density Computing

May 08, 2025