Jim Cramer On Intercontinental Exchange (ICE): A Winning Investment?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jim Cramer on Intercontinental Exchange (ICE): A Winning Investment?

Is the Mad Money host right about this financial behemoth? Let's dive into the details.

Jim Cramer, the famously outspoken host of CNBC's "Mad Money," has often weighed in on Intercontinental Exchange (ICE), the operator of major global exchanges including the New York Stock Exchange. His opinions, while often controversial, frequently influence investor sentiment. But is ICE truly a winning investment, as Cramer has sometimes suggested? Let's examine the company's performance and prospects to determine if his assessment holds water.

ICE: A Colossus in the Financial World

Intercontinental Exchange isn't your typical stock; it's a powerful player in the global financial ecosystem. ICE operates several crucial marketplaces, facilitating trading in a wide range of assets, from futures contracts and options to commodities and fixed income. This diversification is a key strength, providing a buffer against downturns in specific sectors. The company also boasts a robust data and analytics arm, further adding to its revenue streams and overall resilience. Key holdings and offerings include:

- New York Stock Exchange (NYSE): A cornerstone of global finance, contributing significantly to ICE's revenue.

- ICE Futures U.S.: A major player in the energy futures market, particularly for crude oil and natural gas.

- ICE Futures Europe: A leading European exchange for energy and agricultural commodities.

- Bond Markets: ICE also plays a critical role in the global bond market, providing crucial trading infrastructure.

Analyzing Cramer's Perspective

Cramer's pronouncements on ICE have often focused on its resilience and consistent growth. He's highlighted the company's ability to generate strong cash flow, even during periods of market volatility. This is a crucial aspect for long-term investors seeking stability. However, it's important to remember that Cramer's recommendations should be considered alongside other analyses, not taken as gospel.

The Bull Case for ICE

Several factors support a bullish outlook on ICE:

- Market Dominance: ICE holds significant market share across multiple asset classes, offering a competitive advantage.

- Diversified Revenue Streams: The company's multiple offerings mitigate risk associated with dependence on a single market segment.

- Strong Cash Flow: Consistent cash generation allows for reinvestment, acquisitions, and shareholder returns.

- Technological Innovation: ICE continues to invest in technology, improving efficiency and expanding its offerings.

Potential Challenges for ICE

While the outlook for ICE appears positive, potential challenges exist:

- Regulatory Scrutiny: The financial industry faces constant regulatory oversight, which can impact profitability.

- Competition: The exchange market is competitive, with new entrants and existing players vying for market share.

- Economic Slowdown: A global economic slowdown could dampen trading volumes and impact revenue.

Is ICE a Winning Investment? The Verdict

Whether or not ICE represents a winning investment depends on individual risk tolerance and investment goals. While Cramer's optimism regarding the company's long-term prospects holds merit, due diligence is crucial. Investors should conduct thorough research, considering both the positive aspects and potential challenges before making any investment decisions. ICE's strong fundamentals and diversified business model suggest a solid foundation, but market conditions and unforeseen events always introduce uncertainty. Therefore, a well-diversified portfolio remains the cornerstone of sound investment strategy. Consider consulting with a qualified financial advisor to assess the suitability of ICE for your specific circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jim Cramer On Intercontinental Exchange (ICE): A Winning Investment?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sundays Game Chet Holmgrens Return Confirmed After Injury

Mar 18, 2025

Sundays Game Chet Holmgrens Return Confirmed After Injury

Mar 18, 2025 -

Pelemahan Rupiah Dan Ihsg Dibuka Merah Analisis Pasar Hari Ini

Mar 18, 2025

Pelemahan Rupiah Dan Ihsg Dibuka Merah Analisis Pasar Hari Ini

Mar 18, 2025 -

New Zealands Dominant T20 Victory Against Pakistan In Christchurch

Mar 18, 2025

New Zealands Dominant T20 Victory Against Pakistan In Christchurch

Mar 18, 2025 -

Competition Heats Up Metas Custom Ai Chip Takes On Nvidias Gpu Monopoly

Mar 18, 2025

Competition Heats Up Metas Custom Ai Chip Takes On Nvidias Gpu Monopoly

Mar 18, 2025 -

March Crypto Forecast 3 Digital Assets Showing Potential

Mar 18, 2025

March Crypto Forecast 3 Digital Assets Showing Potential

Mar 18, 2025

Latest Posts

-

Arsenal Psg Doue Et Dembele Demarrent Suivez La Demi Finale En Direct

Apr 29, 2025

Arsenal Psg Doue Et Dembele Demarrent Suivez La Demi Finale En Direct

Apr 29, 2025 -

Swiatek Escapes Shnaiders Challenge Reaches Madrid Quarters

Apr 29, 2025

Swiatek Escapes Shnaiders Challenge Reaches Madrid Quarters

Apr 29, 2025 -

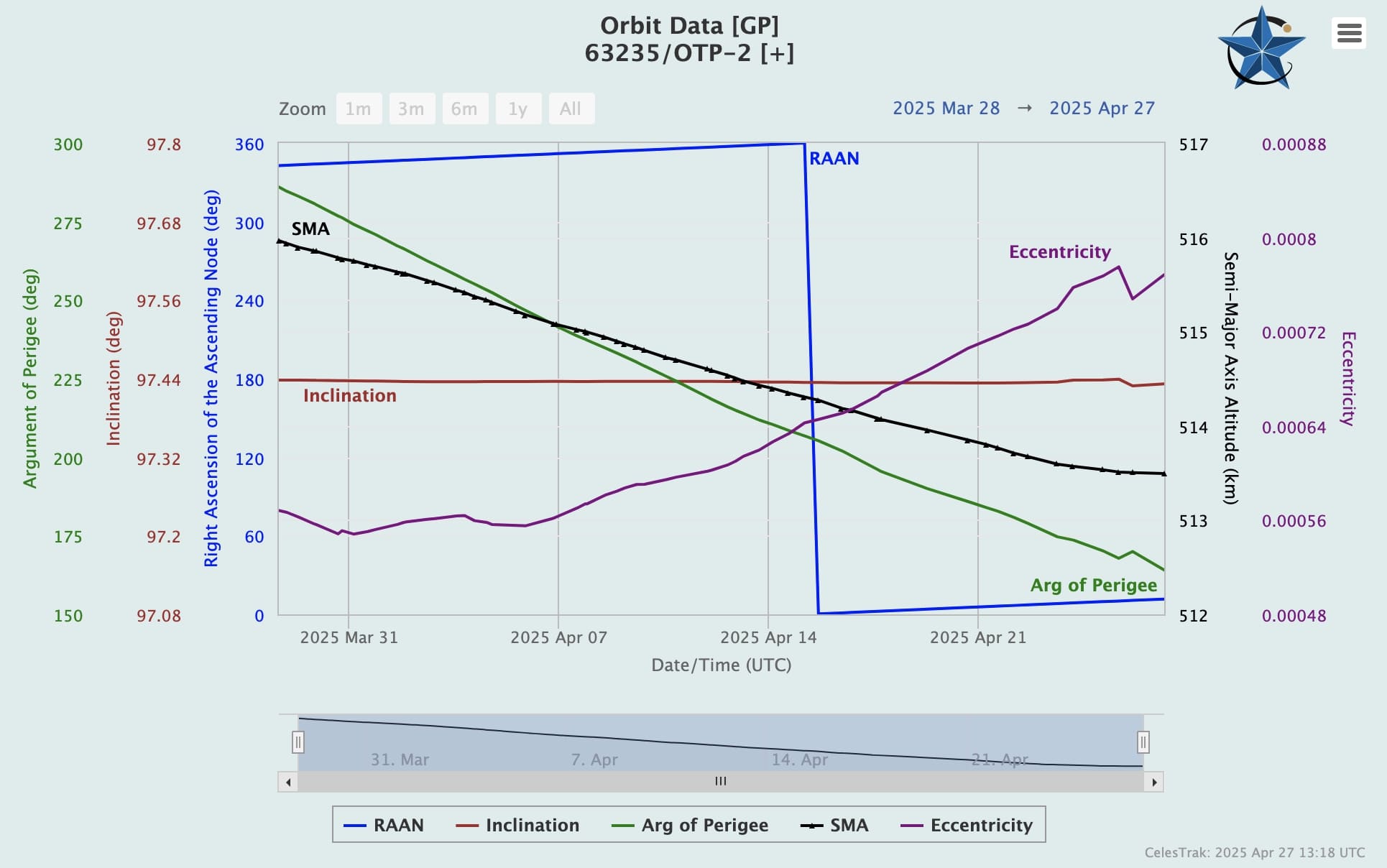

Propellantless Satellite Drive Shows Promise Otp 2s Orbital Decline Rate Decreases

Apr 29, 2025

Propellantless Satellite Drive Shows Promise Otp 2s Orbital Decline Rate Decreases

Apr 29, 2025 -

Fired Ftc Commissioners Fight For Their Jobs

Apr 29, 2025

Fired Ftc Commissioners Fight For Their Jobs

Apr 29, 2025 -

Update Stronghold Fire Reaches 3 000 Acres Further Spread Expected

Apr 29, 2025

Update Stronghold Fire Reaches 3 000 Acres Further Spread Expected

Apr 29, 2025