Is The 2014 Crypto Tax Code Stifling Innovation?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is the 2014 Crypto Tax Code Stifling Innovation? A Look at the Impact of Outdated Regulations

The meteoric rise of cryptocurrency has outpaced the ability of governments to regulate it effectively. Many argue that the existing tax code, particularly the 2014 guidance in the US treating cryptocurrency as property, is now outdated and actively hindering innovation in the burgeoning blockchain space. Is this assessment accurate? Let's delve into the complexities of the issue.

The 2014 Guidance: A Relic of the Past?

The Internal Revenue Service (IRS) issued Notice 2014-21, clarifying the tax treatment of virtual currencies like Bitcoin. This guidance established that cryptocurrencies are treated as property for tax purposes, meaning transactions are subject to capital gains taxes. While seemingly straightforward, this classification presents significant challenges in the rapidly evolving crypto landscape.

Challenges Posed by the 2014 Tax Code:

- Complexity and Ambiguity: The tax implications of cryptocurrency transactions are notoriously complex. Determining the cost basis, accounting for forks, and navigating the intricacies of staking and DeFi protocols can be incredibly challenging, even for seasoned tax professionals. This complexity discourages participation, particularly for smaller players and startups.

- High Tax Burden: The current capital gains tax structure can lead to a significant tax burden, especially for investors who have experienced substantial gains. This high tax burden can stifle investment and limit the growth potential of the cryptocurrency market.

- Lack of Clarity on Specific Use Cases: The 2014 guidance doesn't adequately address the nuances of newer crypto technologies, like decentralized finance (DeFi) and non-fungible tokens (NFTs). The lack of clear guidelines creates uncertainty and discourages innovation in these areas.

- Regulatory Uncertainty: The inconsistent application of tax laws across jurisdictions creates further uncertainty for both individuals and businesses operating in the crypto space. This regulatory uncertainty makes it difficult to plan for long-term growth and investment.

Impact on Innovation:

Many argue that these challenges are stifling innovation within the crypto ecosystem. The high tax burden and regulatory uncertainty can discourage investment in promising new projects and technologies. Startups may struggle to attract funding, and talented developers might be hesitant to contribute their expertise to a space with such complex and uncertain tax implications. This creates a significant hurdle for the broader adoption of blockchain technology.

Potential Solutions and Calls for Reform:

Experts are calling for a more comprehensive and modern regulatory framework that specifically addresses the unique characteristics of cryptocurrencies. This could involve:

- Simplified Tax Reporting: Streamlining the tax reporting process could significantly reduce the burden on taxpayers and make it easier for them to comply with the law.

- Tax Rate Adjustments: Lowering the capital gains tax rate for cryptocurrency could encourage investment and stimulate market growth.

- Clearer Guidance on DeFi and NFTs: The IRS needs to provide clear guidance on the tax treatment of DeFi and NFT transactions to reduce uncertainty and promote innovation in these areas.

- International Coordination: Greater international coordination on cryptocurrency taxation would create a more stable and predictable regulatory environment.

The Future of Crypto Taxation:

The 2014 crypto tax code, while intended to provide clarity, has inadvertently created significant obstacles to innovation. Addressing these challenges through regulatory reform is crucial for unlocking the full potential of the cryptocurrency market and fostering responsible growth in this rapidly evolving sector. The future of cryptocurrency and blockchain technology depends on finding a balance between responsible regulation and encouraging innovation. The conversation surrounding crypto tax reform is far from over, and its outcome will significantly impact the future of the industry.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is The 2014 Crypto Tax Code Stifling Innovation?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Al Ahlis 2 0 Victory Against Kawasaki Key Moments And Performance Review May 3 2025

May 04, 2025

Al Ahlis 2 0 Victory Against Kawasaki Key Moments And Performance Review May 3 2025

May 04, 2025 -

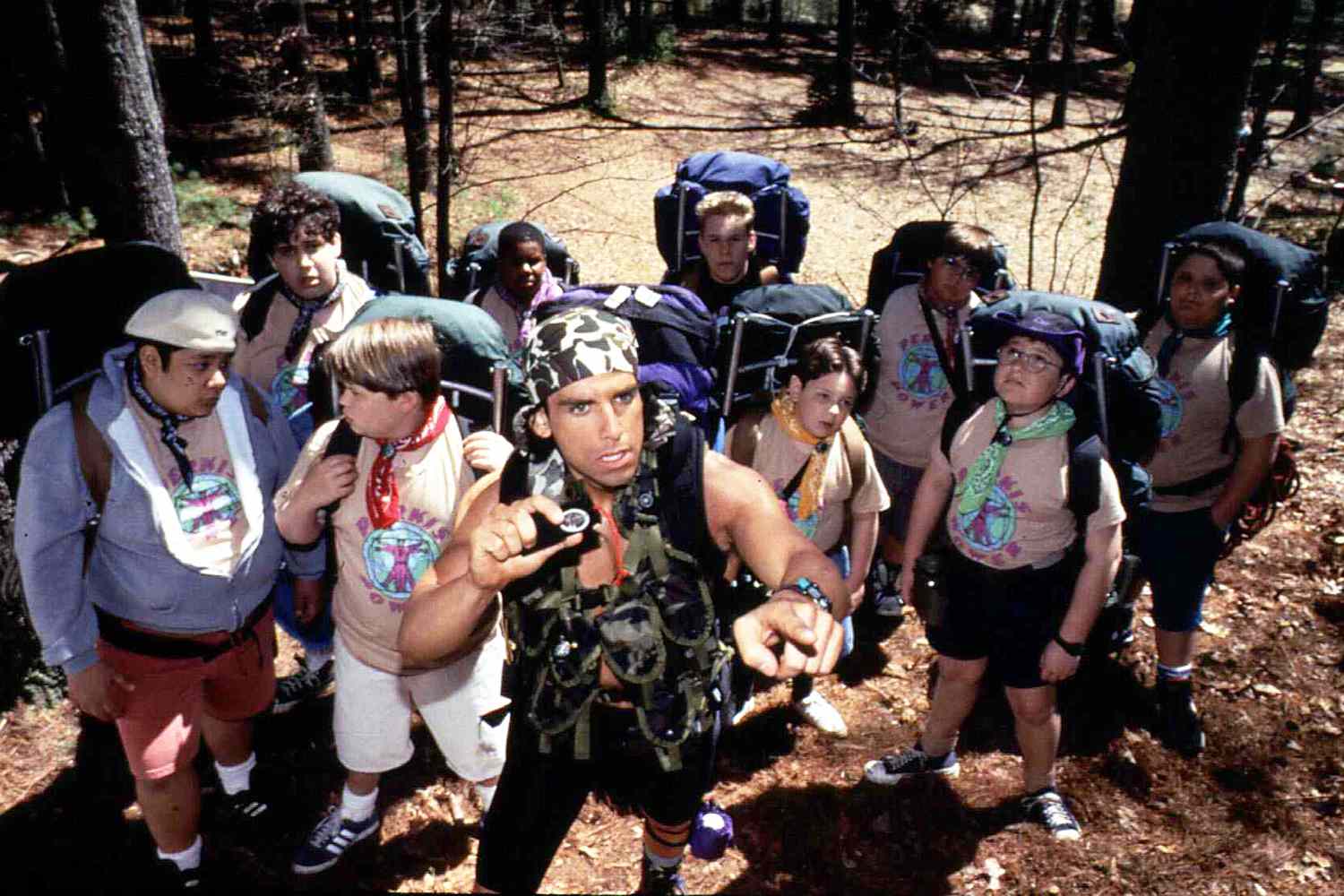

Ben Stillers On Set Conduct Questioned Shaun Weiss Recounts Heavyweights Experience

May 04, 2025

Ben Stillers On Set Conduct Questioned Shaun Weiss Recounts Heavyweights Experience

May 04, 2025 -

Saturday May 3 2025 Detailed Pm Weather Forecast

May 04, 2025

Saturday May 3 2025 Detailed Pm Weather Forecast

May 04, 2025 -

Ufc Des Moines Yana Santos Dream Match With Miesha Tate

May 04, 2025

Ufc Des Moines Yana Santos Dream Match With Miesha Tate

May 04, 2025 -

Investimento Inteligente Cotas Em Casas De Veraneio Para Praia E Campo

May 04, 2025

Investimento Inteligente Cotas Em Casas De Veraneio Para Praia E Campo

May 04, 2025