Is Solana The Ethereum Killer? Examining Transaction Speeds, Fees, And Decentralization

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Solana the Ethereum Killer? Examining Transaction Speeds, Fees, and Decentralization

The cryptocurrency world is buzzing with the question: Can Solana dethrone Ethereum as the king of smart contracts and decentralized applications (dApps)? Solana, with its lightning-fast transaction speeds and low fees, has emerged as a serious contender. But is it truly an "Ethereum killer," or are there crucial differences that prevent it from claiming the throne? Let's delve into a detailed comparison, examining transaction speeds, fees, and the critical aspect of decentralization.

Solana's Speed Advantage: A Lightning Bolt in the Blockchain World

One of Solana's most compelling features is its unparalleled transaction speed. While Ethereum struggles with transaction times often measured in minutes, Solana boasts speeds exceeding 2,000 transactions per second (TPS). This remarkable throughput is achieved through its innovative hybrid consensus mechanism, combining Proof-of-History (PoH) with Proof-of-Stake (PoS). This significantly reduces latency and enables near-instantaneous transaction processing, making it ideal for high-frequency trading and demanding dApps.

Fees: A Wallet-Friendly Alternative?

Ethereum's notoriously high gas fees have been a major pain point for users, particularly those interacting with DeFi applications. Solana, in contrast, offers significantly lower transaction fees. This affordability makes it more accessible to a wider range of users and developers, potentially fueling its adoption and growth. The reduced cost per transaction is a substantial advantage for both individual users and businesses building on the platform.

Decentralization: The Achilles Heel?

While Solana excels in speed and cost-effectiveness, concerns remain about its level of decentralization. Unlike Ethereum's vast and distributed network of validators, Solana's network relies on a smaller number of validators, raising questions about its resilience against censorship and potential vulnerabilities. This centralized nature, though not entirely unique in the blockchain space, is a critical point of contention for those prioritizing a truly decentralized system. The ongoing debate about Solana's validator distribution and potential for centralization is a key factor to consider.

Beyond Transaction Speeds and Fees: A Holistic Perspective

The "Ethereum killer" narrative shouldn't solely focus on transaction speeds and fees. Ethereum's strength lies in its robust and mature ecosystem, boasting a vast developer community, a rich library of tools and resources, and a wide array of established dApps. Solana, while rapidly developing its ecosystem, still lags behind Ethereum in terms of overall maturity and adoption.

The Verdict: A Powerful Contender, Not Yet a Killer

Solana presents a compelling alternative to Ethereum, especially for applications demanding high transaction throughput and low fees. Its technological innovations are undeniable. However, concerns regarding decentralization and the relative immaturity of its ecosystem prevent it from being definitively crowned the "Ethereum killer." Both platforms cater to different needs and priorities, and the future of the blockchain landscape likely involves the coexistence and competition of multiple leading platforms.

Key Takeaways:

- Solana's speed: Significantly faster than Ethereum, enabling high-TPS applications.

- Solana's fees: Substantially lower than Ethereum, making it more accessible.

- Decentralization concerns: Solana's relatively centralized nature compared to Ethereum is a key differentiator.

- Ecosystem maturity: Ethereum boasts a more mature and established ecosystem.

The battle for blockchain dominance is far from over. Solana's emergence as a strong competitor pushes Ethereum to innovate and improve, ultimately benefiting the entire cryptocurrency ecosystem. Whether Solana ultimately surpasses Ethereum remains to be seen, but its impact on the blockchain landscape is undeniable.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Solana The Ethereum Killer? Examining Transaction Speeds, Fees, And Decentralization. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

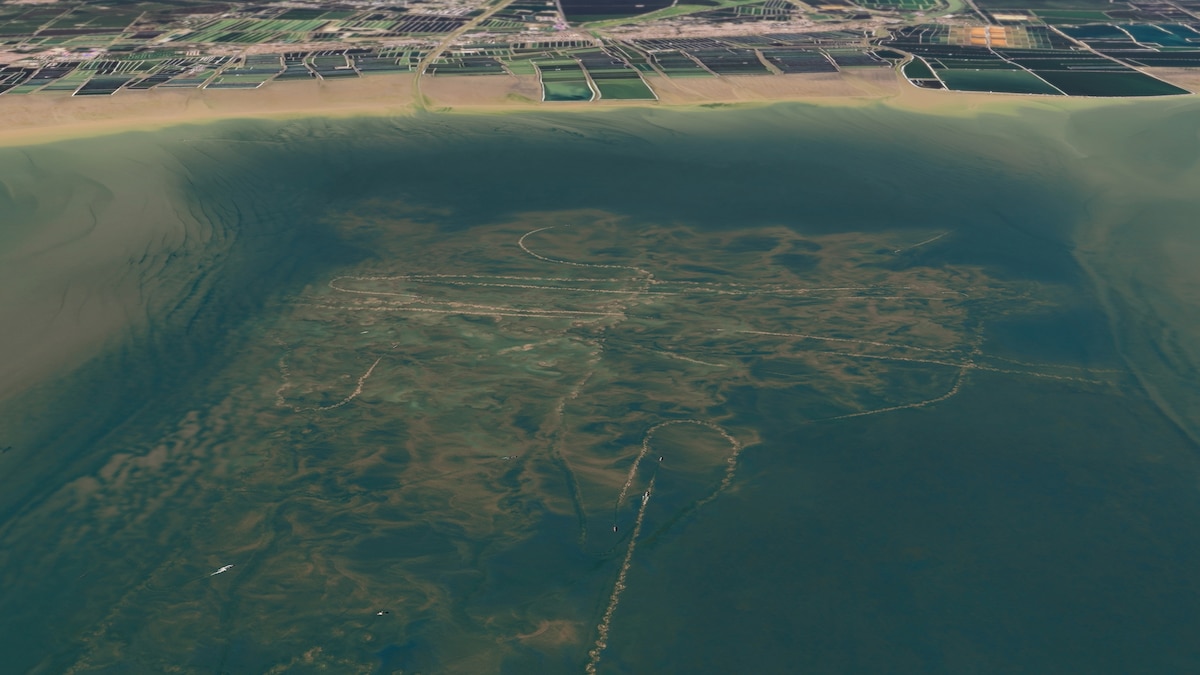

Bottom Trawl Fishing A Rare Glimpse Into The Destructive Practices Impact On Fish

May 17, 2025

Bottom Trawl Fishing A Rare Glimpse Into The Destructive Practices Impact On Fish

May 17, 2025 -

Major M6 Delays Motorway Closed Drivers Face Huge Congestion

May 17, 2025

Major M6 Delays Motorway Closed Drivers Face Huge Congestion

May 17, 2025 -

Confirmed Lineups And Team News Chelseas Premier League Fixture Against Manchester United

May 17, 2025

Confirmed Lineups And Team News Chelseas Premier League Fixture Against Manchester United

May 17, 2025 -

Vf B Stuttgart Podcast Rueckblick Analyse Und Zukunft Der Roten

May 17, 2025

Vf B Stuttgart Podcast Rueckblick Analyse Und Zukunft Der Roten

May 17, 2025 -

Nottoway Plantation Fire A Look At The Destruction Through Images And Footage

May 17, 2025

Nottoway Plantation Fire A Look At The Destruction Through Images And Footage

May 17, 2025