Is Bitcoin's Recent Rise Due To Trump? Investment Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

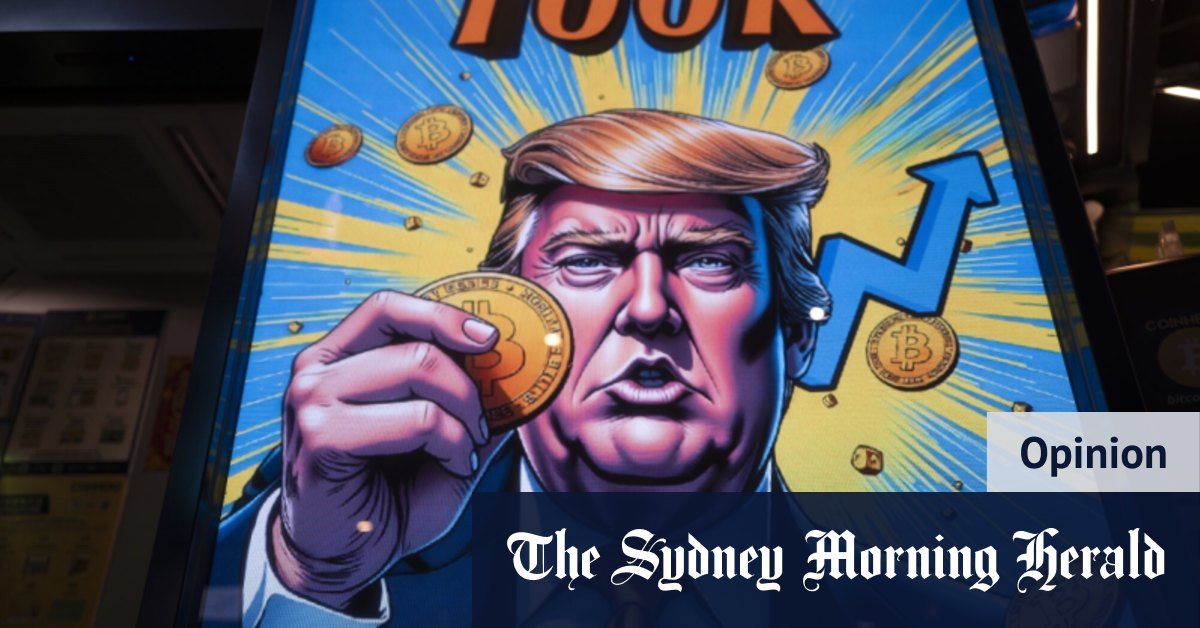

Is Bitcoin's Recent Rise Due to Trump? Investment Analysis

Bitcoin's price has seen a significant surge recently, leaving many investors wondering about the driving forces behind this rally. While numerous factors influence cryptocurrency markets, the question on many minds is: Could Donald Trump's recent actions and announcements be a contributing factor? This article delves into the potential connection between Trump's influence and Bitcoin's price increase, offering an in-depth investment analysis.

The Trump Factor: Speculation and Reality

The correlation, if any, between Trump's activities and Bitcoin's price is largely speculative. However, several potential links warrant examination:

-

Political Uncertainty: Trump's pronouncements and actions often create market volatility. This uncertainty can drive investors towards alternative assets like Bitcoin, perceived as a hedge against political risk. The inherent decentralization of Bitcoin makes it attractive in times of perceived instability in traditional financial systems.

-

Regulatory Scrutiny (or Lack Thereof): Changes in regulatory landscapes significantly impact cryptocurrency prices. Any perceived shift in the US regulatory stance towards cryptocurrencies under a Trump presidency, whether positive or negative, could trigger market fluctuations. Uncertainty itself can be a catalyst for price movement.

-

Inflation Hedge Narrative: Concerns about potential inflationary pressures under certain economic policies can bolster Bitcoin's appeal as a store of value. If investors believe Trump's policies might lead to inflation, they may flock to Bitcoin as a potential hedge.

-

Social Media Influence: Trump's significant social media presence cannot be ignored. Any comments, even indirect ones, regarding cryptocurrencies from such a high-profile figure can sway public opinion and subsequently influence market behavior.

Beyond Trump: Other Contributing Factors

While Trump's influence is a compelling narrative, it's crucial to acknowledge other significant factors impacting Bitcoin's recent performance:

-

Halving Events: The Bitcoin halving, a programmed reduction in the rate of new Bitcoin creation, is a significant event that historically correlates with price increases due to decreased supply.

-

Institutional Adoption: Growing institutional investment in Bitcoin and related cryptocurrencies continues to drive demand and price appreciation.

-

Technological Advancements: Developments within the Bitcoin ecosystem, such as the Lightning Network improving transaction speeds, can boost investor confidence.

-

Global Economic Conditions: Broader macroeconomic factors, such as inflation rates and geopolitical events, play a significant role in influencing Bitcoin's price.

Investment Analysis: Cautious Optimism

Attributing Bitcoin's rise solely to Trump's influence would be an oversimplification. The reality is far more nuanced, involving a complex interplay of various economic, political, and technological factors. While Trump's actions might contribute to the overall market volatility and potentially increase Bitcoin's appeal as a hedge against uncertainty, it is not the sole driver.

Investors should proceed with caution. Cryptocurrencies are highly volatile assets, and predicting future price movements with certainty is impossible. Before making any investment decisions, thorough due diligence, risk assessment, and diversification are crucial. Consider seeking advice from a qualified financial advisor.

Keywords: Bitcoin price, Bitcoin rise, Trump, cryptocurrency, investment analysis, Bitcoin investment, political uncertainty, inflation hedge, regulatory scrutiny, halving, institutional adoption, cryptocurrency market, volatile assets, financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Bitcoin's Recent Rise Due To Trump? Investment Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Virginia Court Burglary Case Against Jan 6th Rioter Linked To Ashli Babbitt Incident

May 23, 2025

Virginia Court Burglary Case Against Jan 6th Rioter Linked To Ashli Babbitt Incident

May 23, 2025 -

Amy Schumer A 45 Million Investment In The Real Estate Market

May 23, 2025

Amy Schumer A 45 Million Investment In The Real Estate Market

May 23, 2025 -

100th Career Win Nears For Djokovic As He Turns 38

May 23, 2025

100th Career Win Nears For Djokovic As He Turns 38

May 23, 2025 -

Hands On With The Fujifilm X Half Retro Compact Camera Impressions

May 23, 2025

Hands On With The Fujifilm X Half Retro Compact Camera Impressions

May 23, 2025 -

Lottery Jackpot Changes Lives Kentucky Couple Wins Big

May 23, 2025

Lottery Jackpot Changes Lives Kentucky Couple Wins Big

May 23, 2025

Latest Posts

-

Game Stops Bitcoin Strategy And Strong Financials A Deep Dive Analysis

May 23, 2025

Game Stops Bitcoin Strategy And Strong Financials A Deep Dive Analysis

May 23, 2025 -

Job Losses And Falling Living Standards In Laos The World Banks Inflation Analysis

May 23, 2025

Job Losses And Falling Living Standards In Laos The World Banks Inflation Analysis

May 23, 2025 -

Starlinks Australian Expansion Hit By Regulatory Warning

May 23, 2025

Starlinks Australian Expansion Hit By Regulatory Warning

May 23, 2025 -

Octopus Energy Ceo Targets Chinese Partnerships For Growth

May 23, 2025

Octopus Energy Ceo Targets Chinese Partnerships For Growth

May 23, 2025 -

Web3 Expansion Animoca Brands And Astar Network Secure Major Asian Ip Rights

May 23, 2025

Web3 Expansion Animoca Brands And Astar Network Secure Major Asian Ip Rights

May 23, 2025