Klarna Customer Financing: A Guide To Buying Electronics On A Budget

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Klarna Customer Financing: A Guide to Buying Electronics on a Budget

Is that new TV or gaming console calling your name but your budget's feeling a little tight? Klarna might be the answer. This popular buy-now-pay-later (BNPL) service is transforming how consumers purchase electronics, offering flexible payment options that can make big-ticket items more accessible. But is it right for you? This guide delves into the world of Klarna customer financing for electronics, exploring its benefits, drawbacks, and how to use it responsibly.

What is Klarna?

Klarna is a global payment network that allows shoppers to split purchases into smaller, interest-free installments. For electronics retailers, it acts as a powerful marketing tool, attracting budget-conscious customers who might otherwise delay purchases. Instead of paying the full price upfront, Klarna users can opt for various payment plans, often with options like:

- Pay in 30 days: This offers a grace period to pay the total amount within a month. Perfect for smaller purchases or when you're expecting a paycheck soon.

- Pay in 4: Splits the purchase into four equal interest-free installments, typically paid every two weeks. Ideal for managing the cost of more expensive electronics.

- Financing: Klarna also offers longer-term financing options through partner lenders, but these often involve interest charges. Carefully review the terms before opting for this method.

Buying Electronics with Klarna: The Pros and Cons

Pros:

- Increased affordability: Klarna makes expensive electronics more manageable by breaking down the cost into smaller payments.

- Interest-free options: Many Klarna plans are interest-free, saving you money compared to traditional credit cards or loans.

- Improved budgeting: Spreading payments can improve your cash flow, preventing budget overstretches.

- Wide acceptance: Klarna is partnered with numerous major electronics retailers, offering a wide selection of products.

- Simple application process: Applying for Klarna is generally quick and straightforward, often requiring minimal personal information.

Cons:

- Missed payment fees: Late payments can incur significant fees, impacting your credit score.

- Potential for overspending: The ease of using BNPL can lead to impulsive purchases and debt accumulation if not managed carefully.

- Not suitable for everyone: Klarna isn't a solution for everyone; responsible financial management is crucial.

- Credit impact: While many Klarna plans don't directly impact your credit score, late payments can negatively affect it.

How to Use Klarna Responsibly for Electronics Purchases

- Check your budget: Before using Klarna, ensure you can comfortably afford the repayments within your budget.

- Compare prices: Don't let the ease of Klarna cloud your judgment; compare prices across different retailers before committing to a purchase.

- Read the terms carefully: Understand the repayment schedule, fees, and interest rates (if applicable) before finalizing the purchase.

- Set reminders: Set up reminders to ensure timely payments and avoid late fees.

- Track your spending: Monitor your Klarna activity and ensure you stay within your financial limits.

Conclusion: Klarna and Smart Electronics Shopping

Klarna can be a valuable tool for purchasing electronics on a budget, providing flexible payment options that make big purchases more accessible. However, responsible use is paramount. By understanding its benefits and drawbacks, and by following the tips outlined above, you can leverage Klarna's power to acquire the electronics you need without compromising your financial stability. Remember, always prioritize responsible spending and avoid accumulating debt beyond your capacity to repay.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Klarna Customer Financing: A Guide To Buying Electronics On A Budget. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

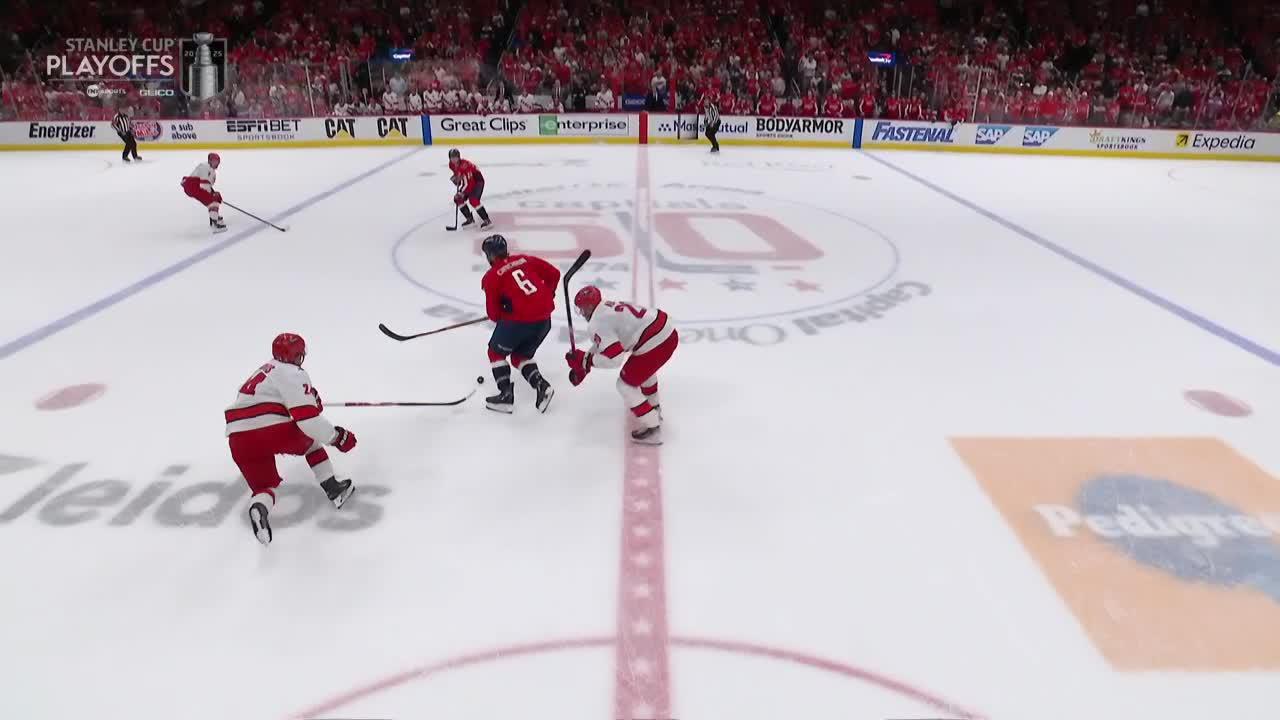

Capitals Beat Capitals Jarvis Empty Netter Secures Victory

May 22, 2025

Capitals Beat Capitals Jarvis Empty Netter Secures Victory

May 22, 2025 -

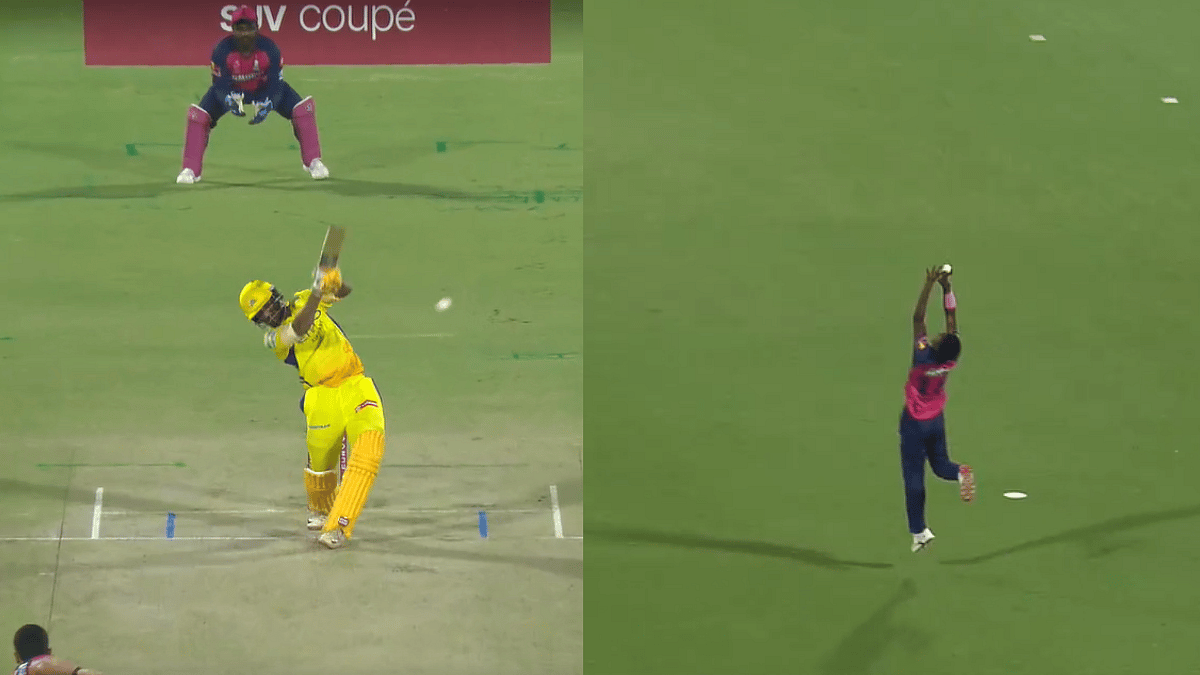

Ipl 2025 Unbelievable Catch Kwena Maphaka Vs Urvil Patel Csk Vs Rr

May 22, 2025

Ipl 2025 Unbelievable Catch Kwena Maphaka Vs Urvil Patel Csk Vs Rr

May 22, 2025 -

Pacers Knecht 16 1 Ppg A Summer Trade Target For The Los Angeles Lakers

May 22, 2025

Pacers Knecht 16 1 Ppg A Summer Trade Target For The Los Angeles Lakers

May 22, 2025 -

Skinners Comeback Targeting A Conference Final Appearance

May 22, 2025

Skinners Comeback Targeting A Conference Final Appearance

May 22, 2025 -

Dustin Martins Future Uncertain As Teammate Seeks Immediate Release

May 22, 2025

Dustin Martins Future Uncertain As Teammate Seeks Immediate Release

May 22, 2025