Is UNH Stock A Value Trap? Assessing The Risks And Rewards

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is UNH Stock a Value Trap? Assessing the Risks and Rewards

UnitedHealth Group (UNH), a healthcare giant, has consistently delivered strong returns, making it a popular choice for long-term investors. However, its recent performance and valuation have sparked a crucial question: is UNH stock a value trap? This in-depth analysis explores the potential risks and rewards, helping you decide if UNH deserves a place in your portfolio.

Understanding the Allure of UNH:

UnitedHealth Group's dominance in the healthcare sector is undeniable. Its two primary segments, UnitedHealthcare (insurance) and Optum (healthcare services), provide a diversified revenue stream and significant competitive advantages. The company's consistent revenue growth, strong earnings, and substantial dividend payouts have attracted considerable investor interest over the years. For years, UNH has been considered a reliable blue-chip stock, providing stable returns in both bull and bear markets. This consistent performance has fueled its impressive market capitalization, making it a significant player in the S&P 500.

The Case for UNH as a Value Trap:

Despite its historical success, several factors raise concerns about UNH's current valuation:

-

High Valuation Multiples: UNH's price-to-earnings (P/E) ratio and other valuation metrics are currently trading at a premium compared to historical averages and its peers. This suggests the market might be overestimating future growth potential. This elevated valuation leaves little room for error and makes the stock susceptible to significant price drops if growth expectations are not met.

-

Regulatory Headwinds: The healthcare industry is heavily regulated, and changes in government policies can significantly impact UNH's profitability. Potential changes to the Affordable Care Act or other healthcare legislation could negatively affect its insurance operations.

-

Competition: Increasing competition from other large healthcare companies and the emergence of new technologies and business models pose a threat to UNH's market share. Maintaining its competitive edge will require continuous innovation and investment.

-

Economic Sensitivity: The health insurance industry is sensitive to economic downturns. During recessions, people and companies may cut back on healthcare spending, impacting UNH's revenue and profitability.

The Case for UNH as a Sound Investment:

Despite the risks, several factors support the argument that UNH is a worthy investment:

-

Strong Brand Recognition and Market Share: UnitedHealth Group enjoys strong brand recognition and a substantial market share, providing a significant competitive advantage.

-

Diversified Revenue Streams: The combination of its insurance and healthcare services arms reduces reliance on any single segment, improving resilience against economic fluctuations.

-

Consistent Dividend Growth: UNH boasts a history of consistent dividend growth, making it attractive to income-seeking investors. This steady stream of income can help offset potential price volatility.

-

Technological Innovation: UNH's investment in technology and data analytics positions it to improve operational efficiency and enhance its services, strengthening its long-term prospects.

Conclusion: Weighing the Risks and Rewards

Determining whether UNH stock is a value trap requires a careful assessment of its current valuation, future growth prospects, and the overall market conditions. While the high valuation presents a risk, the company's strong fundamentals, diversified operations, and consistent dividend growth offer potential rewards. Investors should conduct thorough due diligence, considering their own risk tolerance and investment horizon before making any investment decisions. Consulting with a financial advisor is always recommended before investing in any individual stock. The information provided here is for educational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is UNH Stock A Value Trap? Assessing The Risks And Rewards. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Police Arrest Chris Brown For Alleged Bottle Attack At Club

May 16, 2025

Police Arrest Chris Brown For Alleged Bottle Attack At Club

May 16, 2025 -

Black Families Reshaping The Landscape Of The Travel Industry

May 16, 2025

Black Families Reshaping The Landscape Of The Travel Industry

May 16, 2025 -

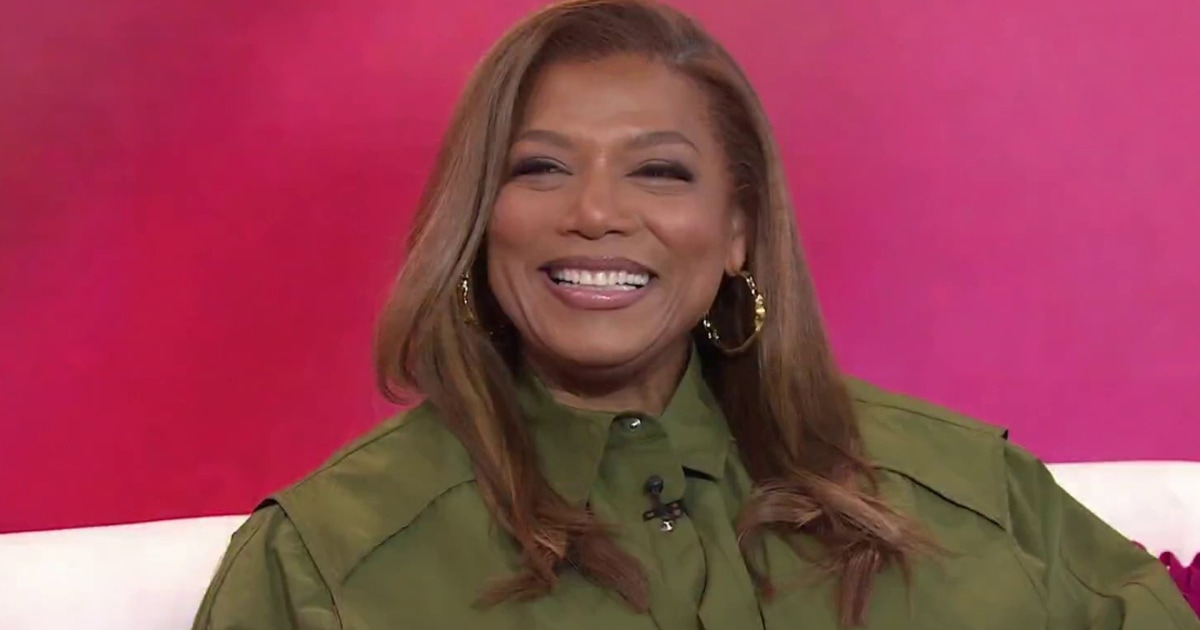

An In Depth Look At Queen Latifahs Career And The Anticipated Biopic

May 16, 2025

An In Depth Look At Queen Latifahs Career And The Anticipated Biopic

May 16, 2025 -

The River Keeps Us Alive New Film Showcases Kimberleys Cultural Heritage

May 16, 2025

The River Keeps Us Alive New Film Showcases Kimberleys Cultural Heritage

May 16, 2025 -

Bethpages Intense Atmosphere A Key Element In European Ryder Cup Preparations

May 16, 2025

Bethpages Intense Atmosphere A Key Element In European Ryder Cup Preparations

May 16, 2025