Is This Bitcoin Dip A Buying Opportunity? Expert Analysts Offer Insight

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is This Bitcoin Dip a Buying Opportunity? Expert Analysts Offer Insight

Bitcoin's price has experienced another downturn, leaving many investors wondering: is this a buying opportunity, or a sign of further trouble ahead? The cryptocurrency market is notoriously volatile, and this recent dip has sparked heated debate among experts. Let's delve into the analysis and explore whether now is the time to buy the dip or wait for clearer signals.

Understanding the Current Bitcoin Dip

The recent Bitcoin price drop, while significant for some, isn't unprecedented. Bitcoin's history is punctuated by periods of intense volatility, characterized by both dramatic rises and equally sharp declines. Several factors contribute to this current dip, including:

- Regulatory Uncertainty: Ongoing regulatory scrutiny from governments worldwide continues to impact investor sentiment and price stability. Unclear regulatory frameworks create uncertainty, making some investors hesitant to invest heavily in Bitcoin.

- Macroeconomic Factors: Global economic instability, high inflation rates, and rising interest rates globally are all impacting investor risk appetite. These macroeconomic factors often influence the price of risk assets like Bitcoin.

- Market Sentiment: Fear, uncertainty, and doubt (FUD) can significantly affect the cryptocurrency market. Negative news cycles, even if unfounded, can trigger sell-offs and contribute to price drops.

Expert Opinions: Bullish or Bearish?

While predicting the future of Bitcoin is impossible, several expert analysts offer differing perspectives on this recent dip:

Some analysts, adopting a bullish stance, argue that this dip presents a compelling buying opportunity. They point to Bitcoin's long-term potential and its resilience in the face of past market downturns. They believe that the current price is undervalued and represents a chance to accumulate Bitcoin at a relatively low price, anticipating a future price surge.

Conversely, bearish analysts remain cautious, citing the ongoing regulatory challenges and macroeconomic headwinds. They warn that further price declines are possible before a significant rebound. These analysts suggest waiting for clearer signals of market recovery before investing.

Technical Analysis: Charts and Indicators

Technical analysis, using charts and indicators, provides further insight. While not foolproof, studying indicators like moving averages, Relative Strength Index (RSI), and volume can help identify potential support and resistance levels. Currently, some technical indicators suggest that the Bitcoin price may find support at a particular level, indicating a potential buying opportunity for those with a higher risk tolerance. However, other indicators remain bearish, suggesting a potential for further downward movement.

What Should Investors Do?

The decision to buy Bitcoin during a dip is highly personal and depends on individual risk tolerance and investment goals. Several key considerations include:

- Risk Tolerance: Bitcoin is a highly volatile asset. Only invest what you can afford to lose.

- Investment Horizon: A long-term investment strategy often mitigates the impact of short-term price fluctuations.

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio to mitigate risk.

Conclusion:

The recent Bitcoin dip presents both opportunities and risks. While some experts see it as a buying opportunity, others advise caution. Thorough research, understanding your risk tolerance, and considering expert opinions are crucial before making any investment decisions. Remember, this information is for educational purposes only and does not constitute financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is This Bitcoin Dip A Buying Opportunity? Expert Analysts Offer Insight. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

C Span Vs Google The Fight To Keep Public Affairs Broadcasting Alive

May 16, 2025

C Span Vs Google The Fight To Keep Public Affairs Broadcasting Alive

May 16, 2025 -

Wong Hes Shocking Revelation Sexual Assault And A Fight For Justice

May 16, 2025

Wong Hes Shocking Revelation Sexual Assault And A Fight For Justice

May 16, 2025 -

Draper Falls To Alcaraz In Close Italian Open Quarterfinal Match

May 16, 2025

Draper Falls To Alcaraz In Close Italian Open Quarterfinal Match

May 16, 2025 -

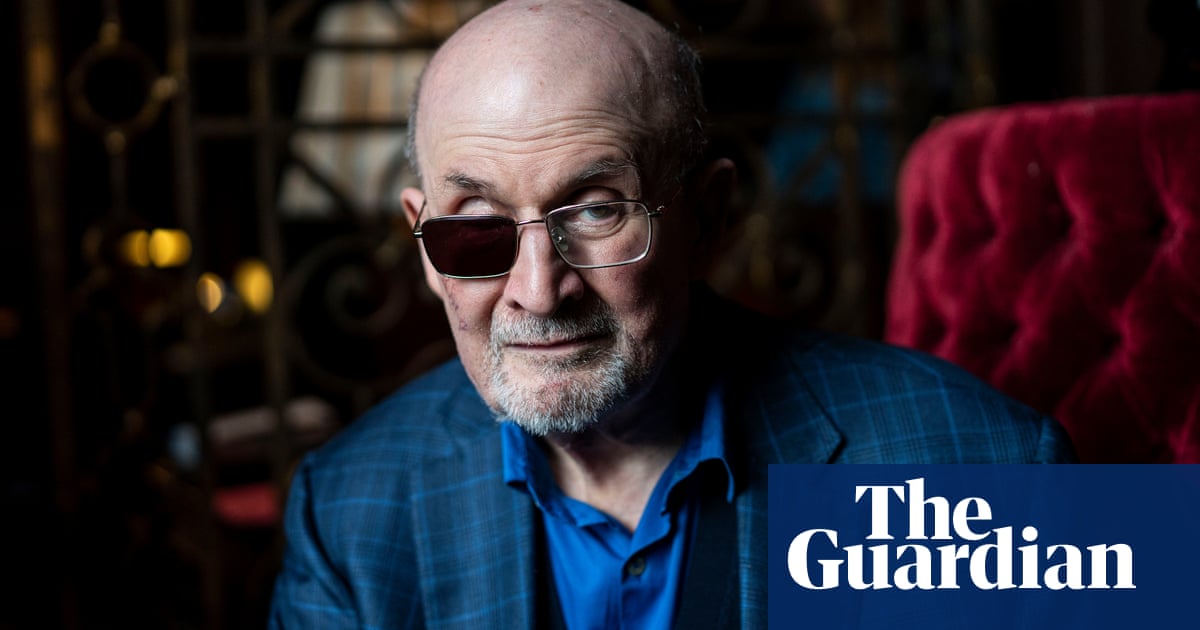

Man Who Stabbed Author Salman Rushdie Sentenced

May 16, 2025

Man Who Stabbed Author Salman Rushdie Sentenced

May 16, 2025 -

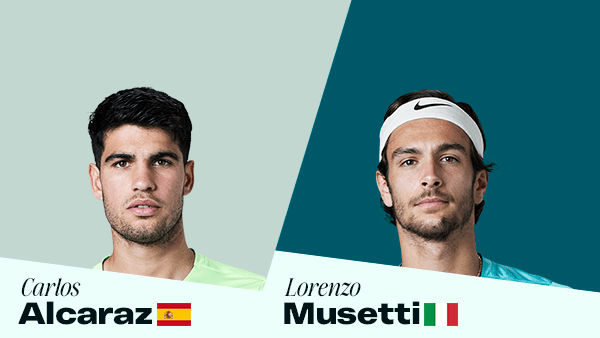

Carlos Alcaraz Vs Lorenzo Musetti Rome Masters Semifinal Match Preview And Viewing Guide

May 16, 2025

Carlos Alcaraz Vs Lorenzo Musetti Rome Masters Semifinal Match Preview And Viewing Guide

May 16, 2025