Is The Current Tax Code Smothering Cryptocurrency Innovation?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is the Current Tax Code Smothering Cryptocurrency Innovation?

The meteoric rise of cryptocurrency has brought with it a complex web of regulatory challenges, none more significant than the existing tax code. While governments worldwide grapple with how to effectively tax digital assets, many argue that the current framework is inadvertently stifling innovation and hindering the growth of this burgeoning sector. Is the tax code a necessary evil, or is it actively choking the life out of crypto's potential?

The Current Landscape: A Minefield of Uncertainty

The lack of clarity surrounding cryptocurrency taxation is arguably its biggest hurdle. Different jurisdictions have implemented vastly different approaches, leading to a fragmented and often confusing landscape for individuals and businesses alike. This uncertainty discourages investment and participation, as navigating the complex rules and regulations requires significant time, resources, and expertise.

-

Capital Gains Taxes: The most common approach is to treat cryptocurrency transactions as taxable events, similar to stocks. However, the frequent fluctuations in value and the complexities of tracking transactions across numerous platforms present significant challenges for accurate reporting. This can lead to unintentional errors and hefty penalties.

-

Tax Reporting Complexity: The sheer number of transactions possible within the crypto space, coupled with the lack of standardized reporting mechanisms, makes accurate tax filing a herculean task. Many individuals lack the technical expertise or financial resources to properly manage their crypto tax obligations, leading to potential underreporting and audits.

-

Defining "Cryptocurrency": The lack of a universally accepted definition of "cryptocurrency" further complicates matters. The ambiguity surrounding stablecoins, NFTs, and decentralized finance (DeFi) protocols makes consistent tax application difficult, potentially leading to inconsistent and unfair tax burdens.

The Stifling Effect on Innovation

The current regulatory uncertainty is having a demonstrably negative impact on cryptocurrency innovation. Entrepreneurs and developers are hesitant to invest time and resources in projects that face significant tax risks. This chilling effect can be felt across the entire crypto ecosystem:

-

Reduced Investment: The fear of hefty tax penalties deters potential investors, slowing down the development of new technologies and applications.

-

Brain Drain: Talented developers and entrepreneurs may relocate to jurisdictions with more favorable tax policies, leading to a loss of innovation within countries with stringent regulations.

-

Hindered Adoption: The complexities of crypto taxation make it less accessible to the average consumer, limiting widespread adoption and hindering the potential for mainstream use.

Finding a Balance: Regulation vs. Innovation

The challenge lies in finding a balance between effective regulation and fostering innovation. Overly burdensome tax policies can stifle growth, while a complete lack of regulation can lead to market manipulation and illicit activities. A more nuanced approach is needed, one that addresses the unique characteristics of cryptocurrency without stifling its potential.

Potential Solutions:

-

Clearer guidelines and regulations: Establishing clear, consistent, and easily understandable guidelines on cryptocurrency taxation is paramount. This requires collaboration between governments, regulatory bodies, and industry experts.

-

Simplified tax reporting: Developing user-friendly tax reporting tools and systems can significantly ease the burden on individuals and businesses.

-

Tax incentives for innovation: Governments could incentivize crypto innovation by providing tax breaks or other incentives for the development of promising technologies.

The future of cryptocurrency hinges on finding a sustainable path forward. Addressing the challenges posed by the current tax code is critical to unlocking the technology's full potential and ensuring its responsible and equitable development. Failure to do so risks stifling innovation and hindering the growth of a technology with the potential to reshape the global financial landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is The Current Tax Code Smothering Cryptocurrency Innovation?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Australia Votes Examining Trumps Influence On The 2024 Election

May 03, 2025

Australia Votes Examining Trumps Influence On The 2024 Election

May 03, 2025 -

Aaron Judges Historic April Mlb Best 427 Average And 10 Home Runs

May 03, 2025

Aaron Judges Historic April Mlb Best 427 Average And 10 Home Runs

May 03, 2025 -

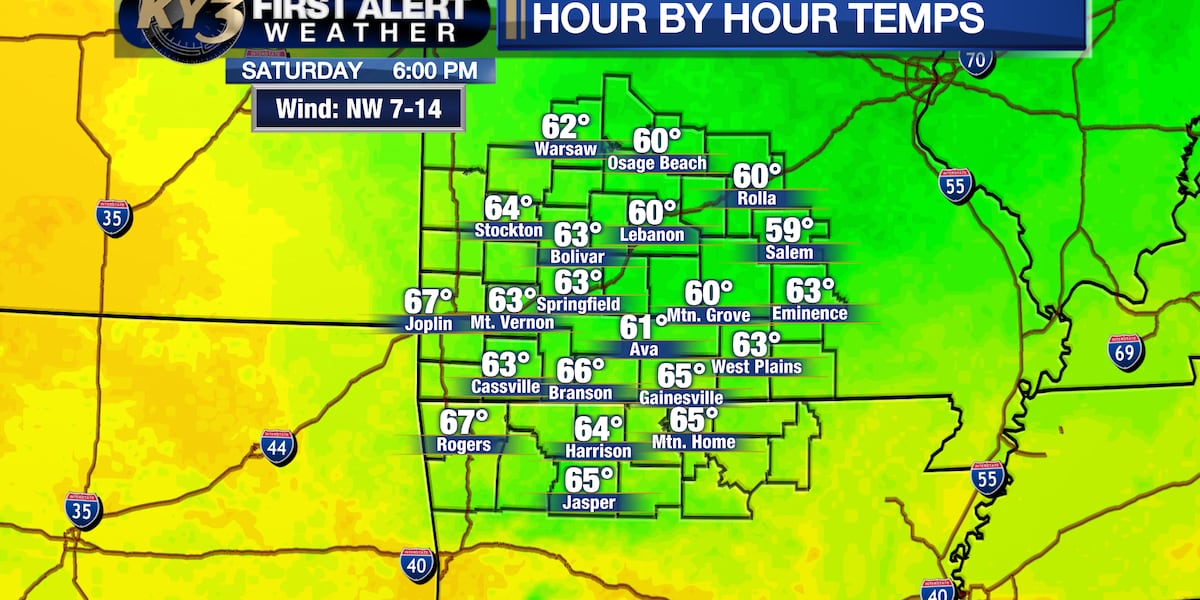

Rain And Thunderstorm Outlook Friday Weather Update

May 03, 2025

Rain And Thunderstorm Outlook Friday Weather Update

May 03, 2025 -

Watch Indiana Fever Vs Brazil Womens National Team Free Online Streaming Guide

May 03, 2025

Watch Indiana Fever Vs Brazil Womens National Team Free Online Streaming Guide

May 03, 2025 -

May In Singapore 34 C Heatwave Thunderstorms And Downpours

May 03, 2025

May In Singapore 34 C Heatwave Thunderstorms And Downpours

May 03, 2025

Latest Posts

-

Australian Election Labor Poised For Larger Victory You Gov Mrp Shows

May 03, 2025

Australian Election Labor Poised For Larger Victory You Gov Mrp Shows

May 03, 2025 -

Manchester City Vs Wolves Premier League Preview And Prediction

May 03, 2025

Manchester City Vs Wolves Premier League Preview And Prediction

May 03, 2025 -

Worlds First True Triple Screen Laptop Expanding Your Productivity Horizons

May 03, 2025

Worlds First True Triple Screen Laptop Expanding Your Productivity Horizons

May 03, 2025 -

Sequel Fails To Capture The Magic Of The Original 2018 Comedy

May 03, 2025

Sequel Fails To Capture The Magic Of The Original 2018 Comedy

May 03, 2025 -

College Softball Rankings Week 12 Oklahomas Top Spot Contested

May 03, 2025

College Softball Rankings Week 12 Oklahomas Top Spot Contested

May 03, 2025