Jim Chanos' Bitcoin Strategy: A Contrarian Approach

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jim Chanos' Bitcoin Strategy: A Contrarian Approach to Crypto's Top Dog

Jim Chanos, the renowned short-seller known for his prescient calls against Enron and other corporate giants, has made waves again, this time with his contrarian stance on Bitcoin. While many hail Bitcoin as digital gold or the future of finance, Chanos remains skeptical, offering a unique perspective that deserves careful consideration. His strategy, far from simply betting against Bitcoin's price, reveals a deeper understanding of the cryptocurrency's vulnerabilities and the potential for significant downside.

Understanding Chanos' Skepticism:

Chanos isn't simply dismissing Bitcoin as a fad. His critique is more nuanced, focusing on several key areas:

-

Regulatory Uncertainty: A major concern for Chanos revolves around the lack of clear and consistent global regulation for Bitcoin and other cryptocurrencies. The ever-changing regulatory landscape poses significant risks to investors, creating uncertainty that could trigger sharp price corrections. He argues that the current regulatory patchwork is unsustainable and a major regulatory crackdown could devastate the market.

-

Environmental Concerns: The energy-intensive process of Bitcoin mining is a significant drawback in Chanos' eyes. Growing concerns about climate change and the environmental impact of crypto mining could lead to increased scrutiny and potentially restrictive regulations, further impacting Bitcoin's price and adoption. This environmental cost, he argues, makes Bitcoin a less attractive investment compared to other asset classes.

-

Price Volatility: The extreme price volatility of Bitcoin is another key factor influencing Chanos' bearish outlook. While proponents cite Bitcoin's resilience, Chanos highlights the inherent risks associated with such dramatic price swings, particularly for less sophisticated investors who may be drawn in by hype rather than fundamentals.

-

Lack of Intrinsic Value: Chanos fundamentally questions the intrinsic value of Bitcoin, arguing that unlike traditional assets, it lacks underlying productive capacity or tangible assets backing its value. He sees Bitcoin's value as primarily driven by speculation, making it highly susceptible to market sentiment shifts.

Chanos' Implied Bitcoin Strategy:

While Chanos hasn't explicitly detailed a specific shorting strategy, his public comments suggest a cautious, contrarian approach:

-

Indirect Shorting: Instead of directly shorting Bitcoin, Chanos might utilize strategies that profit from a Bitcoin price decline. This could involve investing in inverse Bitcoin ETFs or other financial instruments designed to perform well when Bitcoin's price falls.

-

Long-Term Bearish Outlook: Chanos' statements indicate a long-term bearish outlook on Bitcoin. His strategy isn't likely to involve short-term trading based on market fluctuations but rather a longer-term bet against Bitcoin's overall trajectory.

-

Focus on Regulatory Risks: His strategy likely prioritizes monitoring and analyzing regulatory developments worldwide, anticipating and potentially profiting from any significant regulatory actions that impact Bitcoin.

The Importance of Diversification:

Chanos' views underscore the importance of diversification in any investment portfolio. While Bitcoin can offer diversification benefits for some investors, its volatility and regulatory uncertainties make it crucial to consider a balanced approach that minimizes overall risk.

Conclusion:

Jim Chanos' Bitcoin strategy represents a contrarian viewpoint in a market dominated by bullish sentiment. His concerns about regulation, environmental impact, price volatility, and intrinsic value highlight the potential risks associated with investing in Bitcoin. While his skepticism may not resonate with all investors, his analysis provides a valuable counterpoint to the prevailing narrative, reminding us to approach cryptocurrency investments with caution and a comprehensive understanding of the associated risks. Regardless of whether you agree with Chanos' assessment, his perspective offers a crucial reminder of the importance of critical thinking and thorough due diligence in the volatile world of cryptocurrencies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jim Chanos' Bitcoin Strategy: A Contrarian Approach. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Man Who Stabbed Salman Rushdie Sentenced To 25 Years

May 16, 2025

Man Who Stabbed Salman Rushdie Sentenced To 25 Years

May 16, 2025 -

The Kimberleys Rivers A Documentary On Ecology Culture And Conservation

May 16, 2025

The Kimberleys Rivers A Documentary On Ecology Culture And Conservation

May 16, 2025 -

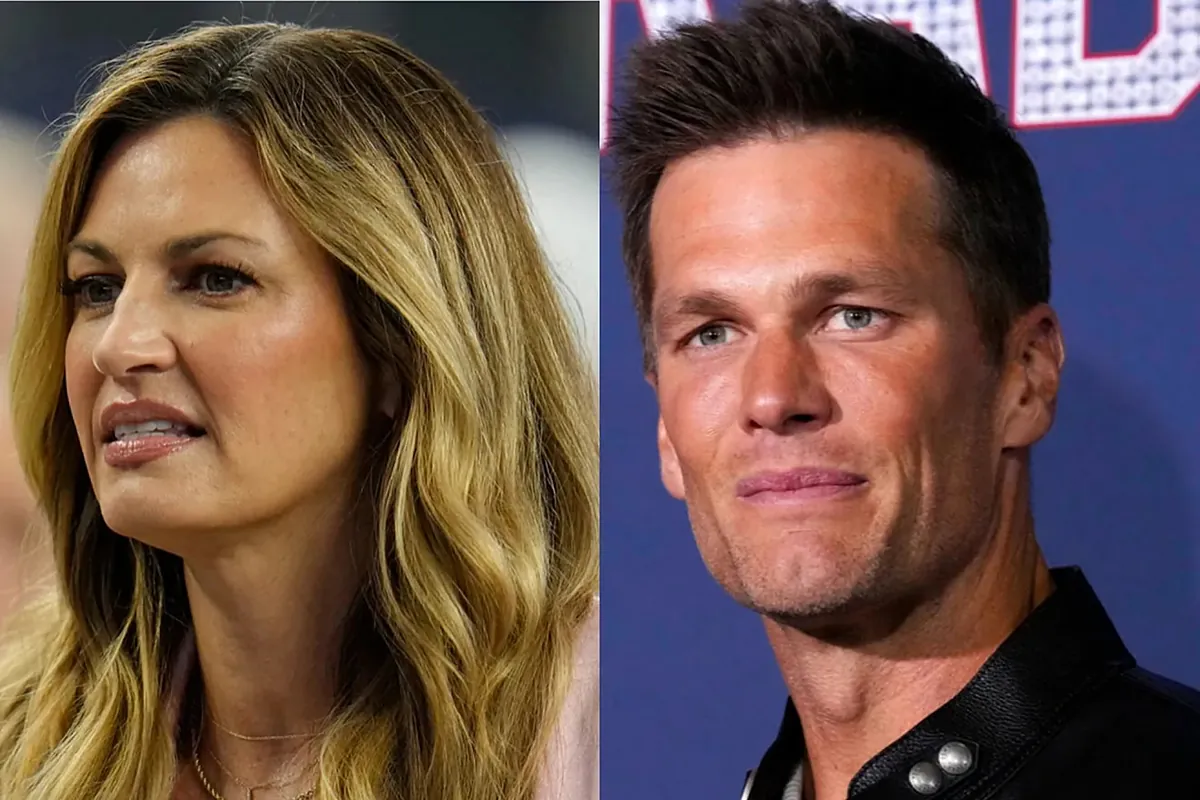

Erin Andrews Leaves Fox The Story Behind Her Unexpected Move With Tom Brady

May 16, 2025

Erin Andrews Leaves Fox The Story Behind Her Unexpected Move With Tom Brady

May 16, 2025 -

Sinner Musetti E Paolini Agli Internazionali D Italia 2025 Guida Tv E Streaming

May 16, 2025

Sinner Musetti E Paolini Agli Internazionali D Italia 2025 Guida Tv E Streaming

May 16, 2025 -

Thailand Open 2024 Indian Womens Doubles Pair Eliminated

May 16, 2025

Thailand Open 2024 Indian Womens Doubles Pair Eliminated

May 16, 2025