IRS Layoffs Spark Concerns: Could AI Replace Human Workers?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IRS Layoffs Spark Concerns: Could AI Replace Human Workers?

The Internal Revenue Service (IRS) recently announced a series of layoffs, igniting widespread concern about the future of employment within the agency and raising the specter of artificial intelligence (AI) taking over human roles. While the IRS cites budget constraints and restructuring as the primary reasons, the timing coincides with increased investment in AI technologies for tax processing and auditing. This raises critical questions about the long-term impact on IRS employees and the potential for widespread AI-driven job displacement in the public sector.

The Layoff Announcement and its Fallout

The IRS's recent layoff announcement, impacting a significant number of employees across various departments, has sent shockwaves through the workforce. Many fear that these cuts represent more than just a budgetary response, pointing to the increasing automation capabilities of AI as a possible underlying factor. The uncertainty surrounding job security has led to widespread anxiety and calls for greater transparency from the IRS regarding its long-term workforce planning. Union representatives have already voiced strong opposition, demanding answers about the agency's commitment to its employees and the potential role of AI in future workforce reductions.

The Rise of AI in Tax Administration

The IRS has been steadily investing in AI and machine learning technologies to improve efficiency and accuracy in tax processing and auditing. AI-powered systems can analyze vast amounts of data, identify potential tax fraud, and automate routine tasks, potentially leading to significant cost savings. While these technologies offer benefits in terms of speed and accuracy, they also raise concerns about the displacement of human workers whose jobs become automated.

Specific AI Applications in the IRS:

- Automated Tax Return Processing: AI can quickly process simple tax returns, freeing up human agents to focus on more complex cases.

- Fraud Detection: AI algorithms can identify patterns and anomalies that indicate potential tax fraud, leading to more effective enforcement.

- Auditing and Compliance: AI can assist auditors in identifying high-risk taxpayers and prioritizing audits more efficiently.

- Customer Service: AI-powered chatbots can answer frequently asked questions and provide basic tax assistance, reducing the workload on human customer service representatives.

The Human Element: Irreplaceable Skills and Concerns

While AI can automate many tasks, it’s crucial to acknowledge the limitations of current technology. Certain aspects of tax administration still require human judgment, empathy, and complex problem-solving skills. Dealing with nuanced situations, understanding individual circumstances, and providing personalized assistance remain crucial elements that AI struggles to replicate effectively.

The ethical implications of widespread AI adoption within the IRS are also significant. Concerns regarding algorithmic bias, data privacy, and the potential for increased inequality need careful consideration. Ensuring fairness and transparency in the application of AI is paramount to avoid exacerbating existing inequalities.

Looking Ahead: Retraining and the Future of Work

The IRS layoffs underscore the urgent need for proactive measures to address the impact of AI on the workforce. Investing in comprehensive retraining and upskilling programs for displaced workers is essential to equip them with the skills needed to thrive in a changing job market. This might involve focusing on areas such as data analysis, cybersecurity, and AI-related roles themselves. A collaborative approach involving the IRS, labor unions, and educational institutions is critical to ensure a just transition for affected employees.

The integration of AI in the IRS is inevitable, but it shouldn't come at the expense of human workers without proper planning and mitigation strategies. Open dialogue, transparency, and a focus on human capital development are crucial to navigate the challenges and harness the benefits of AI responsibly. The future of work within the IRS and beyond hinges on addressing these concerns proactively and ensuring a fair and equitable transition.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IRS Layoffs Spark Concerns: Could AI Replace Human Workers?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Denver Nuggets 43 Point Victory Evens Up Series Against Oklahoma City Thunder

May 11, 2025

Denver Nuggets 43 Point Victory Evens Up Series Against Oklahoma City Thunder

May 11, 2025 -

Securing The Future The Rise Of Decentralized Cloud And Its Impact On Risk Management

May 11, 2025

Securing The Future The Rise Of Decentralized Cloud And Its Impact On Risk Management

May 11, 2025 -

Round 10 Injury News Which Players Are Out And Whos Questionable

May 11, 2025

Round 10 Injury News Which Players Are Out And Whos Questionable

May 11, 2025 -

Inversion De Buffett En Apple Disminucion Significativa Del 13 Los Motivos Detras De La Decision

May 11, 2025

Inversion De Buffett En Apple Disminucion Significativa Del 13 Los Motivos Detras De La Decision

May 11, 2025 -

Nine Days In Hospital How A Ufc Fighter Fought Back From A Devastating Infection

May 11, 2025

Nine Days In Hospital How A Ufc Fighter Fought Back From A Devastating Infection

May 11, 2025

Latest Posts

-

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025 -

Catching A Glimpse Of Mays Full Flower Moon A Practical Guide

May 12, 2025

Catching A Glimpse Of Mays Full Flower Moon A Practical Guide

May 12, 2025 -

Gary Sun On Coinbases Esports Strategy Building Trust And Expanding Cryptos Reach

May 12, 2025

Gary Sun On Coinbases Esports Strategy Building Trust And Expanding Cryptos Reach

May 12, 2025 -

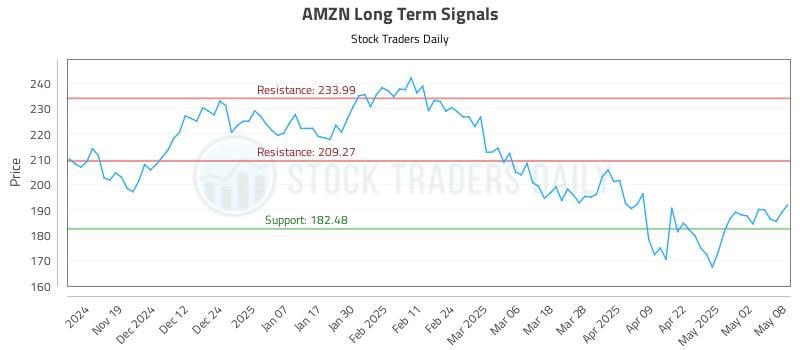

Is Amzn A Buy In Depth Investment Report And Stock Forecast

May 12, 2025

Is Amzn A Buy In Depth Investment Report And Stock Forecast

May 12, 2025