Is The Bitcoin And Ethereum Supply Shock A Reality? Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is the Bitcoin and Ethereum Supply Shock a Reality? A Market Analysis

The cryptocurrency market is abuzz with talk of an impending "supply shock" for Bitcoin (BTC) and Ethereum (ETH). But is this hype, or a genuine market-shifting event on the horizon? Let's delve into a detailed market analysis to uncover the truth.

The concept of a supply shock hinges on the limited supply of both Bitcoin and Ethereum contrasted with growing demand. Bitcoin's maximum supply is capped at 21 million coins, while Ethereum's supply, while not capped in the same way, is subject to significant deflationary pressures through mechanisms like burning. This inherent scarcity, coupled with increasing institutional and retail adoption, fuels the argument for a significant price surge.

Understanding the Dynamics of a Supply Shock

A supply shock occurs when the available supply of an asset drastically falls short of the existing demand. This imbalance typically leads to a sharp increase in price. For cryptocurrencies like Bitcoin and Ethereum, several factors contribute to the potential for a supply shock:

-

Halving Events (Bitcoin): Bitcoin's halving, which cuts the rate of newly mined Bitcoin in half, significantly reduces the influx of new coins into circulation. This periodic event has historically preceded bull markets. The next Bitcoin halving is anticipated in 2024, further fueling speculation.

-

Ethereum's Burning Mechanism: Ethereum's transition to a proof-of-stake (PoS) consensus mechanism introduced "transaction fee burning." A portion of transaction fees is permanently removed from circulation, effectively reducing the overall supply. This ongoing burn mechanism is a significant factor contributing to potential scarcity.

-

Increased Institutional Adoption: The growing acceptance of Bitcoin and Ethereum by institutional investors, including hedge funds and corporations, signifies increased demand for these assets. This institutional interest adds considerable weight to the narrative of a potential supply shock.

-

Growing DeFi Ecosystem (Ethereum): The booming decentralized finance (DeFi) ecosystem built on Ethereum necessitates a large amount of ETH for staking, lending, and other activities, further contributing to reduced circulating supply.

Counterarguments and Potential Challenges

While the prospect of a supply shock is alluring, it's crucial to consider potential counterarguments:

-

Regulatory Uncertainty: Stringent government regulations could dampen the market enthusiasm and potentially offset the impact of a limited supply.

-

Market Volatility: The cryptocurrency market is inherently volatile. Unexpected events, such as security breaches or regulatory crackdowns, can significantly impact prices regardless of supply dynamics.

-

Technological Advancements: The emergence of competing cryptocurrencies with potentially more efficient or scalable solutions could divert investor interest away from Bitcoin and Ethereum.

Conclusion: A Likely Scenario, But Not Guaranteed

While the fundamental principles of limited supply and increasing demand strongly suggest the possibility of a Bitcoin and Ethereum supply shock, predicting its precise timing and magnitude is impossible. The market is influenced by a multitude of complex and interconnected factors. However, the confluence of halving events, burning mechanisms, and increased institutional adoption points towards a scenario where scarcity will play an increasingly important role in shaping the future price of these cryptocurrencies. Investors should approach the market with caution, conducting thorough research and managing risk appropriately. The possibility of a supply shock is a strong argument for long-term investment, but short-term price movements remain highly unpredictable.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is The Bitcoin And Ethereum Supply Shock A Reality? Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Solve Nyt Spelling Bee Puzzle 446 May 23 2025 Hints Answers And Pangram

May 26, 2025

Solve Nyt Spelling Bee Puzzle 446 May 23 2025 Hints Answers And Pangram

May 26, 2025 -

2025 Indy 500 Race Start Time Tv Schedule Live Stream Details And Driver Lineup

May 26, 2025

2025 Indy 500 Race Start Time Tv Schedule Live Stream Details And Driver Lineup

May 26, 2025 -

Monaco Gp Penalty Blunder Hamilton Points Finger At Verstappens Penalty

May 26, 2025

Monaco Gp Penalty Blunder Hamilton Points Finger At Verstappens Penalty

May 26, 2025 -

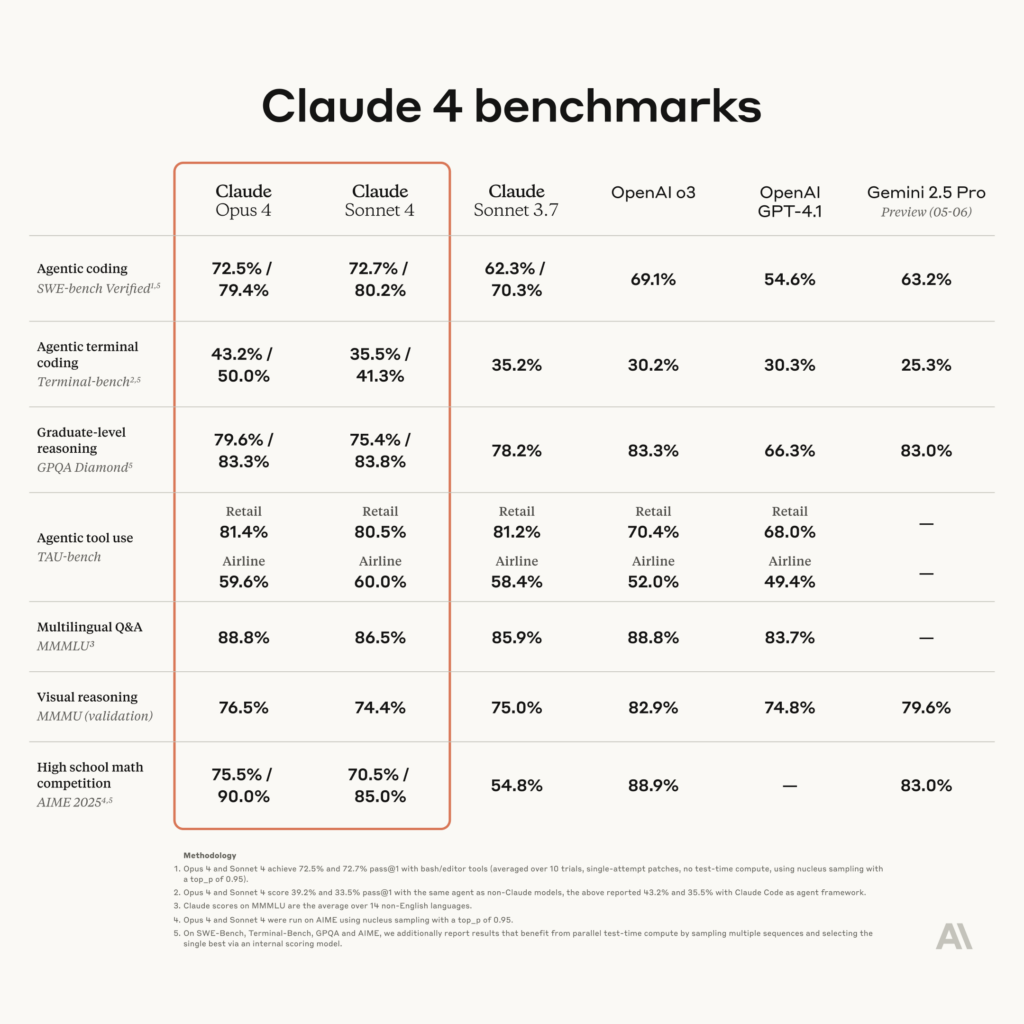

Anthropic Unveils Claude 4 Sonnet And Opus For Enhanced Agentic Coding

May 26, 2025

Anthropic Unveils Claude 4 Sonnet And Opus For Enhanced Agentic Coding

May 26, 2025 -

Warren Buffett Y Apple La Explicacion Detras De La Reduccion Del 13 En Su Participacion

May 26, 2025

Warren Buffett Y Apple La Explicacion Detras De La Reduccion Del 13 En Su Participacion

May 26, 2025