Jefferies & BTIG Highlight 2 Dividend Stocks For Aggressive Income Seekers (10% Yield Potential)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jefferies & BTIG Highlight 2 Dividend Stocks for Aggressive Income Seekers (10% Yield Potential)

High-yield dividend stocks are attracting significant attention from investors seeking substantial income streams. While higher yields often come with increased risk, two prominent financial firms, Jefferies and BTIG, have recently highlighted promising options for aggressive income seekers, suggesting potential yields exceeding 10%. This article delves into these recommendations, examining the potential benefits and inherent risks involved.

Understanding the Appeal of High-Yield Dividend Stocks

Investing in dividend stocks offers a compelling strategy for generating passive income. Companies distributing a significant portion of their earnings as dividends provide investors with regular cash flows, potentially supplementing other income sources. However, it's crucial to remember that higher yields often correspond to higher risk. Companies with exceptionally high dividend payouts might face financial instability, potentially leading to dividend cuts or even bankruptcy. Therefore, thorough due diligence is paramount before investing in high-yield dividend stocks.

Jefferies & BTIG's Top Picks: A Closer Look

While the specific stocks recommended by Jefferies and BTIG are not publicly available in detail without access to their premium research reports, we can analyze the general characteristics likely found in such high-yield recommendations. These typically fall into the following categories:

-

Real Estate Investment Trusts (REITs): REITs are known for their high dividend payouts due to tax regulations requiring them to distribute a significant portion of their income to shareholders. However, REIT performance is often heavily influenced by real estate market conditions and interest rate fluctuations.

-

Energy Sector Stocks: Energy companies, particularly those involved in oil and gas production, can offer attractive dividend yields, especially during periods of high commodity prices. However, energy sector performance is notoriously volatile, susceptible to geopolitical events and fluctuating demand.

-

Financials (Banks and Insurance Companies): Banks and insurance companies are also potential sources of high-yield dividends. Yet these are often cyclical, affected by economic downturns and regulatory changes.

The Importance of Due Diligence:

Before investing in any high-yield dividend stock, investors must conduct thorough research. Consider the following factors:

-

Company Financials: Analyze the company's financial statements to assess its profitability, debt levels, and cash flow generation. A high dividend yield without solid financial backing is a warning sign.

-

Dividend History: Examine the company's dividend payment history. Consistent dividend payments suggest financial stability, while inconsistent or decreasing dividends indicate potential problems.

-

Industry Trends: Understanding the overall industry landscape and future outlook is crucial. Investing in a company operating in a declining industry, even with a high yield, is risky.

-

Risk Tolerance: High-yield dividend stocks inherently carry greater risk. Ensure your investment strategy aligns with your risk tolerance and overall financial goals.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in high-yield dividend stocks involves significant risk, and investors should consult with a qualified financial advisor before making any investment decisions. The specific stocks mentioned by Jefferies and BTIG are not discussed here due to the confidential nature of premium research reports. Always conduct thorough research and understand the risks involved before investing.

Keywords: High-yield dividend stocks, dividend investing, aggressive income, Jefferies, BTIG, 10% yield potential, REITs, energy stocks, financial stocks, passive income, dividend growth, income investing, investment risk, due diligence, stock market, investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jefferies & BTIG Highlight 2 Dividend Stocks For Aggressive Income Seekers (10% Yield Potential). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nyt Wordle Game 1422 Answer And Helpful Hints For Sunday May 11

May 13, 2025

Nyt Wordle Game 1422 Answer And Helpful Hints For Sunday May 11

May 13, 2025 -

May 2025 Full Moon Flower Micromoon Viewing Guide

May 13, 2025

May 2025 Full Moon Flower Micromoon Viewing Guide

May 13, 2025 -

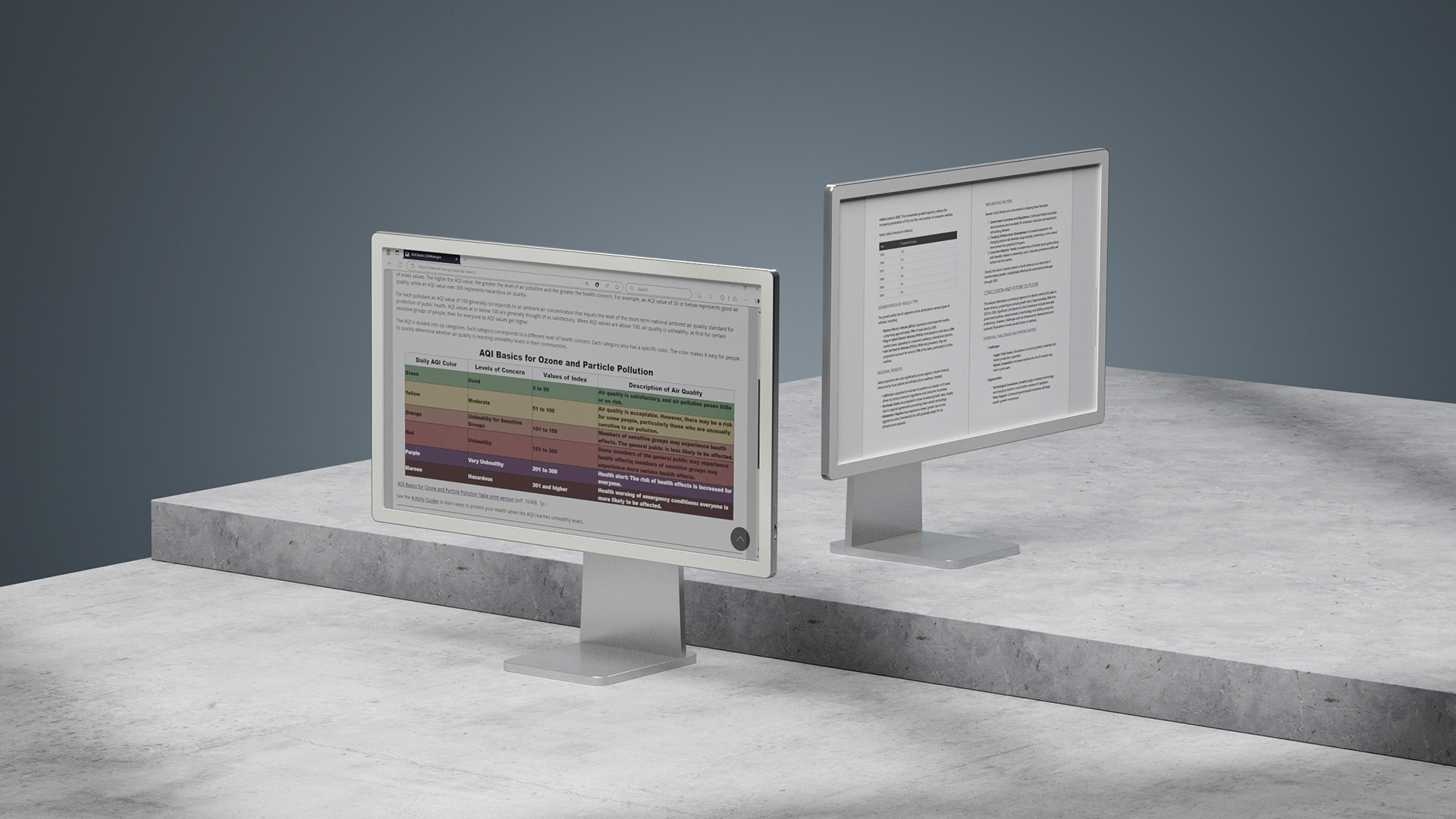

24 Inch Lcd To 25 Inch Color E Ink A Cost Benefit Analysis For Monitor Upgrades

May 13, 2025

24 Inch Lcd To 25 Inch Color E Ink A Cost Benefit Analysis For Monitor Upgrades

May 13, 2025 -

After Nvidias Sell Rating Analyzing The Risks And Potential Market Reactions

May 13, 2025

After Nvidias Sell Rating Analyzing The Risks And Potential Market Reactions

May 13, 2025 -

Figmas Ceo Discusses The Companys Ai Strategy

May 13, 2025

Figmas Ceo Discusses The Companys Ai Strategy

May 13, 2025

Latest Posts

-

How To Check Cbse Board Exam Results 2025 Official And Unofficial Website Options For Class 10 And 12

May 13, 2025

How To Check Cbse Board Exam Results 2025 Official And Unofficial Website Options For Class 10 And 12

May 13, 2025 -

Minnesota Timberwolves Take 2 1 Lead Over Golden State Edwards Randle Lead The Charge

May 13, 2025

Minnesota Timberwolves Take 2 1 Lead Over Golden State Edwards Randle Lead The Charge

May 13, 2025 -

Victory Day Parade Assessing Russias Military Capabilities Under Putin

May 13, 2025

Victory Day Parade Assessing Russias Military Capabilities Under Putin

May 13, 2025 -

Actress Claudia Karvan Overcome With Grief Following Devastating News

May 13, 2025

Actress Claudia Karvan Overcome With Grief Following Devastating News

May 13, 2025 -

Cbse 10th And 12th Result 2024 Release Date Time And Online Checking Guide

May 13, 2025

Cbse 10th And 12th Result 2024 Release Date Time And Online Checking Guide

May 13, 2025