Is Super Micro Computer Stock A Risky Investment? A Comprehensive Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Super Micro Computer Stock a Risky Investment? A Comprehensive Analysis

Super Micro Computer (SMCI) has carved a niche for itself in the server market, experiencing significant growth in recent years fueled by the booming demand for data centers and cloud computing. But is investing in SMCI stock a smart move, or is it a risky gamble? This comprehensive analysis delves into the factors that make Super Micro Computer stock both attractive and potentially volatile.

The Allure of Super Micro Computer:

Super Micro Computer's success stems from its specialization in high-performance computing (HPC) and its strong position in the enterprise server market. The company boasts a diverse customer base, including major cloud providers and corporations. Several factors contribute to its appeal as an investment:

- Strong Growth Potential: The ongoing expansion of data centers and the increasing adoption of cloud services continue to fuel demand for Super Micro's servers. This presents significant opportunities for long-term growth.

- Technological Innovation: SMCI consistently invests in research and development, staying ahead of the curve in server technology. Their focus on energy efficiency and advanced features provides a competitive edge.

- Strategic Partnerships: Collaborations with key players in the technology industry further strengthen Super Micro's market position and expand its reach.

The Risks Associated with Investing in SMCI:

Despite its promising prospects, Super Micro Computer stock is not without its risks. Investors need to carefully consider these potential downsides:

- Supply Chain Vulnerabilities: Like many technology companies, SMCI is susceptible to disruptions in the global supply chain. Component shortages or geopolitical instability can significantly impact production and profitability.

- Competition: The server market is fiercely competitive, with major players like Dell, HP, and Lenovo vying for market share. SMCI needs to constantly innovate and maintain its competitive edge to succeed.

- Economic Slowdown: A broader economic downturn could negatively impact corporate spending on IT infrastructure, reducing demand for Super Micro's products.

- Valuation: SMCI's stock valuation might be considered high by some analysts, making it vulnerable to price corrections if growth doesn't meet expectations.

Analyzing the Financial Performance:

To assess the risk, it's crucial to examine Super Micro's financial performance. Look closely at key metrics like:

- Revenue growth: Consistent and sustainable revenue growth indicates a healthy and expanding business.

- Profit margins: Healthy profit margins demonstrate efficient operations and pricing power.

- Debt levels: High debt levels can increase financial risk and vulnerability to economic downturns.

- Cash flow: Strong cash flow is essential for reinvestment, debt repayment, and shareholder returns.

Conclusion: Weighing the Risks and Rewards

Super Micro Computer stock presents a compelling investment opportunity for those with a higher risk tolerance. The company's strong position in a rapidly growing market, coupled with its focus on innovation, offers significant growth potential. However, investors must acknowledge the inherent risks associated with the technology sector, including supply chain vulnerabilities and intense competition.

Thorough due diligence, including a comprehensive analysis of SMCI's financial statements and an understanding of the broader market dynamics, is crucial before making any investment decisions. Consider diversifying your portfolio to mitigate risk and consult with a financial advisor to determine if SMCI aligns with your investment goals and risk profile. Investing in the stock market always involves risk, and past performance is not indicative of future results. Remember to always conduct your own thorough research before investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Super Micro Computer Stock A Risky Investment? A Comprehensive Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ye And Censoris Grammy Stunt Leads To Cannes Film Festival Nudity Ban

May 14, 2025

Ye And Censoris Grammy Stunt Leads To Cannes Film Festival Nudity Ban

May 14, 2025 -

Evergreen Fire Department Battles Double House Fire On Sunday

May 14, 2025

Evergreen Fire Department Battles Double House Fire On Sunday

May 14, 2025 -

Functioning Addict Bradley Wiggins Details His Past Cocaine Abuse

May 14, 2025

Functioning Addict Bradley Wiggins Details His Past Cocaine Abuse

May 14, 2025 -

Lnh Les Capitals Subissent Une Contre Performance Face Aux Hurricanes 5 2

May 14, 2025

Lnh Les Capitals Subissent Une Contre Performance Face Aux Hurricanes 5 2

May 14, 2025 -

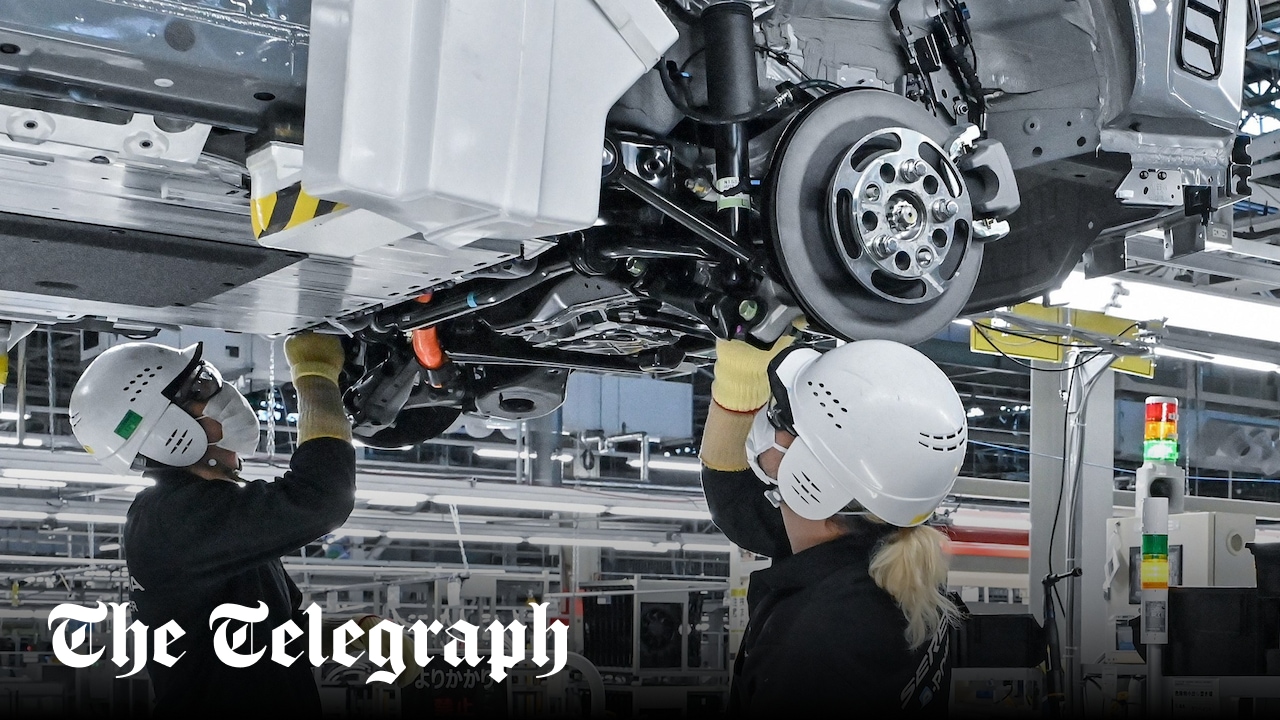

Nissans Restructuring Plan 20 000 Job Losses Worldwide

May 14, 2025

Nissans Restructuring Plan 20 000 Job Losses Worldwide

May 14, 2025

Latest Posts

-

Trauma And Transformation Understanding Doom Patrols Complex Characters

May 14, 2025

Trauma And Transformation Understanding Doom Patrols Complex Characters

May 14, 2025 -

The Psychology Of Doom Patrol Examining Trauma And Resilience

May 14, 2025

The Psychology Of Doom Patrol Examining Trauma And Resilience

May 14, 2025 -

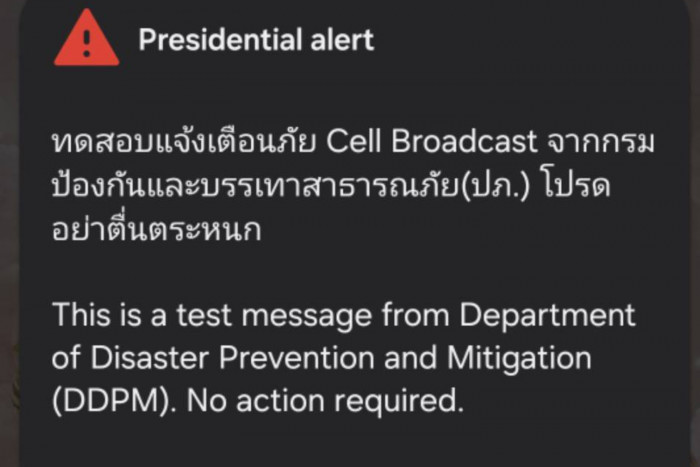

Understanding Thailands Emergency Alert System Recent Test And Public Response

May 14, 2025

Understanding Thailands Emergency Alert System Recent Test And Public Response

May 14, 2025 -

Bindi Irwins Appendix Surgery Understanding Appendicitis

May 14, 2025

Bindi Irwins Appendix Surgery Understanding Appendicitis

May 14, 2025 -

2025 Nfl Schedule Release Date Time And How To Watch

May 14, 2025

2025 Nfl Schedule Release Date Time And How To Watch

May 14, 2025