Jim Cramer's Top Dividend Pick: Realty Income (O)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jim Cramer's Top Dividend Pick: Realty Income (O) – A Deep Dive into the REIT Giant

Investing legend Jim Cramer has once again made waves, highlighting Realty Income Corporation (O) as his top dividend pick. This isn't just a casual suggestion; Cramer's endorsement carries significant weight, influencing countless investors. But what makes Realty Income so attractive, and is it the right investment for you? Let's delve into the details.

Why Realty Income (O)? Cramer's Rationale Explained

Cramer's bullish stance on Realty Income stems from its consistent and robust dividend payouts. The company, a real estate investment trust (REIT), boasts a long history of increasing its dividend, making it a favorite among income-seeking investors. This reliability is a crucial factor, especially in today's volatile market. He emphasizes Realty Income's impressive track record of dividend growth, citing its ability to navigate economic downturns and continue delivering returns to shareholders. This "Monthly Dividend Champion" title isn't given lightly.

Realty Income's Business Model: Diversification and Stability

Realty Income's strength lies in its diversified portfolio of properties. The company invests in a wide range of essential retail spaces, leased to a vast array of tenants across various industries. This diversification significantly mitigates risk. Unlike companies heavily reliant on a single industry or tenant, Realty Income spreads its investments, reducing vulnerability to sector-specific downturns. This strategy allows them to consistently generate strong cash flow, even during economic uncertainties.

Key Advantages of Investing in Realty Income (O)

-

High Dividend Yield: Realty Income offers a compelling dividend yield, significantly higher than many other investment options. This makes it an attractive choice for investors prioritizing income generation.

-

Consistent Dividend Growth: The company's history of steadily increasing dividends underscores its financial stability and commitment to shareholder returns. This long-term track record is a significant selling point.

-

Defensive Characteristics: Realty Income's portfolio of essential retail properties provides a degree of protection against market volatility. The demand for these properties remains relatively stable, even during economic downturns.

-

Strong Tenant Base: Realty Income boasts a diverse tenant base, including many creditworthy companies with long-term lease agreements. This reduces the risk of rental income disruptions.

-

Experienced Management Team: The company's management team has a proven track record of successfully navigating market challenges and delivering consistent results.

Risks to Consider Before Investing

While Realty Income presents a compelling investment opportunity, it's essential to acknowledge potential risks:

-

Interest Rate Sensitivity: Like other REITs, Realty Income is sensitive to interest rate fluctuations. Rising interest rates can impact borrowing costs and potentially reduce profitability.

-

Market Volatility: Although relatively defensive, Realty Income's stock price can still be influenced by broader market trends and economic uncertainty.

-

Property Value Fluctuations: The value of Realty Income's properties can fluctuate based on market conditions and local economic factors.

Is Realty Income Right for Your Portfolio?

Jim Cramer's recommendation is just one piece of the puzzle. Before investing in Realty Income (O), conduct thorough due diligence. Consider your personal risk tolerance, investment goals, and overall portfolio diversification. Consult with a qualified financial advisor to determine if Realty Income aligns with your individual financial strategy. Remember, past performance doesn't guarantee future results. While Realty Income presents an attractive opportunity for income-seeking investors, it's crucial to make informed decisions based on your unique circumstances. The information provided here is for educational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jim Cramer's Top Dividend Pick: Realty Income (O). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Emiten Data Center Dcii Dihapus Dari Papan Pemantauan Khusus Harga Saham Terjun Bebas

Mar 18, 2025

Emiten Data Center Dcii Dihapus Dari Papan Pemantauan Khusus Harga Saham Terjun Bebas

Mar 18, 2025 -

Mounts Allegations Ignored Chelsea Stands By Player Despite Controversy

Mar 18, 2025

Mounts Allegations Ignored Chelsea Stands By Player Despite Controversy

Mar 18, 2025 -

High Profile Toyah Cordingley Murder Jury Discharged Investigation Ongoing

Mar 18, 2025

High Profile Toyah Cordingley Murder Jury Discharged Investigation Ongoing

Mar 18, 2025 -

Sabonis Out But Kings Still Triumph 132 122 Victory Against Grizzlies

Mar 18, 2025

Sabonis Out But Kings Still Triumph 132 122 Victory Against Grizzlies

Mar 18, 2025 -

Missed Potential Movie Title Ambitious Tech Concepts In A Weak Film

Mar 18, 2025

Missed Potential Movie Title Ambitious Tech Concepts In A Weak Film

Mar 18, 2025

Latest Posts

-

Atletico Madrid Eye Arsenals Lewis Skelly Transfer Rumor Details

Apr 30, 2025

Atletico Madrid Eye Arsenals Lewis Skelly Transfer Rumor Details

Apr 30, 2025 -

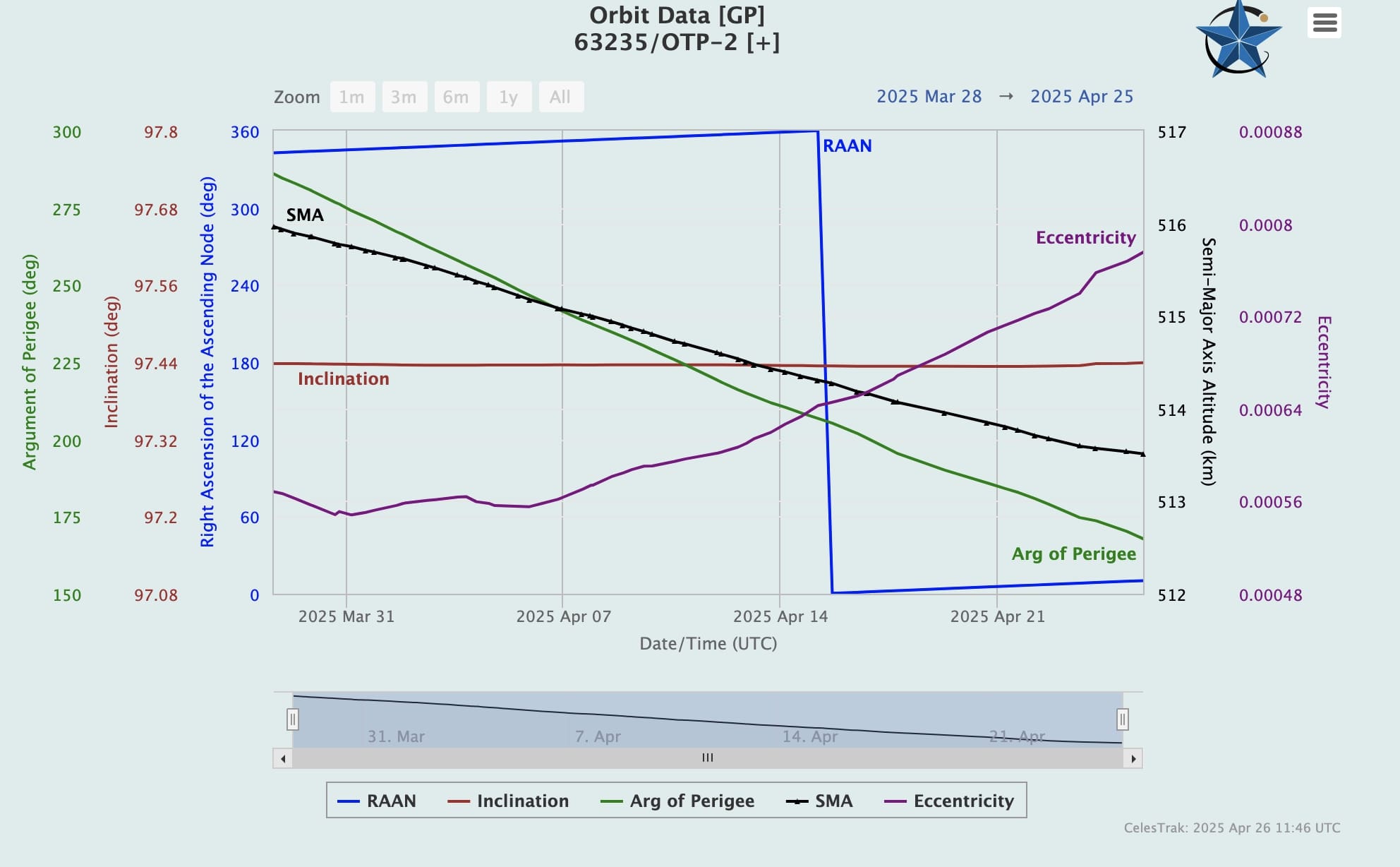

Propellantless Drive Technology Potential And Challenges For The Future

Apr 30, 2025

Propellantless Drive Technology Potential And Challenges For The Future

Apr 30, 2025 -

Book Now Qantas Offers 499 International Flights

Apr 30, 2025

Book Now Qantas Offers 499 International Flights

Apr 30, 2025 -

Multan Sultans Vs Quetta Gladiators Gladiators Bold Bowling Choice In Hbl Psl

Apr 30, 2025

Multan Sultans Vs Quetta Gladiators Gladiators Bold Bowling Choice In Hbl Psl

Apr 30, 2025 -

Secondary School Student Arrested Teacher Injured By Penknife

Apr 30, 2025

Secondary School Student Arrested Teacher Injured By Penknife

Apr 30, 2025