Jim Cramer's Dividend Pick: Realty Income (O)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jim Cramer's Dividend Pick: Realty Income (O) – A Deep Dive into the REIT Giant

Mad Money's Jim Cramer, a prominent figure in the world of finance, recently highlighted Realty Income Corporation (O) as a compelling dividend investment. This REIT (Real Estate Investment Trust) giant, known for its impressive dividend history and diversified portfolio, has caught the attention of many investors. But is Realty Income truly a worthy addition to your portfolio? Let's delve deeper.

Why Realty Income (O)? A Look at Cramer's Rationale

Cramer's endorsement stems from Realty Income's consistent track record of dividend payments. The company boasts a remarkable history of increasing its dividend annually, making it an attractive option for income-seeking investors. This reliability, particularly in uncertain economic times, is a key selling point. He emphasized the company's diverse portfolio of properties, spanning various sectors and geographies, mitigating risk associated with reliance on a single industry or location. This diversification is crucial for long-term stability and growth.

Realty Income's Strengths: More Than Just Dividends

Beyond its appealing dividend yield, Realty Income possesses several key strengths:

-

Strong Tenant Base: Realty Income's portfolio includes a wide range of essential businesses, such as pharmacies, convenience stores, and grocery stores. These tenants are considered relatively recession-resistant, providing a stable income stream even during economic downturns.

-

Long-Term Lease Agreements: The company benefits from long-term lease agreements with its tenants, providing predictable cash flows and reducing volatility. This stability is a major advantage for investors seeking consistent returns.

-

Proven Track Record: Realty Income has a long history of successfully navigating economic challenges, showcasing its resilience and adaptability in the real estate market. This consistent performance instills confidence in long-term investors.

-

Geographic Diversification: The company's portfolio is spread across the United States, minimizing risk associated with regional economic fluctuations. This broad diversification further enhances stability and reduces the impact of localized downturns.

Potential Risks and Considerations

While Realty Income presents a compelling investment case, it's crucial to acknowledge potential risks:

-

Interest Rate Sensitivity: As a REIT, Realty Income is sensitive to changes in interest rates. Rising interest rates can increase borrowing costs and potentially impact profitability.

-

Market Volatility: Despite its stability, Realty Income's stock price can still fluctuate with overall market conditions. Investors should be prepared for short-term price volatility.

-

Competition: The REIT sector is competitive, with numerous companies vying for similar investment opportunities. Realty Income's continued success depends on its ability to maintain a competitive edge.

Is Realty Income Right for You?

Realty Income's strong dividend history, diverse portfolio, and resilient business model make it an attractive option for income-focused investors with a long-term perspective. However, as with any investment, it's crucial to conduct thorough research and consider your own risk tolerance before making a decision. Remember to consult with a qualified financial advisor before making any investment choices. This analysis is for informational purposes only and not financial advice.

Keywords: Realty Income, O, REIT, Jim Cramer, dividend, dividend stock, dividend investing, real estate investment trust, income stock, passive income, stock market, investment strategy, Mad Money, stock pick, recession-proof stocks, long-term investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jim Cramer's Dividend Pick: Realty Income (O). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Most Private Smartphone Ever A New Player Enters The Market

Mar 18, 2025

The Most Private Smartphone Ever A New Player Enters The Market

Mar 18, 2025 -

Break The Mold Lady Gagas Groundbreaking Advice For Creative Innovators

Mar 18, 2025

Break The Mold Lady Gagas Groundbreaking Advice For Creative Innovators

Mar 18, 2025 -

Disneys Snow White Premiere Actors Bold Response To Controversial Changes

Mar 18, 2025

Disneys Snow White Premiere Actors Bold Response To Controversial Changes

Mar 18, 2025 -

Mars Colonization Exploring The Feasibility Of Project Orion With Martian Uranium

Mar 18, 2025

Mars Colonization Exploring The Feasibility Of Project Orion With Martian Uranium

Mar 18, 2025 -

Chet Holmgrens Injury Recovery Cleared To Play This Sunday

Mar 18, 2025

Chet Holmgrens Injury Recovery Cleared To Play This Sunday

Mar 18, 2025

Latest Posts

-

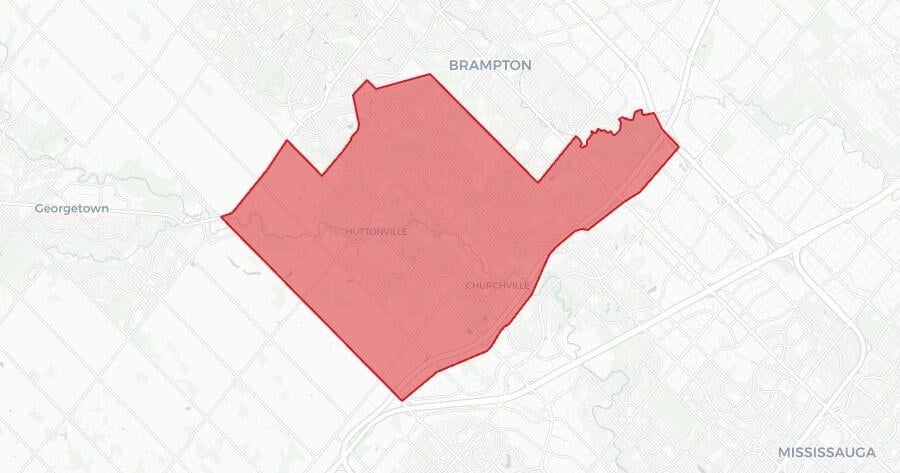

Brampton South Election Results Sonia Sidhus Liberal Re Election

Apr 30, 2025

Brampton South Election Results Sonia Sidhus Liberal Re Election

Apr 30, 2025 -

Compartilhamento De Casas Como Ter Acesso A Imoveis Na Praia E Campo

Apr 30, 2025

Compartilhamento De Casas Como Ter Acesso A Imoveis Na Praia E Campo

Apr 30, 2025 -

Pentagons Women Peace And Security Program Eliminated Hegseths Dei Rationale

Apr 30, 2025

Pentagons Women Peace And Security Program Eliminated Hegseths Dei Rationale

Apr 30, 2025 -

Brampton South Federal Election Latest Results And Winning Candidate

Apr 30, 2025

Brampton South Federal Election Latest Results And Winning Candidate

Apr 30, 2025 -

Epic Games Store Flappy Bird Android Release Play The Mobile Classic Again

Apr 30, 2025

Epic Games Store Flappy Bird Android Release Play The Mobile Classic Again

Apr 30, 2025