Is MOODENG The Next Big Stock After Its Robinhood Debut? Price Analysis And Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is MOODENG the Next Big Stock After its Robinhood Debut? Price Analysis and Outlook

The arrival of MOODENG on Robinhood has sent ripples through the investment community, sparking fervent debate: is this the next big stock poised for explosive growth, or just another fleeting trend? This article delves into a price analysis of MOODENG, examining its performance since its debut and offering a considered outlook on its future potential.

MOODENG's Robinhood Launch: A Closer Look

MOODENG's introduction to the Robinhood platform marked a significant milestone for the company. The ease of access provided by Robinhood opened the door to a vast pool of retail investors, many of whom are drawn to potentially high-growth, albeit riskier, stocks. The initial surge in trading volume following the launch was substantial, reflecting the considerable market interest. However, sustained growth requires more than just initial excitement.

Price Analysis: Examining the Volatility

Since its Robinhood debut, MOODENG's stock price has exhibited significant volatility. Early gains were followed by periods of consolidation and correction, a pattern typical of newly listed stocks. Analyzing the price fluctuations requires a multifaceted approach, considering factors such as:

- Trading Volume: High trading volume, especially during periods of price increases, often suggests strong investor confidence. Conversely, low volume can indicate waning interest.

- Market Sentiment: The overall mood of the market plays a crucial role. Positive market sentiment generally benefits even relatively new stocks, while negative sentiment can lead to sell-offs.

- Company Fundamentals: While short-term price movements are often driven by speculation, long-term success hinges on the company's underlying performance, including its revenue growth, profitability, and competitive landscape. Analyzing these fundamentals is crucial for a long-term investment perspective.

Key Factors Influencing MOODENG's Future

Several key factors will determine MOODENG's long-term trajectory:

- Product Innovation: MOODENG's continued ability to innovate and introduce new, marketable products will be critical for maintaining growth. A strong research and development pipeline is essential for sustained competitive advantage.

- Market Competition: The competitive landscape within MOODENG's industry will play a significant role in its success. Analyzing the strengths and weaknesses of its competitors is crucial.

- Regulatory Landscape: Changes in regulations could significantly impact MOODENG's operations and profitability. Staying informed about the regulatory environment is essential for informed investment decisions.

- Economic Conditions: Broader economic factors, such as interest rates and inflation, also influence stock performance. A strong economy generally benefits growth stocks, while economic downturns can lead to increased volatility and decreased valuations.

Outlook: Cautious Optimism or Measured Caution?

While MOODENG's Robinhood debut generated significant buzz, a balanced perspective is crucial. While the initial surge in interest is promising, long-term success depends on consistent performance and positive developments within the company. Investors should conduct thorough due diligence, analyzing both the company's fundamentals and the broader market conditions before making any investment decisions. The potential for significant returns exists, but so does the risk of substantial losses. A diversified investment strategy is always recommended to mitigate risk.

Disclaimer: This article provides general information and analysis only and does not constitute financial advice. Before making any investment decisions, consult with a qualified financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is MOODENG The Next Big Stock After Its Robinhood Debut? Price Analysis And Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tom Cruise Skips John Wick Ballerina Premiere Amidst Ana De Armas Dating Rumors

May 24, 2025

Tom Cruise Skips John Wick Ballerina Premiere Amidst Ana De Armas Dating Rumors

May 24, 2025 -

150 000 Scratch Off Kentucky Couple Shares Winning Secret

May 24, 2025

150 000 Scratch Off Kentucky Couple Shares Winning Secret

May 24, 2025 -

Plan Your Trip Hay Festival Shuttle Bus From Worcester And Hereford

May 24, 2025

Plan Your Trip Hay Festival Shuttle Bus From Worcester And Hereford

May 24, 2025 -

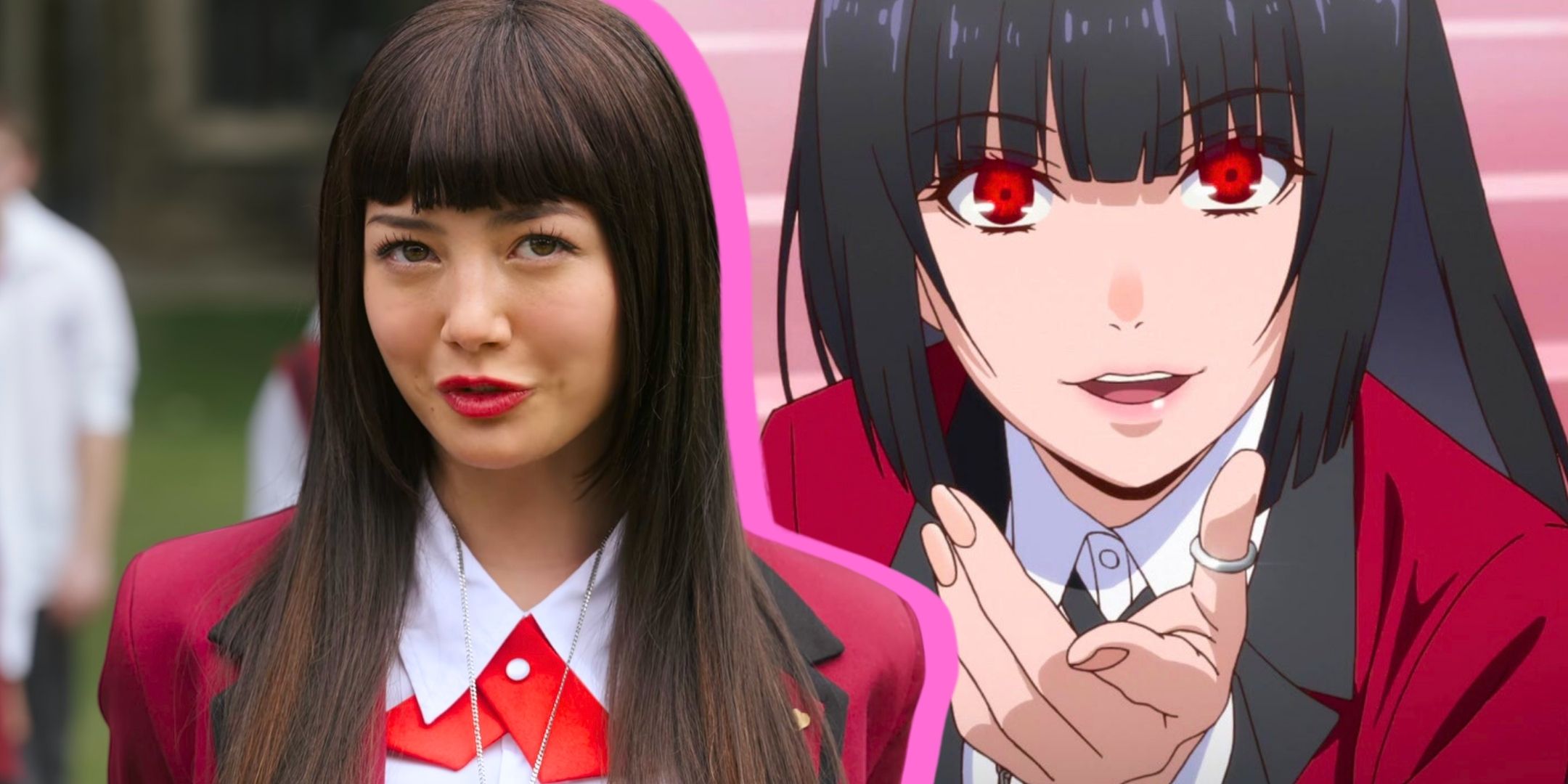

Live Action Anime Series On Netflix High Viewership Amidst Polarizing Reviews

May 24, 2025

Live Action Anime Series On Netflix High Viewership Amidst Polarizing Reviews

May 24, 2025 -

Political Fallout Agents Dismissal After Mel Gibson Gun License Refusal

May 24, 2025

Political Fallout Agents Dismissal After Mel Gibson Gun License Refusal

May 24, 2025