Klarna Reports Expanded Losses Amidst Surge In Loan Defaults

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Klarna Reports Expanded Losses Amidst Surge in Loan Defaults

Buy Now, Pay Later giant struggles as economic downturn impacts consumer spending and repayment rates.

Swedish fintech giant Klarna has reported significantly expanded losses for the first half of 2023, a stark contrast to its previous growth trajectory. The company, a leading player in the Buy Now, Pay Later (BNPL) market, attributed the substantial losses to a sharp increase in loan defaults, a direct consequence of the ongoing economic downturn and a squeeze on consumer spending. This troubling news raises serious questions about the long-term viability of the BNPL model in a less financially buoyant environment.

A Deep Dive into Klarna's Financial Troubles

Klarna's financial report revealed a net loss far exceeding analysts' predictions. The surge in loan defaults, a key driver of these losses, highlights the inherent risk associated with BNPL services. As inflation remains high and interest rates rise globally, consumers are facing increased financial pressure, making repayments increasingly challenging. This is particularly impacting younger demographics who heavily utilize BNPL services.

- Rising Defaults: The percentage of overdue payments has risen considerably, putting a strain on Klarna's profitability and potentially jeopardizing its financial stability.

- Increased Provisioning: To account for the higher default rate, Klarna has significantly increased its provisioning for bad debts, further impacting its bottom line.

- Impact on Valuation: The negative financial results have inevitably impacted Klarna's valuation, raising concerns among investors about the company's future prospects.

The BNPL Model Under Scrutiny

Klarna's struggles are not isolated incidents. The entire BNPL sector is facing increasing pressure as regulatory scrutiny intensifies and the economic climate worsens. Many experts are questioning the long-term sustainability of the BNPL model, particularly in the face of rising interest rates and increased consumer debt.

Concerns include:

- Regulatory Uncertainty: Governments worldwide are grappling with regulating the BNPL industry, aiming to protect consumers from spiraling debt. This regulatory uncertainty adds to the challenges faced by companies like Klarna.

- Increased Competition: The BNPL market is becoming increasingly competitive, with established financial institutions and new fintech companies entering the fray. This heightened competition puts further pressure on profit margins.

- Shifting Consumer Behavior: As economic conditions deteriorate, consumers are becoming more cautious with their spending and are potentially less inclined to use BNPL services.

What the Future Holds for Klarna

Klarna has announced measures to mitigate the impact of the increased defaults, including stricter credit checks and a focus on improving its risk management strategies. However, the success of these measures remains to be seen. The company’s future hinges on its ability to adapt to the changing economic landscape and navigate the increasing regulatory scrutiny. The next few quarters will be crucial in determining whether Klarna can successfully restructure its business model and regain its footing in a challenging market. The situation serves as a cautionary tale for other BNPL providers and underscores the importance of robust risk management and sustainable business practices in the rapidly evolving fintech sector. The ongoing developments at Klarna will undoubtedly continue to shape the future of the Buy Now, Pay Later industry globally.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Klarna Reports Expanded Losses Amidst Surge In Loan Defaults. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stellar Xlm Technical Analysis Short Term Outlook And Potential Correction

May 21, 2025

Stellar Xlm Technical Analysis Short Term Outlook And Potential Correction

May 21, 2025 -

Rejection On Netflix Actress Opens Up About Devastating Acting Critique

May 21, 2025

Rejection On Netflix Actress Opens Up About Devastating Acting Critique

May 21, 2025 -

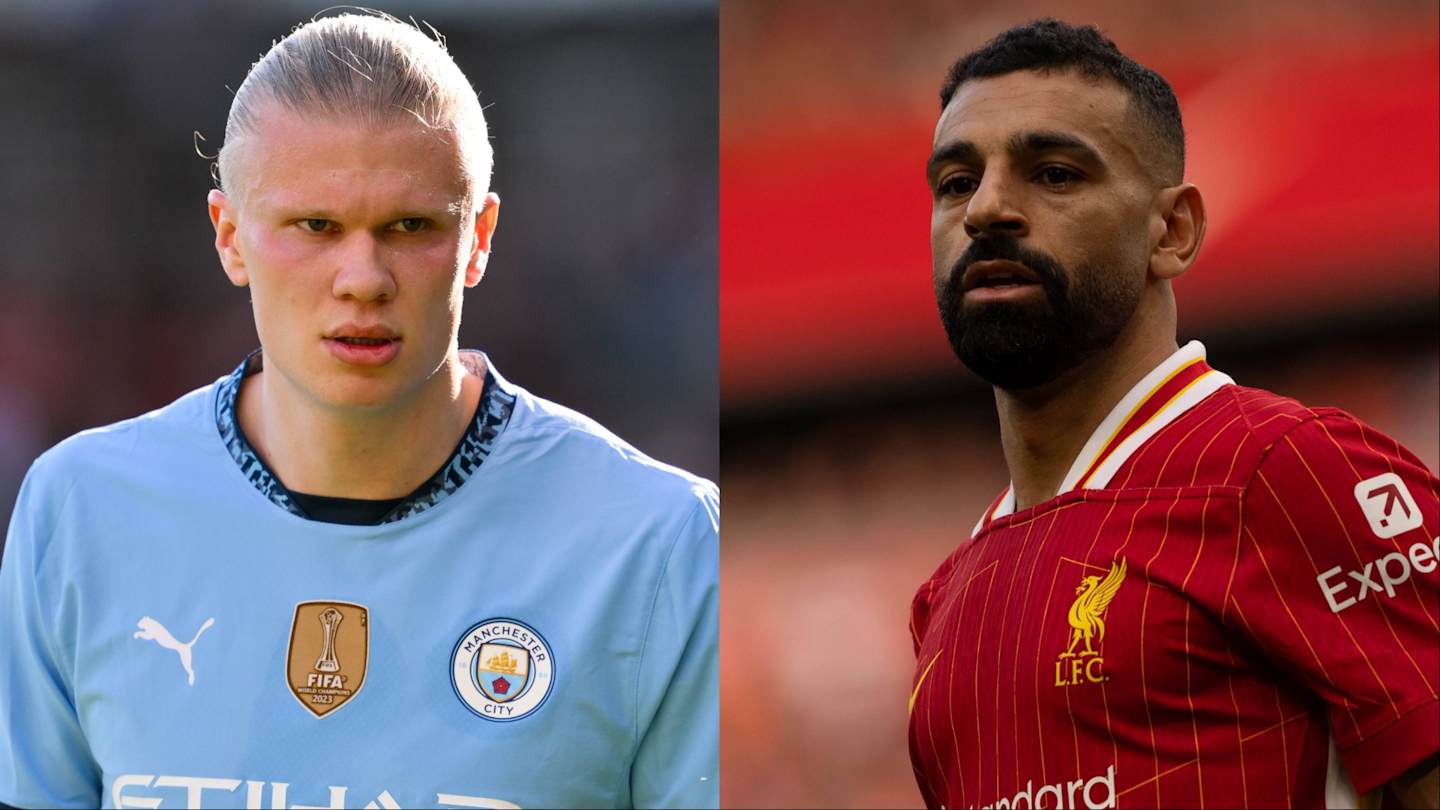

Tracking The Premier League Golden Boot A Close Look At The Top Contenders

May 21, 2025

Tracking The Premier League Golden Boot A Close Look At The Top Contenders

May 21, 2025 -

Premier League Golden Boot Race Who Will Win Top Scorer

May 21, 2025

Premier League Golden Boot Race Who Will Win Top Scorer

May 21, 2025 -

Nyt Connections Sports Puzzle Hints May 19 2025 Edition

May 21, 2025

Nyt Connections Sports Puzzle Hints May 19 2025 Edition

May 21, 2025