Is Super Micro Computer Stock A Risky Investment? A Detailed Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Super Micro Computer Stock a Risky Investment? A Detailed Analysis

Super Micro Computer (SMCI) has carved a niche for itself in the server market, but is its stock a smart investment? The answer, like most things in the stock market, is nuanced. This detailed analysis explores the potential risks and rewards associated with investing in SMCI, helping you determine if it aligns with your investment strategy.

Super Micro Computer: A Brief Overview

Super Micro Computer, Inc. designs, manufactures, and sells a wide range of high-performance computing systems, including servers, workstations, and storage solutions. They cater to a diverse clientele, from cloud providers and data centers to enterprise businesses and government agencies. Their focus on energy-efficient technology and innovative designs positions them as a key player in the ever-growing data center market.

Why SMCI Might Be Risky:

-

High Dependence on the Tech Sector: SMCI's revenue is heavily reliant on the health of the global technology sector. A downturn in the tech market, potentially caused by economic recession or shifts in consumer spending, could significantly impact SMCI's performance. This makes SMCI stock susceptible to broader market volatility.

-

Supply Chain Challenges: Like many tech companies, SMCI faces the ongoing challenges of global supply chain disruptions. Component shortages and rising transportation costs can squeeze profit margins and delay product launches, impacting investor confidence and stock prices.

-

Competition: The server market is fiercely competitive. SMCI faces stiff competition from giants like Dell Technologies, Hewlett Packard Enterprise, and Lenovo. Maintaining market share requires continuous innovation and aggressive pricing strategies, which can put pressure on profitability.

-

Valuation: SMCI's stock valuation is an important factor to consider. A high Price-to-Earnings (P/E) ratio, for instance, suggests investors are placing a high premium on future growth. This increased valuation inherently carries greater risk, especially if growth expectations aren't met. Investors should carefully analyze SMCI's financial statements and compare its valuation metrics to its competitors.

-

Economic Slowdown Concerns: The current economic climate presents a notable risk. A potential recession could significantly impact business spending on IT infrastructure, directly impacting SMCI's sales and profitability. This macro-economic uncertainty adds another layer of risk to investing in SMCI.

Why SMCI Might Be Rewarding:

-

Growth in Cloud Computing and AI: The continued growth of cloud computing and artificial intelligence is a major tailwind for SMCI. These sectors require vast amounts of computing power, driving demand for high-performance servers—SMCI's core product.

-

Energy-Efficient Technologies: SMCI's focus on energy-efficient technologies aligns with the growing global emphasis on sustainability. This could give them a competitive edge and attract environmentally conscious clients.

-

Strong Brand Recognition: SMCI enjoys a solid reputation in the industry, known for its reliable and high-performing servers. This brand recognition translates to customer loyalty and a competitive advantage.

-

Potential for Acquisitions: SMCI's position in the market makes it a potential acquisition target for larger tech companies seeking to expand their server capabilities. This potential for a buyout could significantly benefit investors.

Conclusion: Is SMCI Right for You?

Investing in Super Micro Computer stock involves a degree of risk. The company’s reliance on the tech sector, competitive landscape, and current economic uncertainty are factors to carefully weigh. However, the growth potential in cloud computing and AI, coupled with SMCI's focus on energy efficiency and brand recognition, presents an attractive opportunity for long-term investors with a higher risk tolerance. Before investing, conduct thorough due diligence, considering your personal risk profile, investment goals, and the broader market conditions. Consult with a qualified financial advisor to make an informed decision tailored to your specific circumstances. Remember, past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Super Micro Computer Stock A Risky Investment? A Detailed Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Solve Quordle 1204 Hints And Answers For May 12th Monday

May 14, 2025

Solve Quordle 1204 Hints And Answers For May 12th Monday

May 14, 2025 -

Cbse Class 10 12 Results 2025 Live Updates Faqs And Passing Marks

May 14, 2025

Cbse Class 10 12 Results 2025 Live Updates Faqs And Passing Marks

May 14, 2025 -

Jeff Bezos Fiancee Lauren Sanchez Shares Intimate Mothers Day Photo With Children

May 14, 2025

Jeff Bezos Fiancee Lauren Sanchez Shares Intimate Mothers Day Photo With Children

May 14, 2025 -

Mardi 13 Mai L Horoscope Predit Une Journee Difficile Pour Ces 4 Signes

May 14, 2025

Mardi 13 Mai L Horoscope Predit Une Journee Difficile Pour Ces 4 Signes

May 14, 2025 -

I Am Beyond Vomit The Shocking On Camera Reaction To Tom Seguras Show

May 14, 2025

I Am Beyond Vomit The Shocking On Camera Reaction To Tom Seguras Show

May 14, 2025

Latest Posts

-

Green Bay Packers 2025 Schedule Primetime Matchups And Key Dates Revealed

May 14, 2025

Green Bay Packers 2025 Schedule Primetime Matchups And Key Dates Revealed

May 14, 2025 -

Thai Virologists Warning Adapt Vaccination Strategy To Combat Covid 19 Surge

May 14, 2025

Thai Virologists Warning Adapt Vaccination Strategy To Combat Covid 19 Surge

May 14, 2025 -

Family Resemblance Lauren Sanchezs Daughter 17 And Siblings Striking Photos

May 14, 2025

Family Resemblance Lauren Sanchezs Daughter 17 And Siblings Striking Photos

May 14, 2025 -

13 Year Old Among Three Investigated For Kpod Vape Related Offenses Hsa

May 14, 2025

13 Year Old Among Three Investigated For Kpod Vape Related Offenses Hsa

May 14, 2025 -

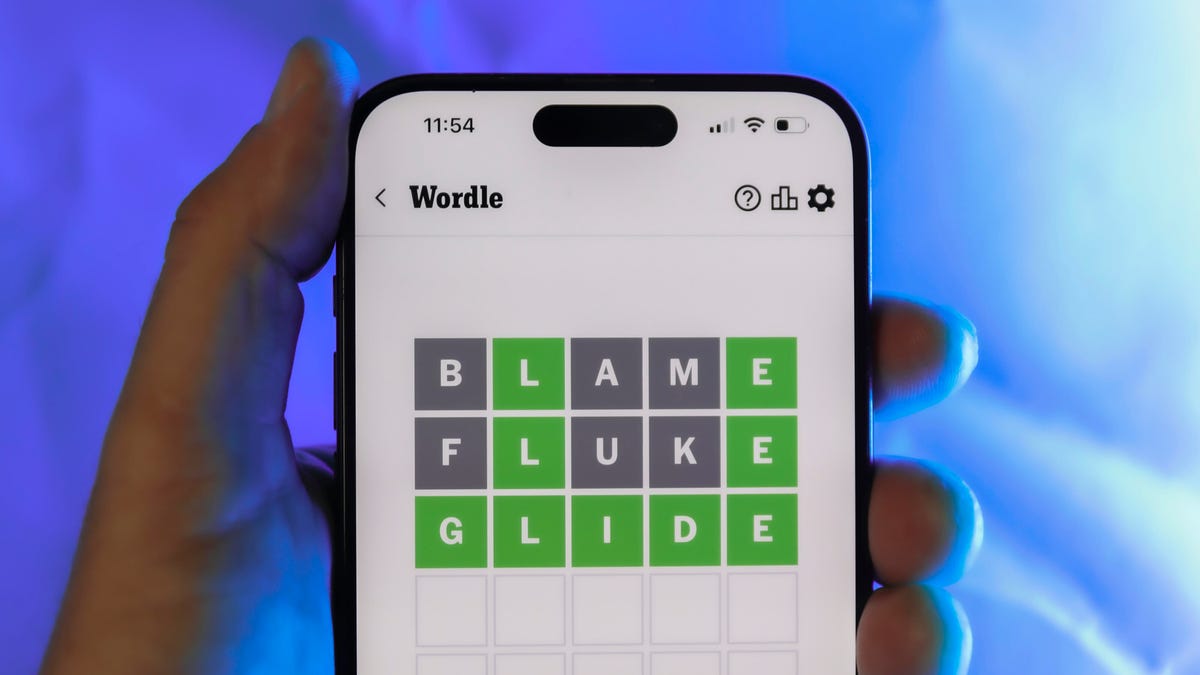

Wordle 1425 For May 14 Clues Answer And Strategy Guide

May 14, 2025

Wordle 1425 For May 14 Clues Answer And Strategy Guide

May 14, 2025