Is $150 The Next Stop For Nvidia Stock? Analyzing NVDA's Trajectory.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is $150 the Next Stop for Nvidia Stock? Analyzing NVDA's Trajectory

Nvidia (NVDA) has been on an absolute tear, leaving many investors wondering: what's next? After recently surpassing $140, the question on everyone's mind is whether the stock's meteoric rise will continue, pushing towards the $150 mark. This in-depth analysis examines Nvidia's current trajectory, considering key factors influencing its price and forecasting potential future movements.

Nvidia's Unstoppable Momentum: A Deep Dive into Recent Performance

Nvidia's recent success is undeniably linked to the explosive growth of the artificial intelligence (AI) sector. The company's high-performance GPUs are crucial for training large language models (LLMs) and powering the burgeoning AI infrastructure. This surging demand has translated into phenomenal financial results, exceeding even the most optimistic projections. The company's strong Q2 earnings report, showcasing record revenue and profit, further solidified investor confidence. This strong financial performance is a major catalyst driving the stock price higher.

Key Factors Fueling Nvidia's Ascent:

- AI Dominance: Nvidia's near-monopoly in the high-end GPU market for AI applications is a significant factor in its sustained growth. Competitors are struggling to keep pace with Nvidia's technological advancements and production capacity.

- Data Center Growth: The demand for Nvidia's GPUs in data centers is booming, fueled by the increasing adoption of AI and cloud computing. This sector is expected to remain a significant driver of Nvidia's revenue for the foreseeable future.

- Strong Brand Recognition and Investor Confidence: Nvidia's reputation for innovation and technological leadership inspires strong investor confidence, contributing to the stock's upward trajectory. This positive sentiment often translates into higher valuations.

- Strategic Partnerships: Nvidia's collaborations with major tech companies further strengthen its position in the market and provide access to new opportunities.

Challenges and Potential Headwinds:

While the outlook appears overwhelmingly positive, several potential headwinds could impact Nvidia's future performance:

- Supply Chain Disruptions: Global supply chain issues could potentially constrain Nvidia's production capacity, affecting its ability to meet the high demand for its products.

- Increased Competition: While currently dominant, increased competition from other chip manufacturers could eventually erode Nvidia's market share.

- Overvaluation Concerns: Some analysts express concern that Nvidia's stock may be overvalued, suggesting a potential correction in the future.

- Economic Slowdown: A potential global economic slowdown could dampen demand for high-end computing power, impacting Nvidia's sales.

Reaching $150: A Realistic Goal?

Reaching $150 is certainly within the realm of possibility, given Nvidia's current momentum and the continued growth of the AI market. However, several factors must be considered. Maintaining the current rate of growth will be challenging, and any significant setbacks could cause a price correction. Analysts' price targets vary significantly, highlighting the uncertainty surrounding future performance. While some predict further substantial gains, others suggest caution due to potential overvaluation.

Conclusion: A Cautious Optimism

Nvidia's future looks bright, fueled by the explosive growth of AI. The $150 milestone is a realistic target, though not guaranteed. Investors should carefully consider the potential risks alongside the substantial rewards before making any investment decisions. Thorough due diligence, considering both positive and negative factors, is crucial for navigating this exciting but volatile market. Continuous monitoring of Nvidia's financial performance, industry trends, and competitive landscape is essential for informed investment choices. The journey to $150 and beyond will be determined by a complex interplay of factors, making careful analysis and informed decision-making paramount for any investor considering NVDA.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is $150 The Next Stop For Nvidia Stock? Analyzing NVDA's Trajectory.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fortune 500 Cybersecurity Crisis Spy Cloud Highlights Widespread Phishing Vulnerability

May 12, 2025

Fortune 500 Cybersecurity Crisis Spy Cloud Highlights Widespread Phishing Vulnerability

May 12, 2025 -

Jasmine Rice Bgt Audition Shadowed By Personal Tragedy

May 12, 2025

Jasmine Rice Bgt Audition Shadowed By Personal Tragedy

May 12, 2025 -

Womens Tri Nation Series India Bats First After Winning Toss Against Sri Lanka In Final

May 12, 2025

Womens Tri Nation Series India Bats First After Winning Toss Against Sri Lanka In Final

May 12, 2025 -

Mantras Om Collapse How Ai Could Have Predicted And Prevented The Crisis

May 12, 2025

Mantras Om Collapse How Ai Could Have Predicted And Prevented The Crisis

May 12, 2025 -

Expert Analysis Ai Semiconductor Stock Poised For Post May 28th Rally

May 12, 2025

Expert Analysis Ai Semiconductor Stock Poised For Post May 28th Rally

May 12, 2025

Latest Posts

-

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

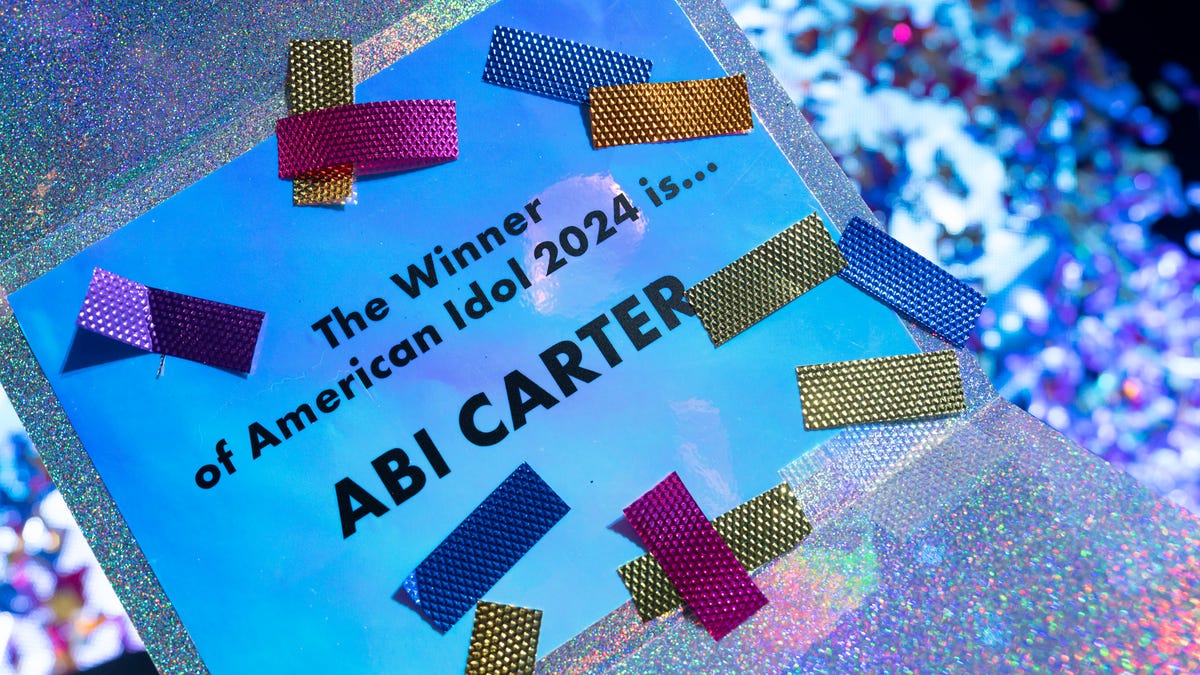

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025 -

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025