Is The Crypto Tax System Broken? The Need For Modernization.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is the Crypto Tax System Broken? The Urgent Need for Modernization

The meteoric rise of cryptocurrency has left tax authorities worldwide scrambling to keep up. While digital assets offer unprecedented opportunities, the current tax systems, designed for traditional finance, are ill-equipped to handle the complexities of blockchain technology. This leaves taxpayers confused, burdened with compliance challenges, and potentially facing significant penalties. The question on everyone's lips: is the crypto tax system broken, and what needs to be done? The answer, unfortunately, is a resounding yes, and the need for modernization is urgent.

The Current System's Shortcomings

The existing tax infrastructure struggles with several key aspects of cryptocurrency:

-

Defining Crypto Assets: The lack of clear regulatory definitions for cryptocurrencies, NFTs, and DeFi protocols creates significant ambiguity. Are they property, currency, or something else entirely? This uncertainty makes accurate tax reporting extremely difficult.

-

Tracking Transactions: The decentralized and pseudonymous nature of blockchain transactions makes tracking and reporting all crypto activities a Herculean task. Current systems aren't designed to automatically integrate with blockchain data, requiring manual tracking and reconciliation, prone to human error.

-

Global Nature of Crypto: Cryptocurrencies transcend national borders, creating jurisdictional challenges. Determining tax residency and applicable tax rates for cross-border crypto transactions is often complex and contentious.

-

Lack of Specialized Expertise: Tax professionals and government agencies often lack the specialized knowledge needed to understand the intricacies of crypto taxation, leading to inconsistent interpretations and enforcement.

-

Reporting Complexity: The various types of crypto transactions – trading, staking, lending, airdrops – each have different tax implications, adding layers of complexity to the reporting process. Form 8949, for example, can be incredibly daunting for even experienced taxpayers.

The Consequences of a Broken System

The shortcomings of the current system lead to several negative consequences:

-

Increased Taxpayer Burden: The complexity and manual effort required for crypto tax compliance place an undue burden on taxpayers, especially those with significant crypto holdings.

-

Non-Compliance: The difficulties in understanding and complying with the regulations can lead to unintentional non-compliance and subsequent penalties.

-

Inconsistent Enforcement: The lack of standardized approaches to crypto taxation across jurisdictions leads to inconsistent enforcement and creates opportunities for tax avoidance.

-

Hindered Innovation: Uncertainty surrounding crypto taxation can stifle innovation in the crypto space, discouraging investment and development.

The Path Towards Modernization

Modernizing the crypto tax system requires a multi-pronged approach:

-

Clearer Regulatory Definitions: Governments need to establish clear and comprehensive definitions for various crypto assets and their associated activities.

-

Technological Integration: Tax authorities should invest in technologies that can integrate with blockchain data, automating aspects of transaction tracking and reporting.

-

International Cooperation: International collaboration is crucial to address the cross-border nature of crypto transactions and establish consistent global standards.

-

Improved Education and Resources: Providing taxpayers with clear, accessible resources and educational materials is essential for promoting compliance.

-

Simplified Reporting Mechanisms: Designing simpler, user-friendly reporting systems tailored to crypto transactions would significantly reduce the taxpayer burden.

Conclusion:

The current crypto tax system is undeniably broken. The consequences of inaction are far-reaching, potentially hindering the growth of the crypto industry and creating significant inequities. Urgent modernization, encompassing regulatory clarity, technological advancements, and international cooperation, is crucial to ensure a fair, efficient, and sustainable tax system for the digital asset economy. The future of crypto depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is The Crypto Tax System Broken? The Need For Modernization.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Review The Walking Dead Dead City Season 2 Episodes 1 6 Breakdown

May 03, 2025

Review The Walking Dead Dead City Season 2 Episodes 1 6 Breakdown

May 03, 2025 -

Cerundolo Vs Ruud Analisis Del Crucial Enfrentamiento En Madrid

May 03, 2025

Cerundolo Vs Ruud Analisis Del Crucial Enfrentamiento En Madrid

May 03, 2025 -

Haney Ramirez Fight Date Time Undercard And Viewing Options

May 03, 2025

Haney Ramirez Fight Date Time Undercard And Viewing Options

May 03, 2025 -

Jakara Jacksons Departure From Wwe Fans React To The News

May 03, 2025

Jakara Jacksons Departure From Wwe Fans React To The News

May 03, 2025 -

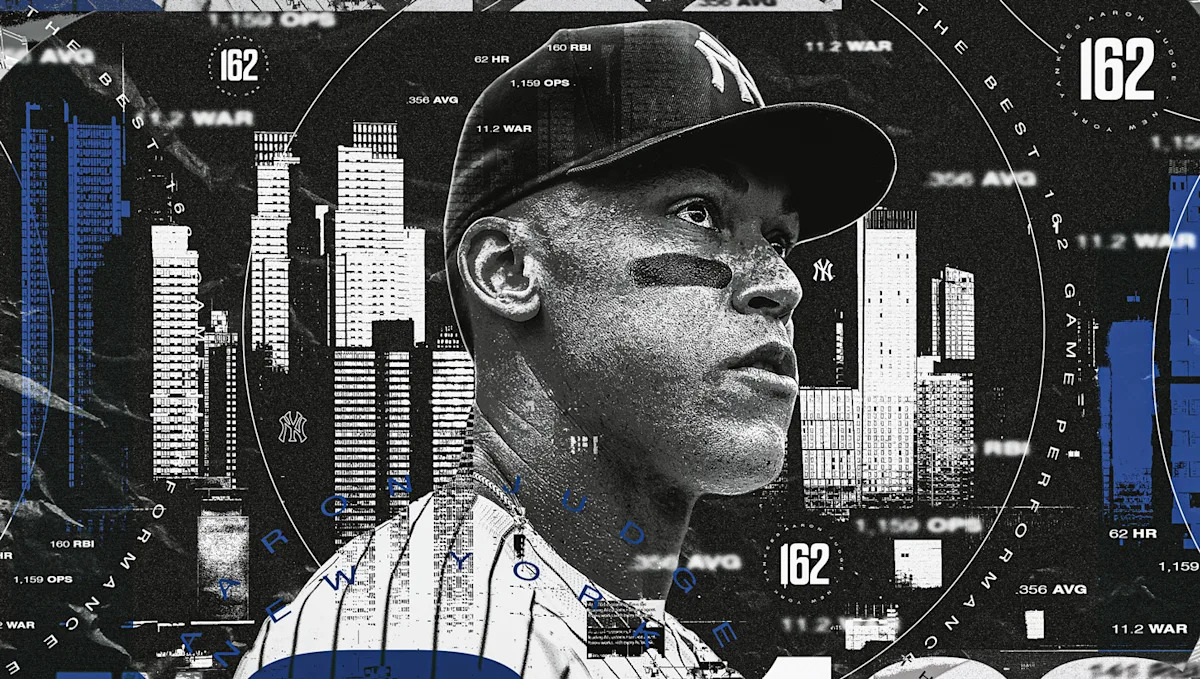

Beyond The Numbers Understanding Aaron Judges 2023 Mlb Year

May 03, 2025

Beyond The Numbers Understanding Aaron Judges 2023 Mlb Year

May 03, 2025

Latest Posts

-

Padres Vs Pirates May 3rd Mlb Prediction Odds Comparison And Best Bets

May 04, 2025

Padres Vs Pirates May 3rd Mlb Prediction Odds Comparison And Best Bets

May 04, 2025 -

Significant Errors Found In Bmi Calculations For One Million Minority Ethnic Adults In England

May 04, 2025

Significant Errors Found In Bmi Calculations For One Million Minority Ethnic Adults In England

May 04, 2025 -

Man Citys 1 0 Win Over Wolves Key Moments And Post Match Analysis May 2 2025

May 04, 2025

Man Citys 1 0 Win Over Wolves Key Moments And Post Match Analysis May 2 2025

May 04, 2025 -

Re Examining Get Carter Michael Caines Impactful British Gangster Film

May 04, 2025

Re Examining Get Carter Michael Caines Impactful British Gangster Film

May 04, 2025 -

Crise No Rs Gerdau Paralisa Producao Apos Fortes Precipitacoes

May 04, 2025

Crise No Rs Gerdau Paralisa Producao Apos Fortes Precipitacoes

May 04, 2025