Is This Bitcoin's Next Big Run? Retail FOMO And Bullish On-Chain Metrics Point To Upside

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is This Bitcoin's Next Big Run? Retail FOMO and Bullish On-Chain Metrics Point to Upside

Bitcoin's price has shown signs of life recently, leaving many wondering: is this the start of the next major bull run? A confluence of factors, including resurgent retail investor Fear Of Missing Out (FOMO) and increasingly bullish on-chain metrics, suggests a potential upward trajectory. But before we get carried away, let's delve into the details.

The Return of Retail FOMO:

After a prolonged period of bearish sentiment and market stagnation, retail investors are showing renewed interest in Bitcoin. This is evident in increased trading volume on popular exchanges and a surge in social media mentions. The narrative surrounding Bitcoin has shifted from one of skepticism and doom to cautious optimism, fueled by positive news cycles and a general sense that the bottom might be in. This renewed retail participation, often characterized by FOMO (Fear Of Missing Out), can be a powerful driver of price appreciation. History has repeatedly shown that retail FOMO can inject significant liquidity into the market, pushing prices higher.

Bullish On-Chain Signals:

Beyond the anecdotal evidence of retail investor activity, several key on-chain metrics are painting a bullish picture. These metrics, which analyze the underlying activity on the Bitcoin blockchain, offer a more objective view of market sentiment and potential price movements.

- Increasing Accumulation by Large Holders: Whale activity, tracked by the number of coins held by large addresses, shows a consistent accumulation trend. This suggests that sophisticated investors believe in Bitcoin's long-term potential and are positioning themselves for future price appreciation.

- Decreased Exchange Reserves: The amount of Bitcoin held on cryptocurrency exchanges is declining. This is a bullish indicator, suggesting that investors are moving their holdings off exchanges into cold storage, indicating a longer-term holding strategy.

- Rising Network Hashrate: The hashrate, a measure of the computational power securing the Bitcoin network, continues to rise, signifying increased network security and overall health. This is a positive sign for long-term stability and adoption.

Potential Headwinds:

While the outlook appears optimistic, it's crucial to acknowledge potential headwinds. Macroeconomic factors, particularly inflation and interest rate hikes, continue to exert influence on the cryptocurrency market. Regulatory uncertainty also remains a persistent concern, potentially impacting investor sentiment and price action.

The Verdict: Cautious Optimism

The combination of resurgent retail FOMO and positive on-chain signals paints a relatively bullish picture for Bitcoin's short-to-medium-term prospects. However, it's important to maintain a level of caution. The cryptocurrency market remains volatile, and unforeseen events can significantly impact prices. While the current indicators are encouraging, they don't guarantee a sustained bull run. Investors should conduct thorough research and only invest what they can afford to lose.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risk, and you could lose your entire investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is This Bitcoin's Next Big Run? Retail FOMO And Bullish On-Chain Metrics Point To Upside. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ottawa Businesses Your Victoria Day Long Weekend Guide

May 15, 2025

Ottawa Businesses Your Victoria Day Long Weekend Guide

May 15, 2025 -

The Handmaids Tale Aunt Lydia Faces A Ghostly Revelation

May 15, 2025

The Handmaids Tale Aunt Lydia Faces A Ghostly Revelation

May 15, 2025 -

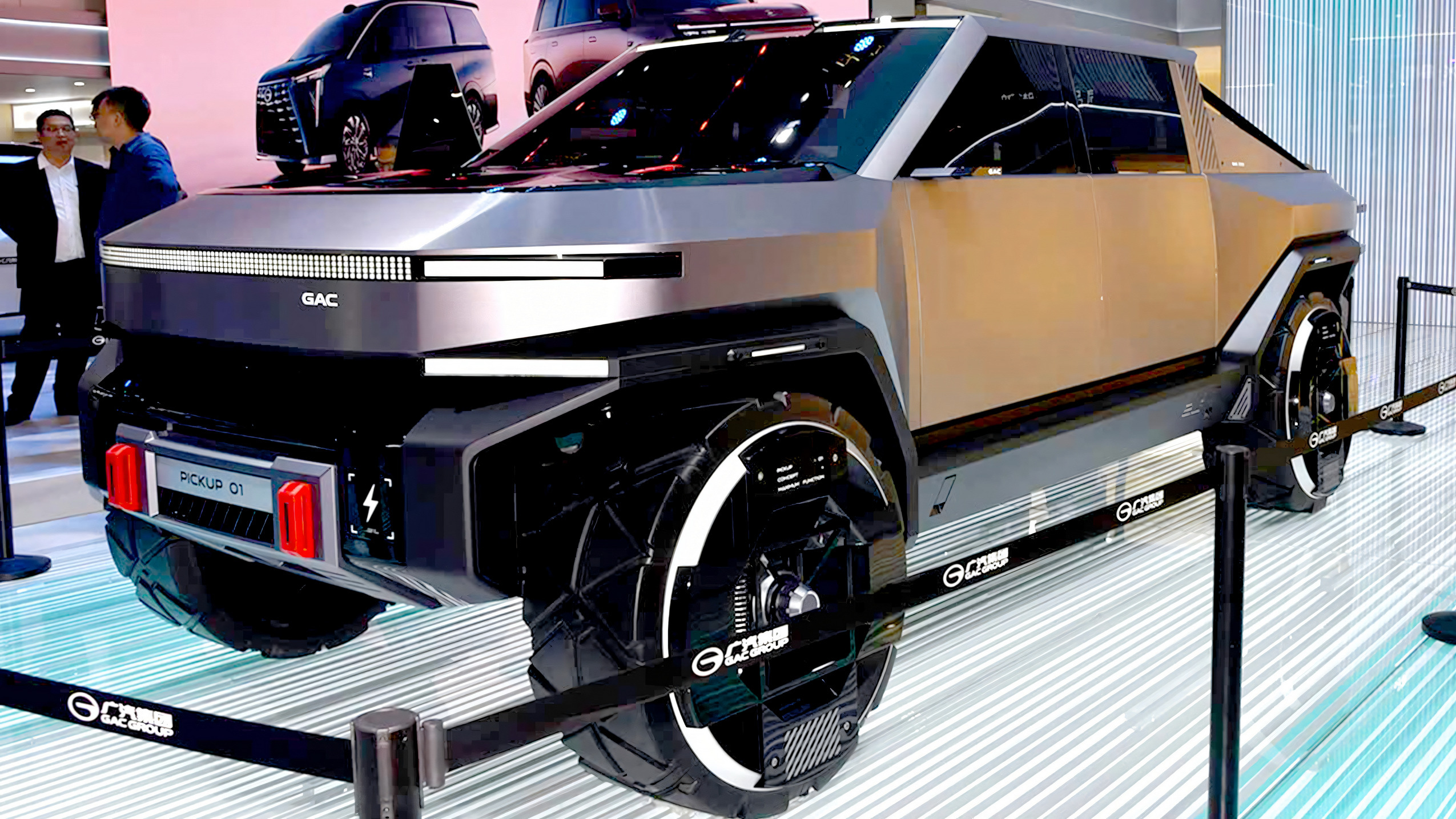

Production Starts On Chinas Answer To Teslas Cybertruck

May 15, 2025

Production Starts On Chinas Answer To Teslas Cybertruck

May 15, 2025 -

F1 Singapore Grand Prix Concert Alan Walker Cl Complete Epic Music Festival

May 15, 2025

F1 Singapore Grand Prix Concert Alan Walker Cl Complete Epic Music Festival

May 15, 2025 -

Thailand Covid 19 Surge Expert Urges Revised Vaccination Approach

May 15, 2025

Thailand Covid 19 Surge Expert Urges Revised Vaccination Approach

May 15, 2025

Latest Posts

-

Police Arrest Chris Brown For Alleged Assault With Tequila Bottle

May 15, 2025

Police Arrest Chris Brown For Alleged Assault With Tequila Bottle

May 15, 2025 -

Samsung Galaxy S25 One Ui 8s Enhanced Coolest Feature

May 15, 2025

Samsung Galaxy S25 One Ui 8s Enhanced Coolest Feature

May 15, 2025 -

Days Before Budget Treasurers Controversial Fire Levy Increase

May 15, 2025

Days Before Budget Treasurers Controversial Fire Levy Increase

May 15, 2025 -

News Summary For Tuesday May 13th

May 15, 2025

News Summary For Tuesday May 13th

May 15, 2025 -

General Sir Gwyn Jenkins Appointed First Sea Lord And Aide De Camp

May 15, 2025

General Sir Gwyn Jenkins Appointed First Sea Lord And Aide De Camp

May 15, 2025