Is This Top AI Stock A Bargain After A 25% Drop?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is This Top AI Stock a Bargain After a 25% Drop? Navigating the Volatility of Artificial Intelligence Investments

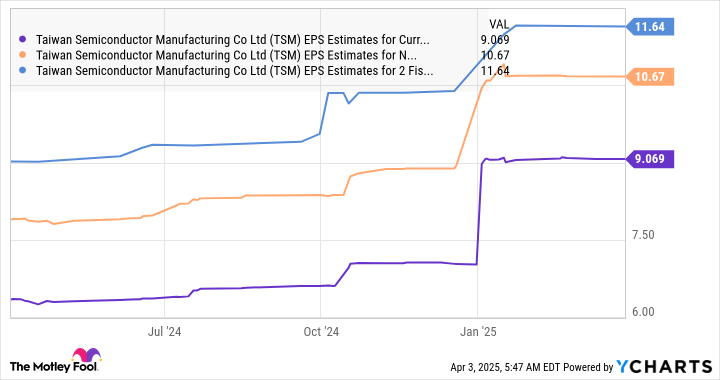

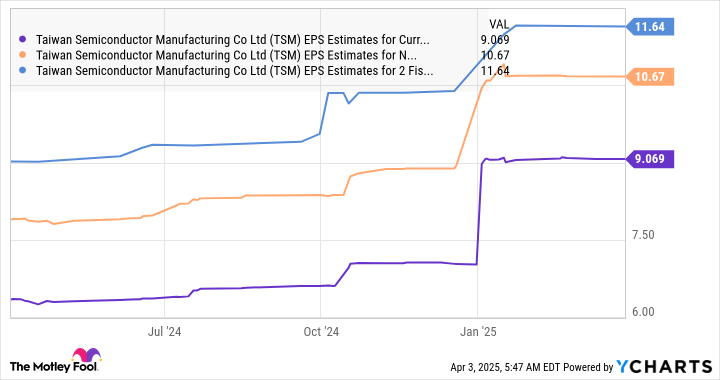

The artificial intelligence (AI) sector has been a rollercoaster ride in recent months, with significant price swings leaving investors wondering where to put their money. One prominent AI stock has experienced a dramatic 25% drop, sparking a crucial question: is this a buying opportunity, or a sign of deeper trouble? This article delves into the current market situation, examining the potential risks and rewards of investing in this top AI player after its recent decline.

Understanding the Market Dip: Why the 25% Drop?

Several factors may contribute to the 25% decline in this AI stock's price. These include:

- Overall Market Volatility: The broader tech sector has seen significant volatility lately, impacting even the strongest performers. Concerns about inflation, interest rate hikes, and a potential recession have created a climate of uncertainty.

- Profit-Taking: After a period of strong growth, some investors may have decided to take profits, leading to a sell-off. This is a normal part of the market cycle, but it can amplify price fluctuations.

- Competition: The AI space is rapidly evolving, with new companies and technologies constantly emerging. Increased competition could put pressure on market share and profitability.

- Concerns about Future Growth: While the long-term outlook for AI remains positive, concerns about the pace of future growth could trigger selling pressure. Investors may be reassessing their projections for the company's performance.

Is it a Bargain or a Trap? Assessing the Investment Risk

The 25% drop presents a complex scenario for potential investors. While the lower price might seem attractive, it's crucial to consider the underlying reasons for the decline. Simply buying a stock because it's "cheap" can be a risky strategy.

Factors to Consider Before Investing:

- Fundamental Analysis: Thoroughly analyze the company's financial statements, including revenue growth, profitability, and debt levels. Is the decline in stock price justified by underlying weaknesses, or is it an overreaction?

- Competitive Landscape: Assess the competitive landscape. Does the company possess a sustainable competitive advantage, such as proprietary technology or strong brand recognition?

- Long-Term Growth Potential: Evaluate the company's long-term growth prospects in the AI market. Is its technology well-positioned to capitalize on future trends?

- Management Team: Analyze the quality of the management team. A strong and experienced leadership team is essential for navigating challenges and driving growth.

The Bottom Line: A Calculated Risk

The 25% drop in this top AI stock presents a potential buying opportunity for long-term investors with a high-risk tolerance. However, it's crucial to conduct thorough due diligence before investing. This involves understanding the reasons for the decline, assessing the company's fundamentals, and evaluating its long-term growth potential. Don't make impulsive decisions; a well-researched investment strategy is vital in this volatile market. Consider consulting with a financial advisor before making any investment decisions.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market carries inherent risks, and you could lose money. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is This Top AI Stock A Bargain After A 25% Drop?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bek Muda Persib Bandung Tinggalkan Masa Lajang Pacar Pernikahan Dan Masa Depan

Apr 08, 2025

Bek Muda Persib Bandung Tinggalkan Masa Lajang Pacar Pernikahan Dan Masa Depan

Apr 08, 2025 -

Black History And Culture A Bonus Episode Conversation With Guest Name S

Apr 08, 2025

Black History And Culture A Bonus Episode Conversation With Guest Name S

Apr 08, 2025 -

Stock Market Crash Dow Futures Dive S And P 500 Nears Bear Territory

Apr 08, 2025

Stock Market Crash Dow Futures Dive S And P 500 Nears Bear Territory

Apr 08, 2025 -

Update Pawan Kalyans Son Injured In Singapore School Fire Incident

Apr 08, 2025

Update Pawan Kalyans Son Injured In Singapore School Fire Incident

Apr 08, 2025 -

Hobart Afl Stadium Crucial Vote Poses Significant Risk To Tasmanian Devils Future

Apr 08, 2025

Hobart Afl Stadium Crucial Vote Poses Significant Risk To Tasmanian Devils Future

Apr 08, 2025