IRS Mass Layoffs Fuel Debate: The Rise Of AI In Tax Administration

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IRS Mass Layoffs Fuel Debate: The Rise of AI in Tax Administration

The Internal Revenue Service (IRS) is facing a wave of retirements and planned layoffs, sparking a heated debate about the future of tax administration in the United States. While the agency cites budgetary constraints and workforce attrition as the primary reasons, the looming question is: can artificial intelligence (AI) effectively fill the void left by experienced human tax professionals? This shift raises significant concerns about fairness, accuracy, and the very nature of taxpayer interaction with the IRS.

The Human Cost of Automation:

The projected reduction in IRS staff translates to fewer human agents available to answer taxpayer questions, resolve complex issues, and conduct audits. This potential loss of expertise could lead to longer wait times, increased errors in processing returns, and a less personalized experience for taxpayers. Critics argue that replacing human judgment with algorithms, especially in nuanced situations, risks exacerbating existing inequalities and creating further burdens for vulnerable populations.

AI's Promise and Peril in Tax Processing:

Proponents of AI integration within the IRS highlight its potential to streamline processes, automate routine tasks, and improve efficiency. AI-powered systems can analyze vast datasets to identify potential errors, flag suspicious returns, and expedite refunds. This could lead to significant cost savings and potentially reduce the tax gap – the difference between taxes owed and taxes collected.

However, the reliance on AI also presents substantial challenges. Concerns include:

- Algorithmic bias: AI systems are trained on data, and if that data reflects existing societal biases, the resulting algorithms could perpetuate and even amplify those biases in tax assessments.

- Lack of transparency: The complex decision-making processes of some AI systems can be opaque, making it difficult to understand why a particular outcome was reached. This lack of transparency can erode public trust and make it challenging to challenge assessments.

- Data security and privacy: The increasing reliance on AI necessitates the handling of massive amounts of sensitive taxpayer data, raising serious concerns about security breaches and data privacy violations.

The Future of Taxpayer-IRS Interaction:

The changing landscape of tax administration is forcing a reconsideration of how taxpayers interact with the IRS. A greater reliance on online portals and automated systems necessitates improved digital literacy among taxpayers and accessible support systems for those who struggle with technology.

Navigating the Transition:

The shift towards AI in tax administration requires a carefully considered and balanced approach. Simply replacing human employees with AI without adequate oversight, training, and safeguards is a recipe for disaster. The IRS must prioritize:

- Investing in robust oversight mechanisms: Independent audits and evaluations are crucial to ensure the fairness and accuracy of AI-driven systems.

- Prioritizing transparency and explainability: Efforts should be made to make the decision-making processes of AI systems more transparent and understandable.

- Protecting taxpayer data: Strong cybersecurity measures and data privacy protocols are essential to prevent breaches and maintain public trust.

- Addressing the digital divide: Providing resources and support to help all taxpayers navigate the increasingly digital world of tax administration is critical.

The mass layoffs at the IRS are not simply a matter of budget cuts; they represent a pivotal moment in the evolution of tax administration. The successful integration of AI requires a commitment to fairness, transparency, and accountability – ensuring that the benefits of technology are shared equitably and that taxpayer rights are protected. The debate is far from over, and the coming years will be crucial in shaping the future of tax administration in the digital age.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IRS Mass Layoffs Fuel Debate: The Rise Of AI In Tax Administration. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unfair Isa Charges 1 000 Penalty For Early Withdrawals

May 11, 2025

Unfair Isa Charges 1 000 Penalty For Early Withdrawals

May 11, 2025 -

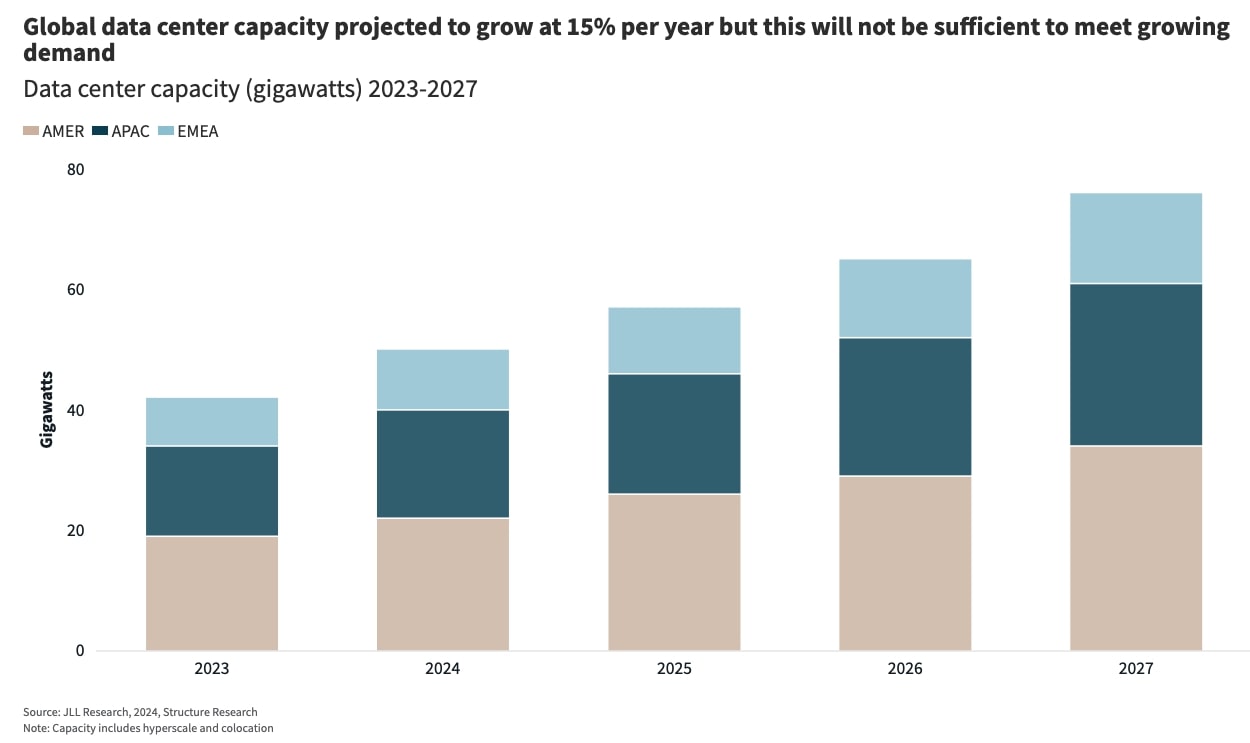

Navigating The Shift Ai Data Center Market Growth Amidst Industry Adjustments

May 11, 2025

Navigating The Shift Ai Data Center Market Growth Amidst Industry Adjustments

May 11, 2025 -

Lifetime Isa Myths Busted Maximize Your Savings Potential

May 11, 2025

Lifetime Isa Myths Busted Maximize Your Savings Potential

May 11, 2025 -

A List Cast Scarlett Johansson Miles Teller And Adam Driver Spotted Filming Paper Tiger In N J

May 11, 2025

A List Cast Scarlett Johansson Miles Teller And Adam Driver Spotted Filming Paper Tiger In N J

May 11, 2025 -

Danny Dyer Extends Rehab Stay Following Daughter Danis Heartfelt Letter

May 11, 2025

Danny Dyer Extends Rehab Stay Following Daughter Danis Heartfelt Letter

May 11, 2025

Latest Posts

-

Easy Win For Celtics In New York Nba Rumors And Game Recap

May 12, 2025

Easy Win For Celtics In New York Nba Rumors And Game Recap

May 12, 2025 -

President Japarovs Moscow Trip Key Discussions And Agreements

May 12, 2025

President Japarovs Moscow Trip Key Discussions And Agreements

May 12, 2025 -

Decoding The Genius Act Implications For Stablecoin Regulation And Growth

May 12, 2025

Decoding The Genius Act Implications For Stablecoin Regulation And Growth

May 12, 2025 -

Nbc Leverages Ai To Reintroduce Iconic Nba Announcer Jim Fagan

May 12, 2025

Nbc Leverages Ai To Reintroduce Iconic Nba Announcer Jim Fagan

May 12, 2025 -

Transfer News Real Madrids Pursuit Of Alexander Arnold Heats Up As Liverpool Exit Beckons

May 12, 2025

Transfer News Real Madrids Pursuit Of Alexander Arnold Heats Up As Liverpool Exit Beckons

May 12, 2025