Is Cardano's Rally Over? Bearish Divergence Spotted In ADA Price Chart

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Cardano's Rally Over? Bearish Divergence Spotted in ADA Price Chart

Cardano (ADA), the popular Proof-of-Stake blockchain platform, has seen a significant price surge in recent weeks, leaving many investors wondering: is this rally sustainable, or are we heading for a correction? Technical analysis reveals a concerning sign: a bearish divergence has emerged on the ADA price chart, raising red flags for short-term investors.

This divergence, a classic indicator of potential price reversals, suggests a weakening in buying pressure despite the recent price gains. Understanding this divergence is crucial for navigating the current market volatility surrounding Cardano.

What is Bearish Divergence?

Bearish divergence occurs when the price of an asset makes higher highs, but a corresponding momentum indicator (like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD)) makes lower highs. Essentially, the price is suggesting bullish momentum, while the indicator is signaling weakening bullishness – a classic bearish warning sign.

In Cardano's case, several analysts have pointed to a bearish divergence forming on the RSI and MACD indicators. While ADA price has climbed to new highs, the RSI and MACD have failed to confirm this upward momentum, instead showing signs of exhaustion and a potential downturn.

Analyzing the ADA Price Chart: Signs of Weakness?

The ADA price chart itself shows some signs of potential weakness beyond the bearish divergence. While the recent surge has been impressive, the volume accompanying these price increases hasn't been consistently strong, suggesting a lack of robust buying pressure from large institutional investors. This could indicate that the rally might be fueled more by retail traders than substantial institutional adoption.

- RSI Weakness: The RSI, a widely used momentum oscillator, has failed to break above overbought levels, suggesting that the buying pressure is waning. A subsequent drop below key support levels on the RSI could signal a significant price correction.

- MACD Divergence: The MACD, which measures the relationship between two moving averages, is showing a bearish divergence, with the price making higher highs while the MACD fails to do so. This indicates weakening momentum.

- Volume Concerns: Trading volume hasn't kept pace with price increases, a bearish signal suggesting a lack of conviction behind the recent rally.

What This Means for ADA Investors

The appearance of a bearish divergence doesn't automatically guarantee a price crash. However, it serves as a significant warning sign for traders, suggesting a potential weakening of the bullish trend. Investors should exercise caution and consider several strategies:

- Risk Management: Implement robust risk management strategies, including stop-loss orders, to protect your investments from potential losses.

- Diversification: Diversifying your crypto portfolio across different assets can mitigate the risk associated with a potential ADA correction.

- Technical Analysis: Closely monitor the ADA price chart and other technical indicators for confirmation of a bearish trend before making any significant trading decisions.

- Fundamental Analysis: Beyond technical analysis, assess Cardano's fundamental strengths and weaknesses. Upcoming developments, partnerships, and network adoption will all influence the long-term price trajectory.

Conclusion: Proceed with Caution

While Cardano's future remains promising, the bearish divergence on the ADA price chart presents a serious concern for short-term investors. The lack of strong volume alongside price increases further adds to the cautious outlook. It's crucial for investors to remain vigilant, employ risk management strategies, and carefully consider the implications of this technical indicator before making any investment decisions. The rally might not be over, but a correction seems increasingly likely in the near term. Remember, this analysis is for informational purposes only and is not financial advice. Always conduct thorough research before investing in any cryptocurrency.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Cardano's Rally Over? Bearish Divergence Spotted In ADA Price Chart. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unifying Crypto Solanas Meta Blockchain Proposal And Its Implications

May 15, 2025

Unifying Crypto Solanas Meta Blockchain Proposal And Its Implications

May 15, 2025 -

Safeguarding Knowledge Indigenous Scientists And Data Sovereignty

May 15, 2025

Safeguarding Knowledge Indigenous Scientists And Data Sovereignty

May 15, 2025 -

Kelly Brook Channels Gothic Chic In New Photos With Jeremy Parisi

May 15, 2025

Kelly Brook Channels Gothic Chic In New Photos With Jeremy Parisi

May 15, 2025 -

Martin Brundle Receives Support From Damon Hill After Recent News

May 15, 2025

Martin Brundle Receives Support From Damon Hill After Recent News

May 15, 2025 -

Experience The Future Of Flight United Airlines Enhanced Polaris Seats

May 15, 2025

Experience The Future Of Flight United Airlines Enhanced Polaris Seats

May 15, 2025

Latest Posts

-

The Handmaids Tale Aunt Lydia Faces A Ghostly Apparition

May 15, 2025

The Handmaids Tale Aunt Lydia Faces A Ghostly Apparition

May 15, 2025 -

Crimen En El Oeste De Mexico Joven Influencer Pierde La Vida

May 15, 2025

Crimen En El Oeste De Mexico Joven Influencer Pierde La Vida

May 15, 2025 -

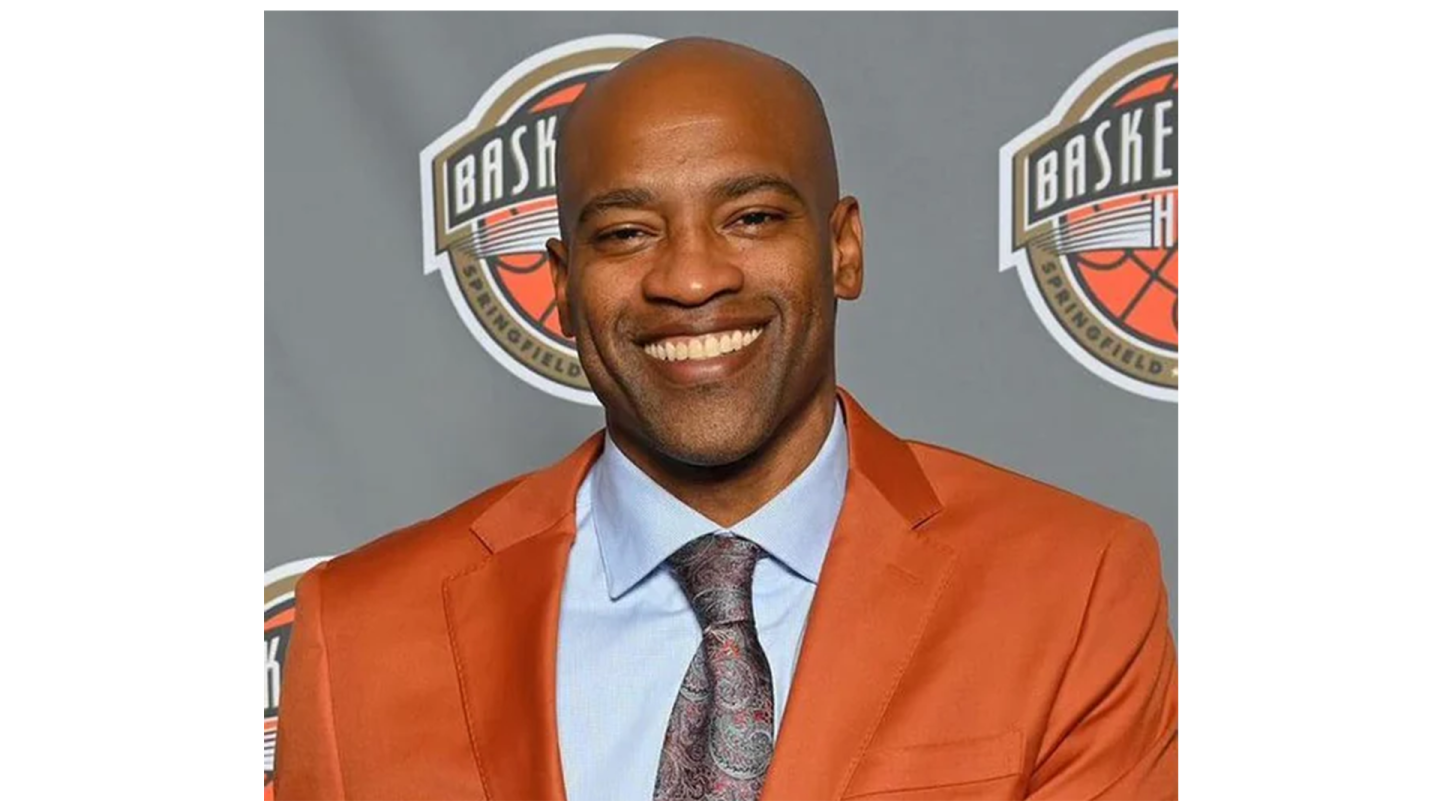

Nbc Sports Adds Vince Carter As Nba Studio Analyst

May 15, 2025

Nbc Sports Adds Vince Carter As Nba Studio Analyst

May 15, 2025 -

Wordle 1425 Solution May 14 2024 Clues And Strategy Guide

May 15, 2025

Wordle 1425 Solution May 14 2024 Clues And Strategy Guide

May 15, 2025 -

Rome Open Andreeva Draper Face Tough Tests Against Gauff Alcaraz

May 15, 2025

Rome Open Andreeva Draper Face Tough Tests Against Gauff Alcaraz

May 15, 2025