Is Nvidia's Stock Overvalued? The Impact Of The First Sell Rating And Predictions For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Nvidia's Stock Overvalued? The Impact of the First Sell Rating and Predictions for Investors

Nvidia's meteoric rise has captivated Wall Street, transforming it into a tech titan seemingly impervious to market downturns. But the recent issuance of the first "sell" rating on the stock by a major investment bank has sent ripples through the investment community, sparking intense debate: is Nvidia's stock overvalued? This article delves into the implications of this unprecedented move and explores potential scenarios for investors.

Nvidia's stock price has soared in recent years, fueled by explosive growth in the artificial intelligence (AI) sector, particularly in GPU demand for data centers and high-performance computing. This phenomenal success has propelled NVDA to become a market darling, attracting both institutional and retail investors alike. However, the unprecedented valuation raises concerns among some analysts.

The First "Sell" Rating: A Watershed Moment?

The recent "sell" rating from Rosenblatt Securities, marking the first such recommendation from a major investment bank, is a significant event. Analyst Hans Mosesmann cited concerns over a potential peak in data center GPU demand and the cyclical nature of the semiconductor industry as key reasons behind the downgrade. This bold move, contrasting sharply with the overwhelmingly bullish sentiment surrounding NVDA, has forced investors to reassess their positions.

Arguments for Overvaluation:

Several factors contribute to the argument that Nvidia's stock is overvalued:

- High Valuation Multiples: Nvidia currently trades at significantly higher price-to-earnings (P/E) and price-to-sales (P/S) ratios compared to its historical averages and many of its competitors. This suggests a premium valuation reflecting significant future growth expectations. However, if these expectations aren't met, the stock could experience a significant correction.

- Market Saturation Concerns: While AI growth is undeniable, concerns exist about potential saturation in certain market segments. The rate of future growth might not sustain the current valuation, leading to a decline in investor interest.

- Competition: The GPU market is becoming increasingly competitive, with AMD and other companies making inroads. Increased competition could put pressure on Nvidia's pricing power and profit margins.

- Economic Uncertainty: Broader macroeconomic factors, including potential recessions and rising interest rates, could impact investor sentiment towards high-growth technology stocks like Nvidia.

Arguments Against Overvaluation:

Conversely, arguments supporting Nvidia's current valuation cite:

- Dominance in AI: Nvidia enjoys a dominant position in the rapidly expanding AI market, particularly in GPU technology critical for training large language models (LLMs) and other AI applications. This leadership position provides a strong moat against competition.

- Long-Term Growth Potential: The AI revolution is still in its early stages, and the long-term growth potential for GPU technology remains vast. Nvidia's strategic positioning in this sector justifies a premium valuation in the eyes of some analysts.

- Diversification Efforts: Nvidia is actively diversifying its revenue streams beyond GPUs, exploring opportunities in areas like autonomous vehicles and robotics. This diversification can mitigate risks associated with reliance on a single product category.

Predictions for Investors:

The future of Nvidia's stock price remains uncertain. The "sell" rating highlights the inherent risks in investing in high-growth, high-valuation companies. Investors should carefully consider their risk tolerance and investment horizon before making any decisions.

- Cautious Optimism: A balanced approach might be to maintain a cautiously optimistic stance, acknowledging both the potential for further growth and the risks associated with the current valuation. Diversification within one's portfolio is crucial.

- Risk Management: Investors should implement robust risk management strategies, potentially including stop-loss orders to limit potential losses.

- Fundamental Analysis: Before making any investment decisions, thorough fundamental analysis of Nvidia's financials, competitive landscape, and future growth prospects is essential.

In conclusion, the debate surrounding Nvidia's valuation is far from settled. The first "sell" rating serves as a timely reminder that even the most successful companies face risks. Investors should proceed with caution, conduct thorough due diligence, and maintain a well-diversified portfolio to navigate the complexities of this dynamic market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Nvidia's Stock Overvalued? The Impact Of The First Sell Rating And Predictions For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bob Cowper Australian Cricket Mourns Ashes Legend

May 13, 2025

Bob Cowper Australian Cricket Mourns Ashes Legend

May 13, 2025 -

115 Tariff Cut Us And China Seal Landmark Trade Deal

May 13, 2025

115 Tariff Cut Us And China Seal Landmark Trade Deal

May 13, 2025 -

Atp Rome Masters In Depth Preview Of Sinner De Jong Mensik And Marozsan Matches

May 13, 2025

Atp Rome Masters In Depth Preview Of Sinner De Jong Mensik And Marozsan Matches

May 13, 2025 -

From Lcd To E Ink My Experience And The Price Of Upgrading To A 25 Inch Color Display

May 13, 2025

From Lcd To E Ink My Experience And The Price Of Upgrading To A 25 Inch Color Display

May 13, 2025 -

Cooper Flagg Among Top Prospects At Nba Draft Combine 5 On 5 Analysis

May 13, 2025

Cooper Flagg Among Top Prospects At Nba Draft Combine 5 On 5 Analysis

May 13, 2025

Latest Posts

-

State Labor Caucus To Decide Fate Of Queensland Mp Jimmy Sullivan

May 13, 2025

State Labor Caucus To Decide Fate Of Queensland Mp Jimmy Sullivan

May 13, 2025 -

Decentralized Cloud Infrastructure A Mainstream Solution To Single Point Of Failure Risks

May 13, 2025

Decentralized Cloud Infrastructure A Mainstream Solution To Single Point Of Failure Risks

May 13, 2025 -

Hong Kong Tycoon Li Ka Shing Mum On Port Deal After Public Showing

May 13, 2025

Hong Kong Tycoon Li Ka Shing Mum On Port Deal After Public Showing

May 13, 2025 -

Australian Cricket In Mourning Remembering Bob Cowper

May 13, 2025

Australian Cricket In Mourning Remembering Bob Cowper

May 13, 2025 -

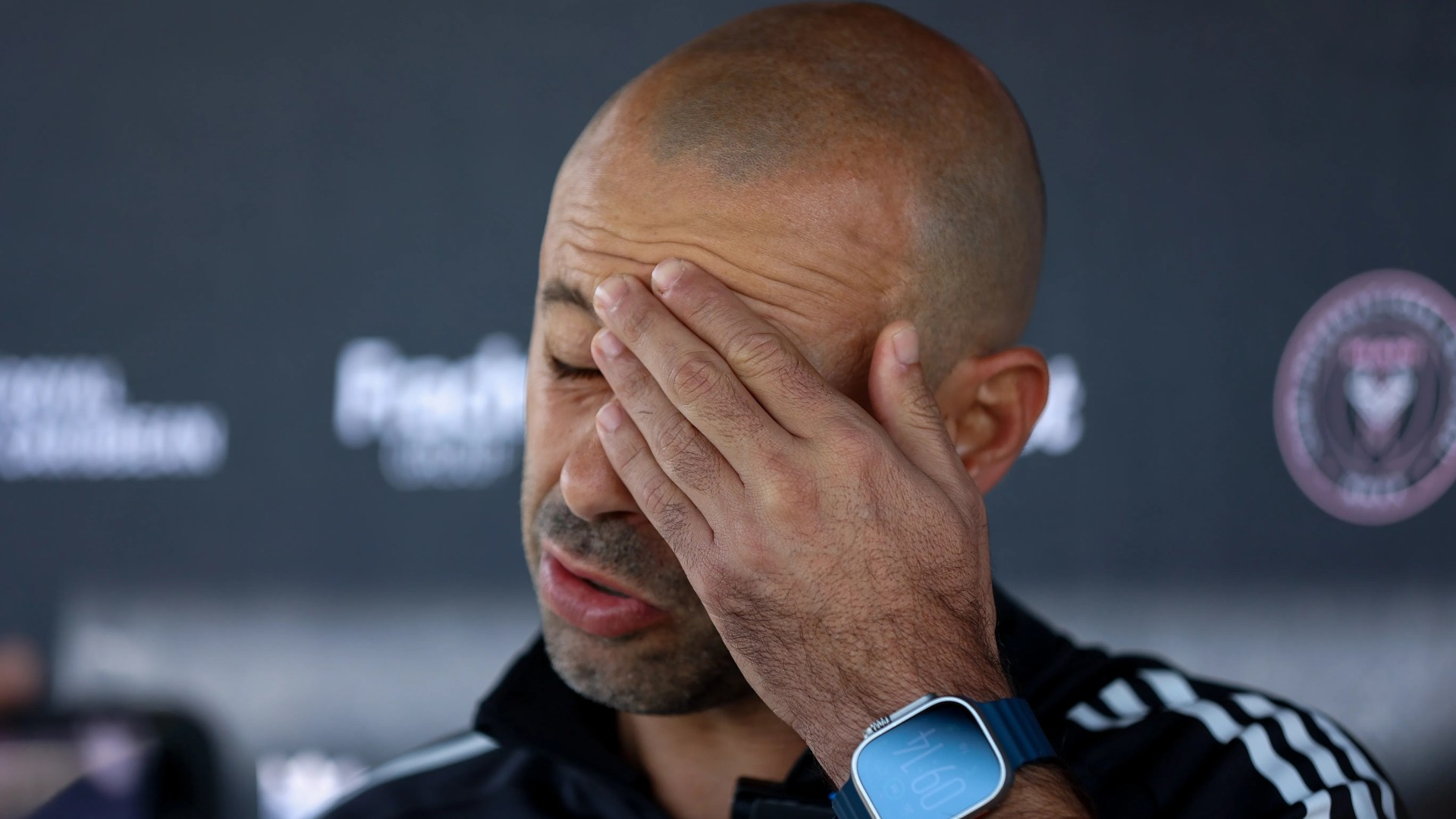

Messis Crushing Mls Defeat Is Mascheranos Job At Risk Under Beckham

May 13, 2025

Messis Crushing Mls Defeat Is Mascheranos Job At Risk Under Beckham

May 13, 2025