Klarna Doubles Losses Despite Reaching 100 Million Customers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Klarna Doubles Losses Despite Reaching 100 Million Customers: A Sign of Trouble or Strategic Investment?

Buy now, pay later (BNPL) giant Klarna recently announced it has reached a significant milestone: 100 million active customers globally. This impressive feat, however, is overshadowed by the company's significantly increased losses. Klarna's losses have doubled, raising concerns about the long-term sustainability of its business model in an increasingly competitive fintech landscape. Is this a temporary setback, a strategic investment for future growth, or a sign of deeper underlying issues? Let's delve into the details.

Klarna's Impressive User Base, Troubling Financials:

The 100 million customer milestone is undeniably a testament to Klarna's success in popularizing BNPL services. The company has cleverly positioned itself as a convenient and appealing alternative to traditional credit cards, particularly amongst younger demographics. This impressive user base underscores the widespread appeal of its flexible payment options and user-friendly app.

However, the celebratory atmosphere is tempered by the stark reality of its financial performance. The company's losses have doubled compared to the previous year, a figure that cannot be ignored. While Klarna hasn't released precise financial figures recently, reports indicate a substantial widening of the gap between revenue and expenditure. This raises critical questions about the company's profitability and its long-term viability.

Analyzing the Causes of Increased Losses:

Several factors likely contribute to Klarna's increased losses. These include:

-

Increased Marketing and Acquisition Costs: Competition in the BNPL market is fierce, forcing Klarna to invest heavily in marketing and customer acquisition to maintain its market share. This aggressive marketing strategy, while effective in growing its customer base, inevitably impacts profitability.

-

Rising Interest Rates and Economic Uncertainty: The current global economic climate, characterized by rising interest rates and inflation, significantly impacts consumer spending habits. This increased economic uncertainty may lead to higher default rates on BNPL loans, directly impacting Klarna's bottom line.

-

Regulatory Scrutiny and Increased Compliance Costs: The BNPL sector is facing increased regulatory scrutiny globally. This translates into higher compliance costs for companies like Klarna, adding pressure on their already strained margins.

-

Investment in Future Growth: Klarna may be strategically investing in new technologies, product development, and expansion into new markets, which could temporarily inflate losses. This long-term investment strategy prioritizes future growth over immediate profitability.

The Future of Klarna: A Balancing Act:

The question remains: is Klarna's doubled loss a harbinger of failure, or a necessary sacrifice for future success? The company's massive user base provides a strong foundation for future growth. However, the sustainability of its model depends on effectively managing costs, navigating regulatory hurdles, and adapting to evolving consumer behavior in a challenging economic environment. Klarna will need to carefully balance its aggressive growth strategy with a focus on profitability to secure its position as a leader in the evolving BNPL landscape. Their ability to navigate this delicate balancing act will determine their long-term success. The next few quarters will be crucial in determining whether this is a temporary stumble or a more significant challenge.

Keywords: Klarna, Buy Now Pay Later, BNPL, losses, financial results, 100 million customers, fintech, economic uncertainty, regulation, competition, market share, profitability, growth strategy, investment, customer acquisition cost.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Klarna Doubles Losses Despite Reaching 100 Million Customers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The New Electricity Michael Dells Urgent Call To Action On Ai Adoption

May 21, 2025

The New Electricity Michael Dells Urgent Call To Action On Ai Adoption

May 21, 2025 -

Josh Gad And Andrew Rannells Celebrity Wheel Of Fortune Appearance Must See Clip

May 21, 2025

Josh Gad And Andrew Rannells Celebrity Wheel Of Fortune Appearance Must See Clip

May 21, 2025 -

Dramatic Anakie Fire Pallets Of Hand Sanitiser Explode

May 21, 2025

Dramatic Anakie Fire Pallets Of Hand Sanitiser Explode

May 21, 2025 -

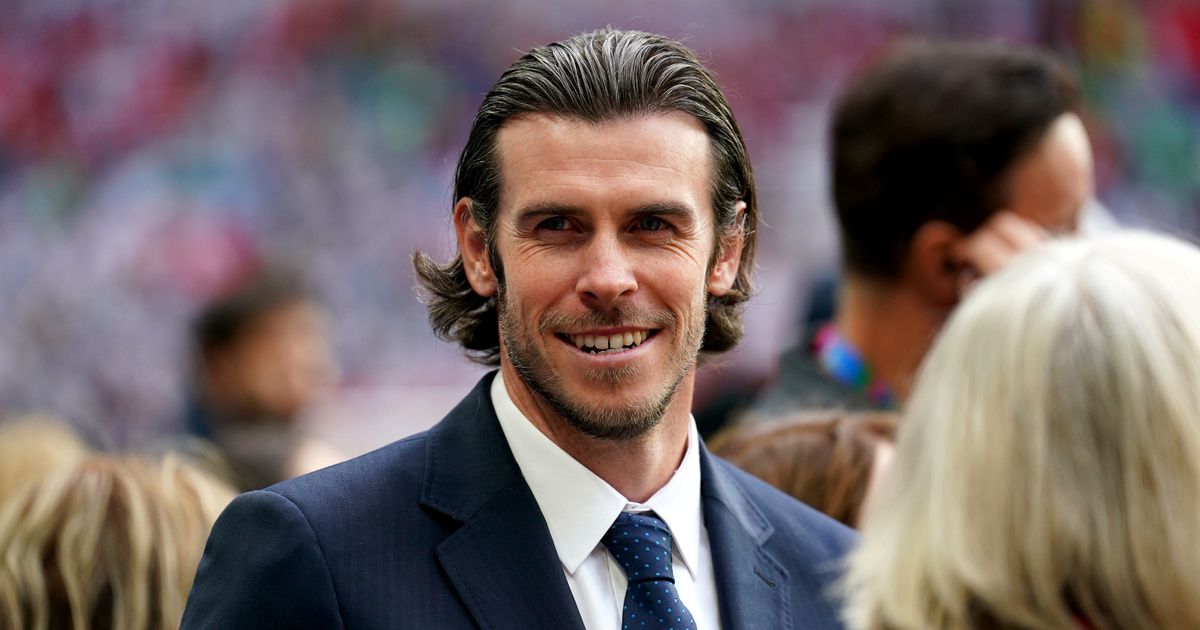

Gareth Bale Appointed At Tottenham Implications For Europa League Final

May 21, 2025

Gareth Bale Appointed At Tottenham Implications For Europa League Final

May 21, 2025 -

Duran Y El Bullpen De Boston Dominan A Mets Victoria Crucial Para Medias Rojas

May 21, 2025

Duran Y El Bullpen De Boston Dominan A Mets Victoria Crucial Para Medias Rojas

May 21, 2025