ISA Savers Hit With Steep Early Withdrawal Penalty

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

ISA Savers Hit with Steep Early Withdrawal Penalty: Is Your Savings Plan at Risk?

Individual Savings Accounts (ISAs) are a cornerstone of UK personal finance, offering tax-free savings and investment opportunities. But a little-known aspect of many ISA plans is the significant penalty incurred for early withdrawals. Recent data reveals a sharp rise in individuals facing these hefty charges, leaving many questioning the true cost of accessing their savings prematurely.

This article delves into the intricacies of ISA early withdrawal penalties, exploring why they exist, how much they can cost, and what steps you can take to avoid them.

Understanding ISA Early Withdrawal Penalties

The primary purpose of ISA early withdrawal penalties is to discourage individuals from treating their ISA as a short-term savings account. While the tax-free benefits are attractive, providers need to protect their investment strategies and mitigate potential losses. These penalties vary widely depending on the specific ISA provider and the type of ISA (cash ISA, stocks and shares ISA, etc.).

-

Cash ISAs: Penalties for early withdrawal from cash ISAs are generally less severe than those from stocks and shares ISAs. They often involve forfeiting a portion of the interest earned or facing a small administration fee.

-

Stocks and Shares ISAs: These ISAs carry a much higher risk of significant penalties due to the fluctuating nature of the stock market. Early withdrawals can result in substantial losses, beyond any provider-imposed fees, as the value of your investments may have decreased since your initial contribution.

How Much Could You Lose?

The cost of early withdrawal can be substantial, ranging from a few pounds on a small cash ISA to thousands of pounds on a larger, more volatile stocks and shares ISA. Some providers may impose a percentage-based penalty on the withdrawal amount, while others might charge a fixed fee. Always carefully review your ISA's terms and conditions before investing to understand the potential consequences of early withdrawal. Don't rely solely on sales brochures – look for the fine print!

Avoiding Early Withdrawal Penalties:

The best way to avoid these penalties is careful planning. Consider the following:

-

Assess your financial goals: Before investing in an ISA, clearly define your financial objectives and the timeframe required to achieve them. This will help you choose the most suitable ISA type and avoid the need for premature withdrawals.

-

Emergency fund: Maintain a readily accessible emergency fund in a separate account to cover unexpected expenses. This prevents you from raiding your ISA in times of financial difficulty.

-

Long-term perspective: Treat your ISA as a long-term investment vehicle. Avoid impulsive decisions and resist the temptation to withdraw funds before your planned timeline.

-

Read the small print: Thoroughly understand the terms and conditions of your ISA, particularly the clauses relating to early withdrawals and penalties.

Seeking Professional Advice:

If you're unsure about the implications of early withdrawal or need assistance planning your savings strategy, seeking professional financial advice is recommended. A qualified financial advisor can help you navigate the complexities of ISA investments and ensure your savings are aligned with your long-term goals.

Conclusion:

While ISAs offer significant tax advantages, the penalties for early withdrawal can be unexpectedly high. Proactive planning, a clear understanding of your ISA's terms, and potentially professional financial advice can prevent costly mistakes and ensure you reap the full benefits of your tax-free savings. Remember, patience and a long-term investment strategy are crucial to maximizing your ISA's potential.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on ISA Savers Hit With Steep Early Withdrawal Penalty. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Futuro Dos Investimentos Da Berkshire O Plano De Greg Abel Sucessor De Buffett

May 10, 2025

Futuro Dos Investimentos Da Berkshire O Plano De Greg Abel Sucessor De Buffett

May 10, 2025 -

Celebrating Joan Rivers An Nbc And Peacock Special Event

May 10, 2025

Celebrating Joan Rivers An Nbc And Peacock Special Event

May 10, 2025 -

Lack Of Staff Leads To Further Closures Of Kansas Parks And Recreation Sites

May 10, 2025

Lack Of Staff Leads To Further Closures Of Kansas Parks And Recreation Sites

May 10, 2025 -

May 2025 Find The Cheapest Go Pro Deals Now

May 10, 2025

May 2025 Find The Cheapest Go Pro Deals Now

May 10, 2025 -

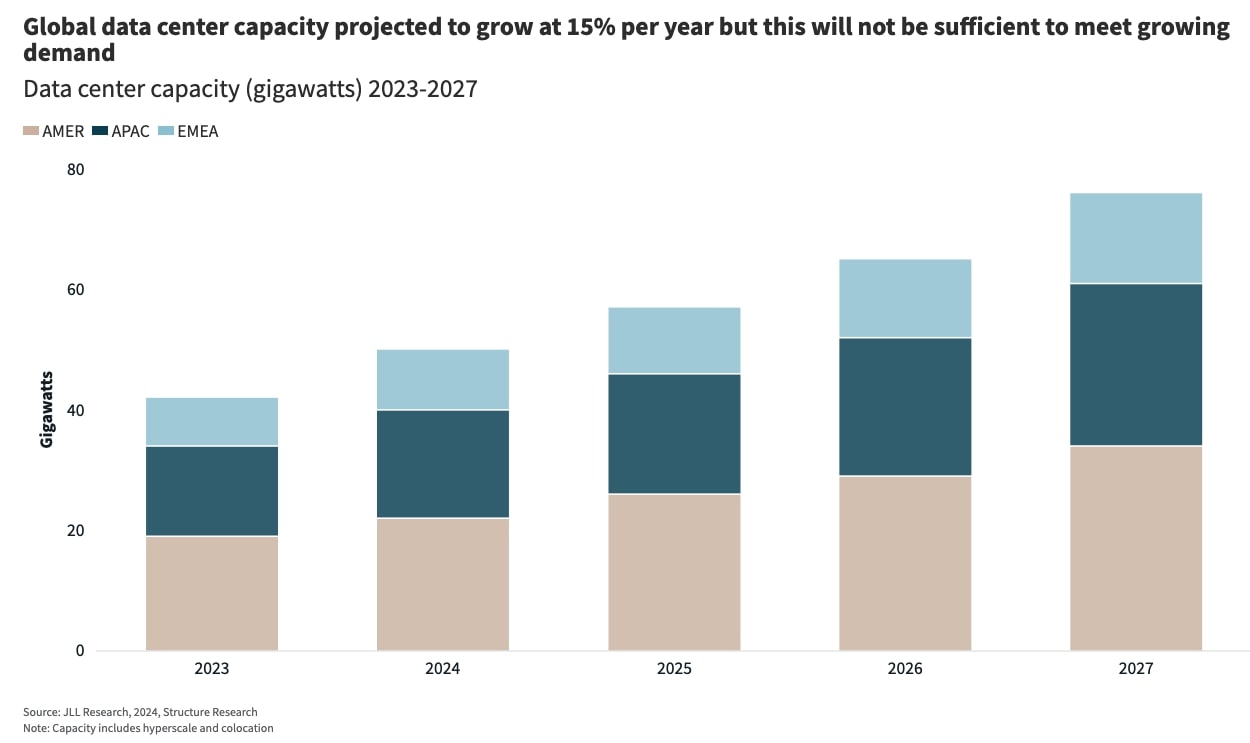

Navigating The Shift Ai Data Center Market Growth Amidst Tech Giant Strategies

May 10, 2025

Navigating The Shift Ai Data Center Market Growth Amidst Tech Giant Strategies

May 10, 2025

Latest Posts

-

The Day I Turned My Life Into An Ai Generated Podcast

May 10, 2025

The Day I Turned My Life Into An Ai Generated Podcast

May 10, 2025 -

Denver Nuggets Regroup Post Game Promises Of A Stronger Performance

May 10, 2025

Denver Nuggets Regroup Post Game Promises Of A Stronger Performance

May 10, 2025 -

Samsung The Frame Pro Significant Improvements Over The Original Frame Tv

May 10, 2025

Samsung The Frame Pro Significant Improvements Over The Original Frame Tv

May 10, 2025 -

Dodgers Star Max Muncy Speaks Out Arenado Trade Speculation And Its Effects

May 10, 2025

Dodgers Star Max Muncy Speaks Out Arenado Trade Speculation And Its Effects

May 10, 2025 -

Unforgettable Mothers Day Gifts 2025 Gift Guide

May 10, 2025

Unforgettable Mothers Day Gifts 2025 Gift Guide

May 10, 2025