IRS Layoffs Spark Fears: Will AI Replace Human Workers?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IRS Layoffs Spark Fears: Will AI Replace Human Workers?

The Internal Revenue Service (IRS) recently announced layoffs, sparking widespread concern and igniting a debate about the future of work in the federal government. While the IRS cites budget constraints as the primary reason, the timing coincides with increased investment in artificial intelligence (AI) technologies, leading many to question whether AI will ultimately replace human workers. This raises crucial questions about job security, the evolving nature of work, and the potential societal impact of automation.

The IRS Layoff Announcement: A Closer Look

The recent IRS layoffs affected a significant number of employees across various departments. While the official statement emphasized budgetary challenges and a need for restructuring, the lack of transparency surrounding specific roles impacted has fueled speculation. Many fear that positions requiring repetitive tasks, data entry, and basic tax processing are most vulnerable to automation.

The Rise of AI in Tax Processing

The IRS has been actively exploring AI and machine learning to improve efficiency and accuracy in tax processing. AI-powered systems can automate tasks like:

- Tax form processing: Quickly and accurately identifying and extracting data from tax returns.

- Fraud detection: Identifying suspicious patterns and flagging potentially fraudulent returns for further investigation.

- Auditing: Analyzing tax data to identify potential discrepancies and areas requiring further review.

- Customer service: Providing automated responses to frequently asked questions and resolving basic tax issues.

These capabilities significantly reduce the need for manual labor in certain areas, creating a potential displacement of human workers.

Will AI Completely Replace Human IRS Employees?

While AI can automate many tasks, it's unlikely to completely replace human workers within the IRS. Complex tax cases requiring nuanced judgment, ethical considerations, and human interaction will continue to necessitate the expertise of trained professionals. Furthermore, the IRS still needs employees to:

- Handle complex cases: AI struggles with unusual circumstances or ambiguous tax laws.

- Develop and implement policy: Human expertise is crucial for creating and updating tax laws and regulations.

- Maintain human contact: Many taxpayers prefer and require interaction with human agents for support and clarification.

- Oversee AI systems: AI requires human oversight to ensure accuracy, fairness, and ethical implementation.

The Broader Implications: Job Security and the Future of Work

The IRS layoffs underscore a larger trend: the increasing impact of automation on the job market. This raises critical questions about:

- Retraining and reskilling: How can displaced workers be effectively retrained for new roles in a rapidly evolving economy?

- Social safety nets: What support systems are needed to help workers transition to new careers?

- Ethical considerations: How can we ensure that AI is used responsibly and ethically, minimizing negative societal impacts?

The situation at the IRS serves as a stark reminder of the need for proactive measures to address the challenges of automation. Investing in education, retraining programs, and robust social safety nets are crucial for mitigating the negative consequences of technological advancements and ensuring a just and equitable transition to a future shaped by AI. The ongoing discussion surrounding these issues is vital for shaping a future of work that benefits all members of society.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IRS Layoffs Spark Fears: Will AI Replace Human Workers?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Liverpool Transfer News Alan Shearer On Cody Gakpo And A Recent Sighting

May 11, 2025

Liverpool Transfer News Alan Shearer On Cody Gakpo And A Recent Sighting

May 11, 2025 -

Sucessor De Buffett Escolhido Greg Abel E O Rumo Dos Investimentos Da Berkshire

May 11, 2025

Sucessor De Buffett Escolhido Greg Abel E O Rumo Dos Investimentos Da Berkshire

May 11, 2025 -

2 9 Billion Acquisition Coinbases Deribit Deal And Its Impact On Coin Stock

May 11, 2025

2 9 Billion Acquisition Coinbases Deribit Deal And Its Impact On Coin Stock

May 11, 2025 -

Under Pressure Evaluating Early R9 Moves By Traders

May 11, 2025

Under Pressure Evaluating Early R9 Moves By Traders

May 11, 2025 -

The Nelson Asofa Solomona Try That Defined The Match

May 11, 2025

The Nelson Asofa Solomona Try That Defined The Match

May 11, 2025

Latest Posts

-

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

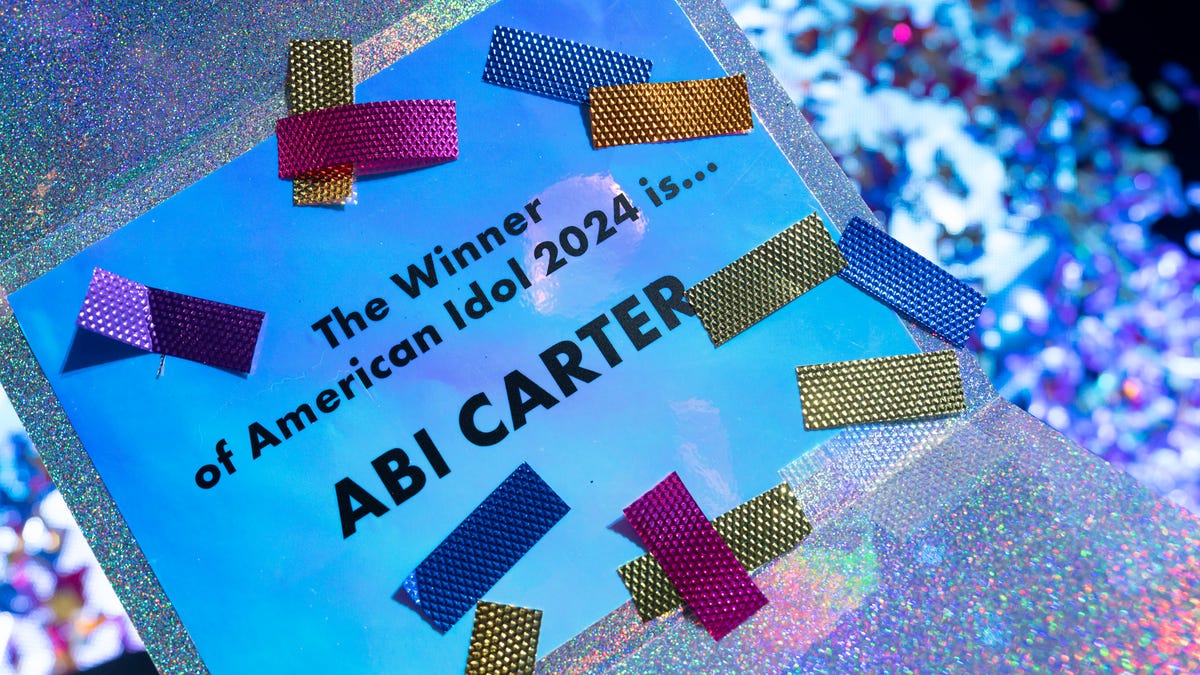

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025 -

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025