Is UNH Stock A Falling Knife? A Deep Dive Into Current Market Trends

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is UNH Stock a Falling Knife? A Deep Dive into Current Market Trends

The healthcare sector is a behemoth, and within it, UnitedHealth Group (UNH) stands as a giant. But recently, UNH stock has seen some volatility, leaving investors wondering: is this a buying opportunity, or are we witnessing the fall of a titan? This deep dive analyzes current market trends and assesses whether UNH stock presents a risky "falling knife" scenario or a potentially lucrative investment.

Understanding the Current Market Landscape:

The broader market has experienced significant fluctuations in 2024, influenced by factors like inflation, interest rate hikes, and geopolitical instability. These macroeconomic headwinds have impacted various sectors, and healthcare is no exception. While UNH boasts a robust business model and consistent growth historically, it's not immune to these pressures.

UNH's Recent Performance and Challenges:

UnitedHealth Group, a dominant player in health insurance and healthcare services, has faced several challenges recently:

- Increased Healthcare Costs: Rising medical inflation and drug prices directly impact UNH's operational expenses and profitability. This pressure on margins is a key concern for investors.

- Regulatory Scrutiny: The healthcare industry faces ongoing regulatory scrutiny, which can lead to increased compliance costs and potential policy changes affecting UNH's operations.

- Competition: Increased competition from other major players in the health insurance market adds further pressure on pricing and market share.

Is UNH Stock a Falling Knife? Analyzing the Risks:

The term "falling knife" refers to a rapidly declining stock, where attempting to "catch" it can lead to further losses. Several factors suggest caution:

- Valuation: While UNH historically trades at a premium, its current valuation relative to its earnings and growth prospects requires careful consideration. Is the current price justified, or is there an overvaluation risk?

- Earnings Reports: Close examination of UNH's recent earnings reports is crucial. Any signs of slowing growth or declining profitability would reinforce concerns about the stock's trajectory.

- Market Sentiment: Negative market sentiment surrounding the healthcare sector and UNH specifically could exacerbate downward pressure on the stock price.

Potential Upsides and Investment Considerations:

Despite the risks, several factors could support UNH's long-term growth:

- Market Dominance: UNH's significant market share and strong brand recognition provide a degree of resilience against competitive pressures.

- Diversified Business Model: UNH's diversified operations across insurance and healthcare services offer some protection against sector-specific downturns.

- Long-Term Growth Potential: The aging population and increasing demand for healthcare services suggest potential for long-term growth in the healthcare sector, benefiting UNH.

Conclusion: A Cautious Approach is Warranted

Whether UNH stock is a "falling knife" is not a simple yes or no answer. While the company possesses inherent strengths and long-term growth potential, the current market conditions and challenges faced by UNH warrant a cautious approach. Investors should conduct thorough due diligence, carefully analyze financial statements, and consider their own risk tolerance before making any investment decisions. Consulting with a financial advisor is highly recommended. The information provided here is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is UNH Stock A Falling Knife? A Deep Dive Into Current Market Trends. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Singapore Airlines Announces Record Profit S 2 8 Billion In Annual Earnings

May 16, 2025

Singapore Airlines Announces Record Profit S 2 8 Billion In Annual Earnings

May 16, 2025 -

Panthers 6 Goal Outburst Pushes Maple Leafs To Eliminations Brink

May 16, 2025

Panthers 6 Goal Outburst Pushes Maple Leafs To Eliminations Brink

May 16, 2025 -

Solana Network Metrics Unpacking The Reality Behind The Hype

May 16, 2025

Solana Network Metrics Unpacking The Reality Behind The Hype

May 16, 2025 -

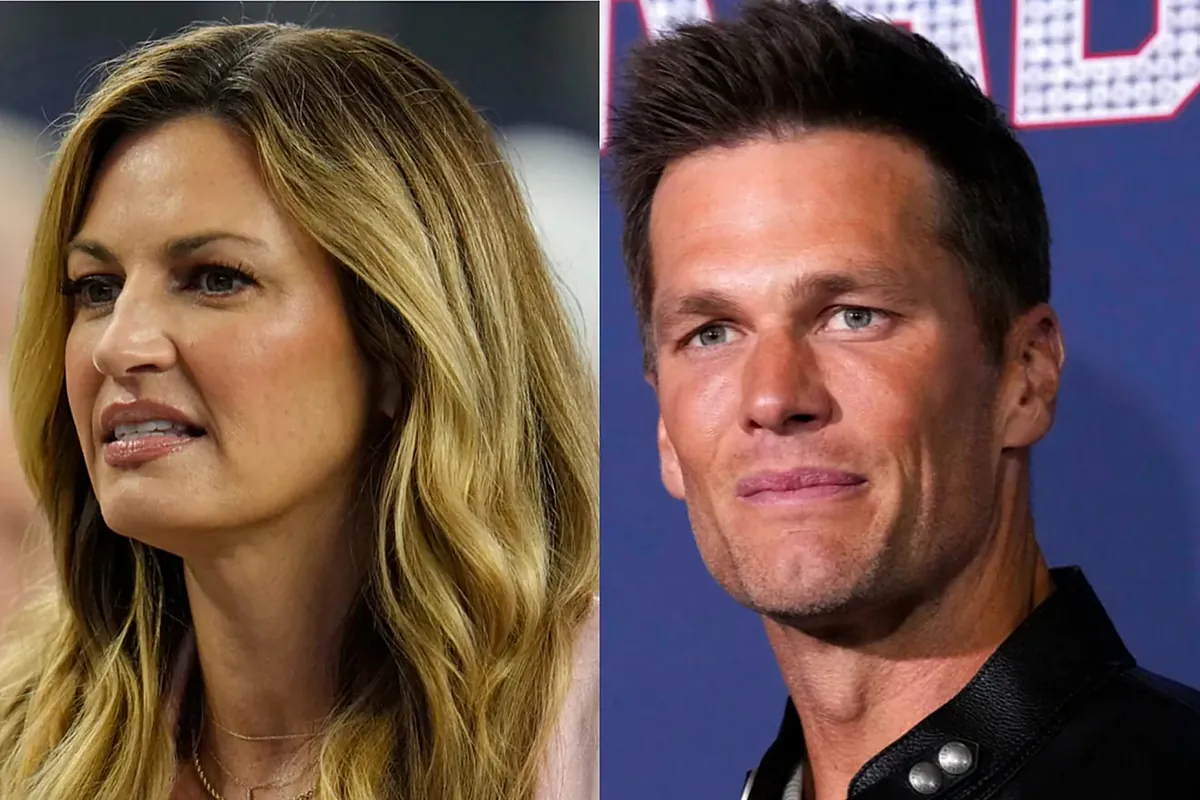

Erin Andrews Leaves Fox The Story Behind Her Unexpected Partnership With Tom Brady

May 16, 2025

Erin Andrews Leaves Fox The Story Behind Her Unexpected Partnership With Tom Brady

May 16, 2025 -

Evaluating Ais Physical Capabilities James Fans New Turing Test Proposal Nvidia

May 16, 2025

Evaluating Ais Physical Capabilities James Fans New Turing Test Proposal Nvidia

May 16, 2025