Is UnitedHealth Group's (UNH) Stock Rise Justified By Its Fundamentals?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is UnitedHealth Group's (UNH) Stock Rise Justified by its Fundamentals?

UnitedHealth Group (UNH), a healthcare giant, has seen its stock price steadily climb, leaving many investors wondering: is this rise justified by the company's underlying fundamentals? While UNH boasts impressive financials and a dominant market position, a closer examination reveals both compelling reasons for optimism and potential areas of concern.

Strong Financial Performance Fuels Growth

UnitedHealth Group's recent performance has been undeniably strong. The company consistently delivers robust revenue growth, fueled by its diverse portfolio encompassing insurance (UnitedHealthcare) and healthcare services (Optum). This dual-pronged approach provides a significant competitive advantage, allowing UNH to capitalize on both the increasing demand for healthcare and the growing need for efficient healthcare delivery systems.

- Revenue Growth: UNH has consistently exceeded analyst expectations for revenue growth, demonstrating a resilient business model even amidst economic uncertainty. This consistent outperformance is a key factor contributing to the stock's upward trajectory.

- Profitability: High profit margins underscore the company's operational efficiency and pricing power within the healthcare market. This strong profitability translates into attractive returns for shareholders, further bolstering investor confidence.

- Market Leadership: UnitedHealth Group holds a leading position in the managed care industry, providing a significant barrier to entry for competitors. This dominance allows UNH to dictate pricing and negotiate favorable contracts, strengthening its financial position.

Optum: A Key Driver of Future Growth

Optum, UNH's healthcare services segment, is a significant growth engine. Its diverse offerings, including pharmacy benefit management (PBM), healthcare information technology, and provider services, position it for substantial future expansion. The increasing adoption of technology in healthcare further fuels Optum's growth potential. The segment's success is crucial to understanding UNH's long-term prospects.

Potential Headwinds and Concerns

Despite the impressive fundamentals, certain factors warrant consideration:

- Regulatory Scrutiny: The healthcare industry is heavily regulated, and UNH faces ongoing scrutiny regarding pricing practices and potential anti-competitive behavior. Changes in healthcare policy could significantly impact the company's profitability.

- Inflationary Pressures: Rising healthcare costs and inflation can squeeze profit margins, impacting future growth. UNH's ability to manage these pressures effectively is crucial for maintaining its strong financial performance.

- Competition: While UNH holds a dominant market position, increasing competition from other large healthcare providers and the emergence of new players could erode its market share over time.

Is the Stock Rise Justified? A Balanced Perspective

The recent rise in UNH's stock price is largely justified by its strong financial performance, diversified business model, and the growth potential of Optum. However, investors must acknowledge the potential headwinds, including regulatory risks and inflationary pressures. A thorough understanding of both the positive and negative factors is crucial for making informed investment decisions.

Conclusion:

UnitedHealth Group's stock remains an attractive investment for many, but it's vital to conduct comprehensive due diligence and consider the inherent risks within the healthcare sector. While the fundamentals are undeniably strong, the company's future performance will depend on its ability to navigate regulatory challenges, manage costs, and maintain its competitive advantage in a dynamic market. The current stock price reflects a bullish outlook, but careful consideration of the outlined factors is essential for long-term success.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is UnitedHealth Group's (UNH) Stock Rise Justified By Its Fundamentals?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Monte Carlo Masters 2025 In Depth Analysis Of Etcheverry Vs Moutet

Apr 08, 2025

Monte Carlo Masters 2025 In Depth Analysis Of Etcheverry Vs Moutet

Apr 08, 2025 -

Facing Headcount Freeze Shopifys Ai First Approach To Staffing

Apr 08, 2025

Facing Headcount Freeze Shopifys Ai First Approach To Staffing

Apr 08, 2025 -

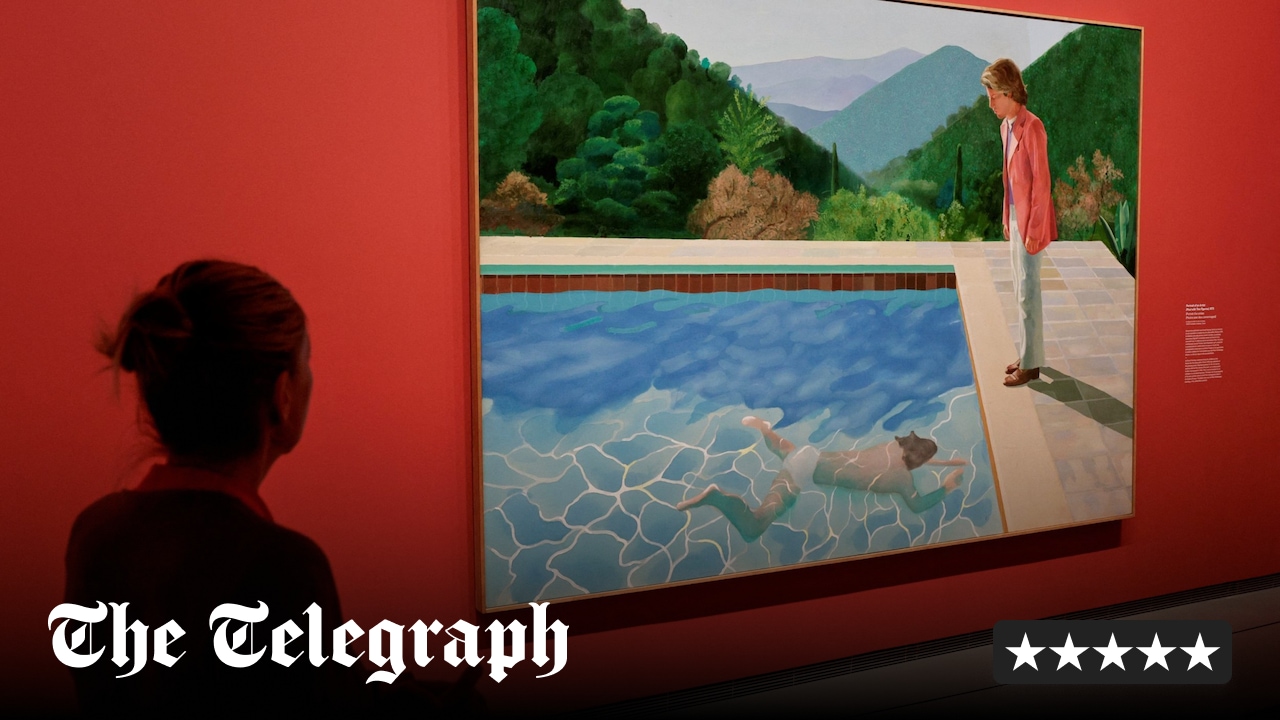

David Hockney At 25 A Retrospective At The Fondation Louis Vuitton

Apr 08, 2025

David Hockney At 25 A Retrospective At The Fondation Louis Vuitton

Apr 08, 2025 -

2025 Nfl Mock Draft Dart To The Jets And Four Other Shocking Trades

Apr 08, 2025

2025 Nfl Mock Draft Dart To The Jets And Four Other Shocking Trades

Apr 08, 2025 -

Urgent Security Alert Customer Data Leak Following Ransomware Attack On Shared Vendor For Dbs And Bank Of China

Apr 08, 2025

Urgent Security Alert Customer Data Leak Following Ransomware Attack On Shared Vendor For Dbs And Bank Of China

Apr 08, 2025