Is Eli Lilly The New Leader In Weight-Loss Medications? A Look At The Competition

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Eli Lilly the New Leader in Weight-Loss Medications? A Look at the Competition

The weight-loss medication market is booming, and Eli Lilly and Company is currently leading the charge with its blockbuster drug, Mounjaro (tirzepatide). But is this a permanent reign, or is it just a temporary hold on the top spot in a rapidly evolving field? Let's delve into the competition and assess Eli Lilly's position.

Mounjaro's Meteoric Rise:

Mounjaro's success isn't just hype. Clinical trials have shown impressive weight loss results, significantly exceeding those seen with other currently available medications. This efficacy, coupled with a relatively well-tolerated side effect profile (compared to some competitors), has fueled its rapid adoption by both patients and physicians. The drug's dual mechanism of action, targeting both glucagon-like peptide-1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP) receptors, is believed to be key to its effectiveness. This has positioned Eli Lilly as a major player in the obesity treatment landscape.

The Competitive Landscape:

However, Eli Lilly isn't alone in this lucrative market. Several strong contenders are vying for a piece of the pie:

-

Novo Nordisk: A long-standing player in the diabetes medication market, Novo Nordisk boasts Wegovy (semaglutide), a GLP-1 receptor agonist, already established as a significant weight-loss drug. While Wegovy faces some supply chain challenges, its proven efficacy and brand recognition make it a formidable competitor. Their Ozempic, also a semaglutide-based drug, further strengthens their market presence.

-

Other GLP-1 Receptor Agonists: The GLP-1 receptor agonist class of drugs is expanding rapidly, with several other companies developing and launching similar medications. These offer potential competition, particularly if they demonstrate superior efficacy or a more favorable safety profile.

-

Emerging Therapies: Beyond GLP-1 receptor agonists, the pipeline for new weight-loss medications is brimming with innovative approaches. These include medications targeting different hormonal pathways or utilizing entirely novel mechanisms. While these are still in various stages of development, they represent a long-term threat to the current market leaders.

Challenges for Eli Lilly:

Despite its current dominance, Eli Lilly faces several challenges:

-

Competition: As mentioned, the competitive landscape is intensifying. New entrants and improved formulations from existing players will undoubtedly put pressure on Mounjaro's market share.

-

Pricing and Accessibility: The high cost of these medications remains a significant barrier for many patients, raising concerns about equitable access to effective weight-loss treatment.

-

Long-Term Data: While short-term efficacy is impressive, more long-term data on the safety and effectiveness of Mounjaro and other similar drugs is needed to fully assess their long-term impact.

-

Side Effects: While generally well-tolerated, side effects like nausea, vomiting, and diarrhea are commonly reported, potentially limiting patient adherence.

Conclusion:

Eli Lilly's success with Mounjaro is undeniable, establishing them as a major force in the weight-loss medication market. However, maintaining this leadership position will require ongoing innovation, strategic pricing, and addressing patient access concerns. The competition is fierce, and the future of the weight-loss medication landscape remains dynamic and unpredictable. Only time will tell if Eli Lilly can sustain its current dominance in this rapidly expanding sector. The race for the top spot is far from over.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Eli Lilly The New Leader In Weight-Loss Medications? A Look At The Competition. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Spy Cloud Report Shocking Employee Data Exposure In Fortune 500 Phishing Attacks

May 14, 2025

Spy Cloud Report Shocking Employee Data Exposure In Fortune 500 Phishing Attacks

May 14, 2025 -

Acceleration De La Cooperation Logistique Et De Transport Entre Le Maroc Et L Arabie Saoudite

May 14, 2025

Acceleration De La Cooperation Logistique Et De Transport Entre Le Maroc Et L Arabie Saoudite

May 14, 2025 -

Facebook Bitcoin Theft A Multi Stage Malware Attack Explained And Defended Against

May 14, 2025

Facebook Bitcoin Theft A Multi Stage Malware Attack Explained And Defended Against

May 14, 2025 -

Final The Handmaids Tale Season 6 Episodes Release Schedule And What To Expect

May 14, 2025

Final The Handmaids Tale Season 6 Episodes Release Schedule And What To Expect

May 14, 2025 -

Quordle 1204 Solution Hints And Answers For Monday May 12th

May 14, 2025

Quordle 1204 Solution Hints And Answers For Monday May 12th

May 14, 2025

Latest Posts

-

Devastacao No Rio Grande Do Sul Chuvas Intensas Deixam Balanco De 75 Mortos E Quase 1 3 Milhoes Afetados

May 14, 2025

Devastacao No Rio Grande Do Sul Chuvas Intensas Deixam Balanco De 75 Mortos E Quase 1 3 Milhoes Afetados

May 14, 2025 -

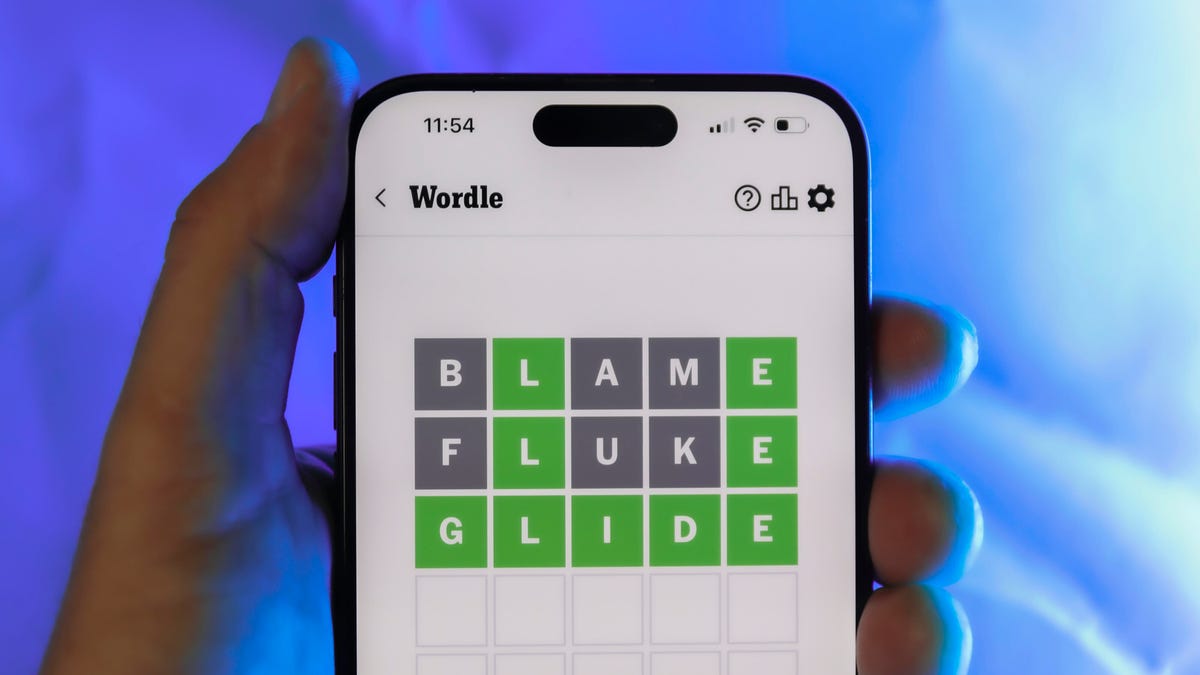

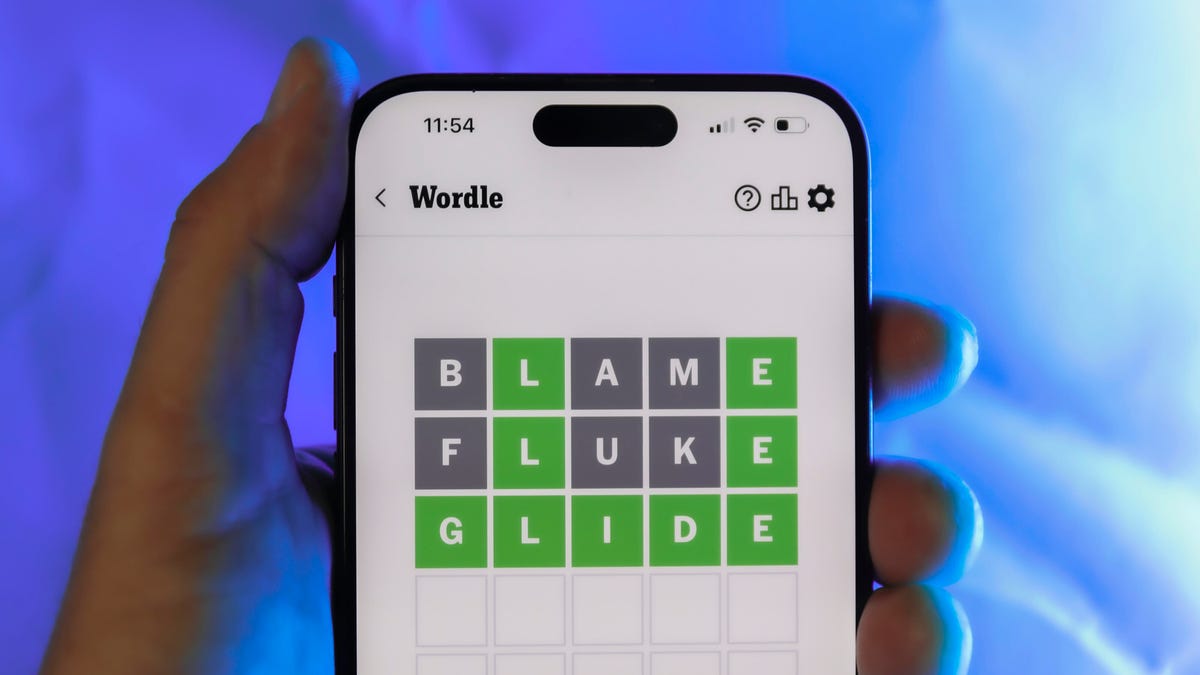

Solve Todays Wordle Hints And Answer For May 14th 1425

May 14, 2025

Solve Todays Wordle Hints And Answer For May 14th 1425

May 14, 2025 -

How Bill Belichick Balances Football And Players Personal Issues

May 14, 2025

How Bill Belichick Balances Football And Players Personal Issues

May 14, 2025 -

Inside The Family Life Of Lauren Sanchez Focusing On Her Children

May 14, 2025

Inside The Family Life Of Lauren Sanchez Focusing On Her Children

May 14, 2025 -

Wordle 1425 May 14 Clues Solution And Gameplay Help

May 14, 2025

Wordle 1425 May 14 Clues Solution And Gameplay Help

May 14, 2025