Is This AI Stock's 25% Fall A Bargain Before April 17?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is This AI Stock's 25% Fall a Bargain Before April 17?

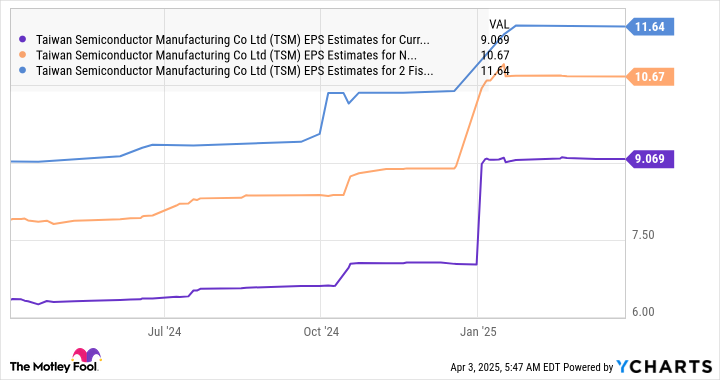

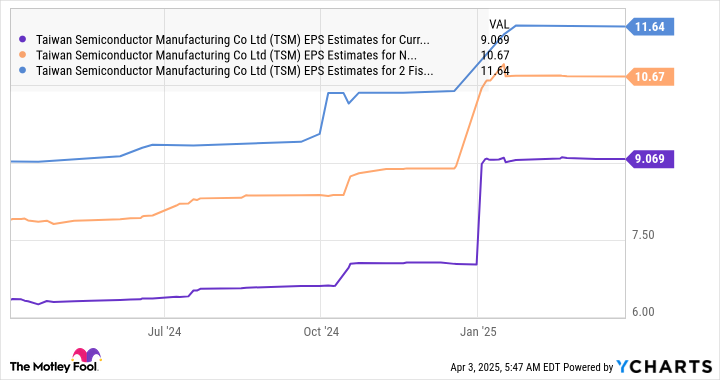

Artificial intelligence (AI) stocks have been on a rollercoaster ride lately, and one prominent player has seen a significant drop. This has left many investors wondering: is this a buying opportunity, or a sign of further trouble ahead? Specifically, the 25% fall in [Insert Stock Name and Ticker Symbol Here] before its crucial April 17th earnings report has sparked considerable debate. Let's delve into the details and explore whether this dip presents a compelling bargain for savvy investors.

The Plunge: Understanding the Recent Downturn

[Insert Stock Name and Ticker Symbol Here] experienced a sharp 25% decline in its share price over the past [Time Period - e.g., week, month]. Several factors likely contributed to this downturn:

- Market Sentiment: The broader tech sector has faced headwinds recently, impacting AI stocks along with other growth-oriented companies. Investor anxieties concerning inflation, interest rates, and a potential recession have also played a role.

- Competition: The AI landscape is fiercely competitive. Increased competition from established tech giants and emerging startups could be putting pressure on [Insert Stock Name and Ticker Symbol Here]'s market share and profitability.

- Specific Company Challenges: [Mention any specific news or events related to the company that might have contributed to the price drop. For example: recent product delays, weaker-than-expected sales figures, or negative analyst reports].

April 17th: A Pivotal Date for Investors

The upcoming earnings report on April 17th is crucial. Investors will be scrutinizing the company's financial performance, including:

- Revenue Growth: Demonstrating strong revenue growth is essential for justifying the company's current valuation.

- Profitability: Investors will be keen to see if [Insert Stock Name and Ticker Symbol Here] is moving towards profitability or if losses are widening.

- Future Guidance: The company's outlook for the rest of the year will be a key indicator of future performance and will significantly impact investor sentiment.

Is This a Buying Opportunity? A Cautious Approach

The 25% drop undeniably makes the stock look attractive, especially for long-term investors. However, caution is advised. Before jumping in, consider:

- Fundamental Analysis: Thoroughly analyze the company's financials, competitive landscape, and long-term growth prospects. Don't solely base your decision on the recent price drop.

- Risk Tolerance: Investing in AI stocks carries inherent risks. Only invest an amount you are comfortable losing.

- Diversification: Don't put all your eggs in one basket. Diversifying your portfolio across different asset classes and sectors is crucial for mitigating risk.

Beyond April 17th: Long-Term Potential

Despite the recent volatility, the long-term outlook for [Insert Stock Name and Ticker Symbol Here] and the AI sector remains positive. The continued growth of AI across various industries presents significant opportunities. However, success will depend on the company's ability to execute its strategy effectively and maintain a competitive edge.

Conclusion:

The 25% fall in [Insert Stock Name and Ticker Symbol Here]'s stock price presents a potential bargain, but not without risks. The April 17th earnings report will be pivotal. Investors should carefully assess the company's fundamentals, future prospects, and their own risk tolerance before making any investment decisions. Remember, thorough research and a long-term perspective are key to navigating the volatile world of AI stocks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is This AI Stock's 25% Fall A Bargain Before April 17?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Penunjukan Rosan Roeslani Dan Dampaknya Pada Kekosongan Duta Besar Indonesia Di As

Apr 07, 2025

Penunjukan Rosan Roeslani Dan Dampaknya Pada Kekosongan Duta Besar Indonesia Di As

Apr 07, 2025 -

Use I Phone Screen Time Effectively Control Your Usage And Boost Productivity

Apr 07, 2025

Use I Phone Screen Time Effectively Control Your Usage And Boost Productivity

Apr 07, 2025 -

Top 3 Bargain Tech Stocks Invest Before The Bull Market

Apr 07, 2025

Top 3 Bargain Tech Stocks Invest Before The Bull Market

Apr 07, 2025 -

Grass Fire Delays Japanese Grand Prix F1 Awaits Rain To Resolve Suzuka Crisis

Apr 07, 2025

Grass Fire Delays Japanese Grand Prix F1 Awaits Rain To Resolve Suzuka Crisis

Apr 07, 2025 -

Clippers Vs Mavericks Witnessing A Subtle Dig At Nico Harrison

Apr 07, 2025

Clippers Vs Mavericks Witnessing A Subtle Dig At Nico Harrison

Apr 07, 2025