Klarna's Buy Now Pay Later: Funding Your Next TV Or AirPods

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Klarna's Buy Now Pay Later: Funding Your Next TV or AirPods – Is it Right for You?

Is that shiny new OLED TV or the latest AirPods Pro staring you down from your online shopping cart? Budget constraints holding you back? Klarna's "Buy Now, Pay Later" (BNPL) service might seem like the perfect solution, offering a tempting pathway to instant gratification. But before you click "purchase," let's delve into whether Klarna's BNPL is the right financial choice for funding your next big tech purchase.

Klarna has become a household name, seamlessly integrated into countless online retailers. Its ease of use is undeniable; a few clicks and your desired goods are on their way, with payments spread over several weeks or months. This makes it particularly appealing for high-ticket items like televisions and AirPods, allowing consumers to absorb the cost over time. But this convenience comes with responsibilities and potential downsides that need careful consideration.

How Klarna's BNPL Works for Electronics

Klarna offers several payment options, including:

- Pay in 30 days: This allows you to receive your purchase and pay the full amount within 30 days. Missing this deadline can incur late fees, impacting your credit score.

- Pay in 4 installments: The purchase price is split into four equal installments, typically paid every two weeks. This option provides a structured payment plan, helping manage the cost of expensive items like a new TV or AirPods.

- Financing: Klarna also offers longer-term financing options through partner lenders, allowing for more extended repayment periods but often involving interest charges.

The Allure and the Risks of Klarna BNPL

The immediate gratification of owning your desired electronics is a major draw. The ease of the application process and integration with popular online retailers adds to its appeal. However, overlooking the financial implications can lead to unforeseen difficulties:

- Late Fees and Interest: Missing payments can result in significant late fees, negatively affecting your credit score and potentially leading to debt accumulation. Interest charges on longer-term financing plans can quickly inflate the overall cost of your purchase.

- Debt Trap Potential: Using BNPL for multiple purchases simultaneously can quickly spiral into unmanageable debt. Careful budgeting and responsible spending habits are crucial.

- Impact on Credit Score: While some responsible BNPL use might not negatively affect your credit score, late payments or missed installments will certainly do so. This can hinder your ability to secure loans or credit in the future.

Alternatives to Klarna for Tech Purchases

Before opting for Klarna, explore alternative financing options:

- Credit Cards: If you have a good credit history, a credit card offering a 0% APR introductory period might be a more cost-effective solution. Responsible credit card use requires careful budgeting and timely repayments.

- Savings: Saving up for your desired purchase might take longer, but it avoids any debt and associated fees.

- Personal Loans: For larger purchases, a personal loan might offer a lower interest rate than Klarna's financing options.

Conclusion: Weigh the Pros and Cons Carefully

Klarna's BNPL service can be a useful tool for managing the cost of big-ticket electronics, but only if used responsibly. Carefully weigh the convenience against the potential risks of late fees, interest charges, and the impact on your credit score. Before committing, explore alternative financing options and ensure you have a clear understanding of the repayment terms and potential consequences. Always prioritize responsible spending and budgeting to avoid falling into a debt trap. Remember, the latest tech isn't worth compromising your financial well-being.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Klarna's Buy Now Pay Later: Funding Your Next TV Or AirPods. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

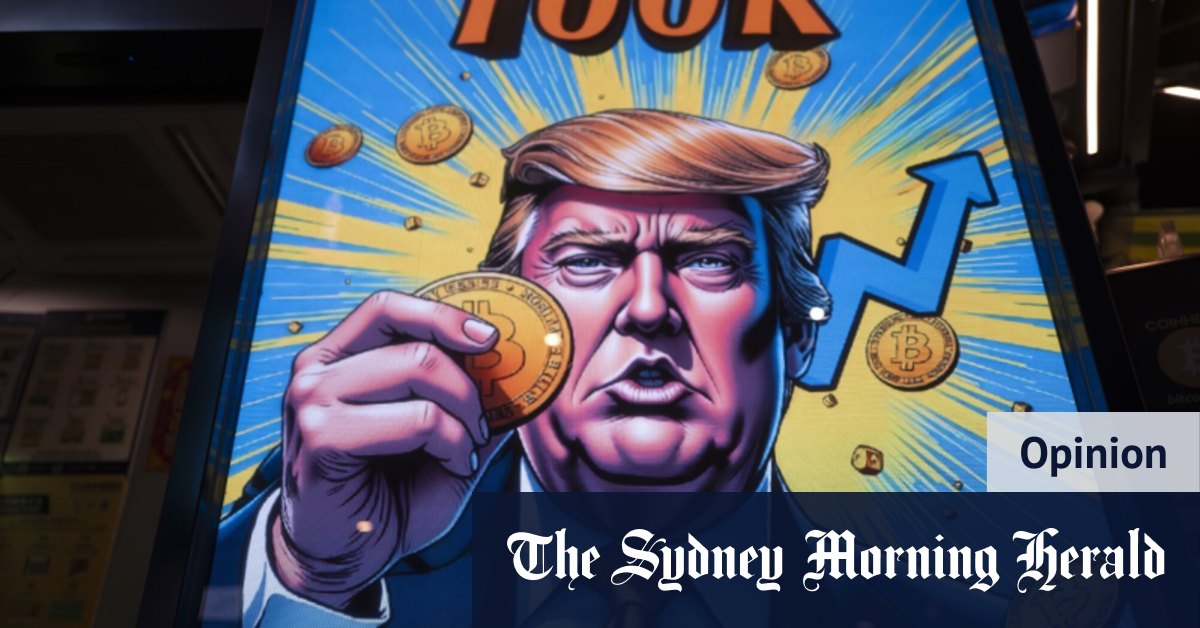

Bitcoin Soars After Trump News Should You Buy Bitcoin Today

May 23, 2025

Bitcoin Soars After Trump News Should You Buy Bitcoin Today

May 23, 2025 -

A Ap Rockys Highest 2 Lowest A Cinematic First

May 23, 2025

A Ap Rockys Highest 2 Lowest A Cinematic First

May 23, 2025 -

Animoca And Astar Network Bringing Popular Japanese And Asian Ips To The Metaverse

May 23, 2025

Animoca And Astar Network Bringing Popular Japanese And Asian Ips To The Metaverse

May 23, 2025 -

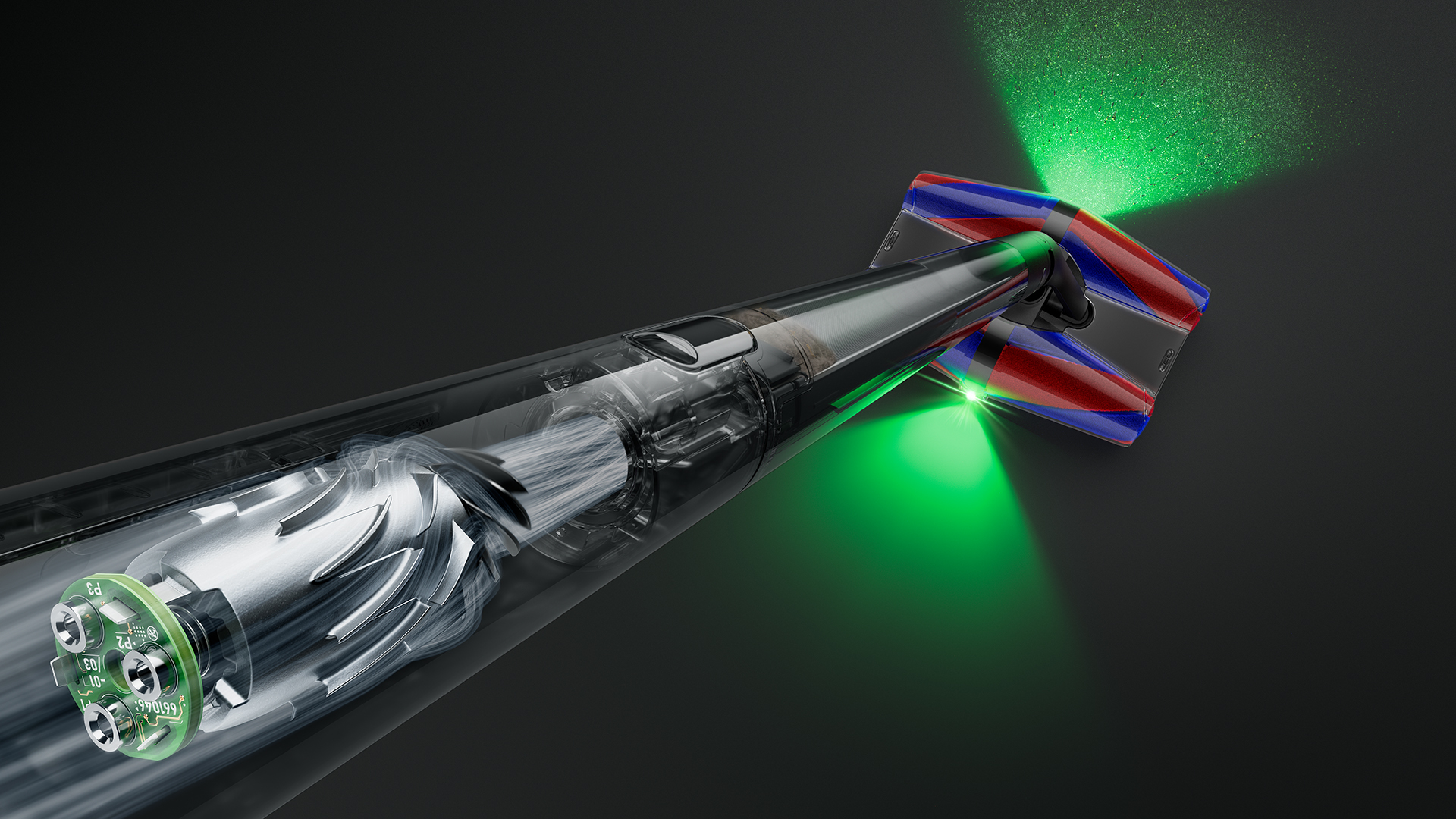

Experience Effortless Cleaning Dysons New Thin Vacuum Technology

May 23, 2025

Experience Effortless Cleaning Dysons New Thin Vacuum Technology

May 23, 2025 -

Xrps Potential What A 40 Trillion Crypto Market Means For Xrp Price

May 23, 2025

Xrps Potential What A 40 Trillion Crypto Market Means For Xrp Price

May 23, 2025

Latest Posts

-

Upset In Denver Gilgeous Alexander Named Nba Mvp Defeating Jokic

May 24, 2025

Upset In Denver Gilgeous Alexander Named Nba Mvp Defeating Jokic

May 24, 2025 -

Microsoft Azure Grok 3 5 Xai Integration Details Revealed

May 24, 2025

Microsoft Azure Grok 3 5 Xai Integration Details Revealed

May 24, 2025 -

Shai Gilgeous Alexander Claims Prestigious Nba Mvp Award

May 24, 2025

Shai Gilgeous Alexander Claims Prestigious Nba Mvp Award

May 24, 2025 -

Slash Your Energy Costs Octopus Energy Unveils 200 Saving Tariff

May 24, 2025

Slash Your Energy Costs Octopus Energy Unveils 200 Saving Tariff

May 24, 2025 -

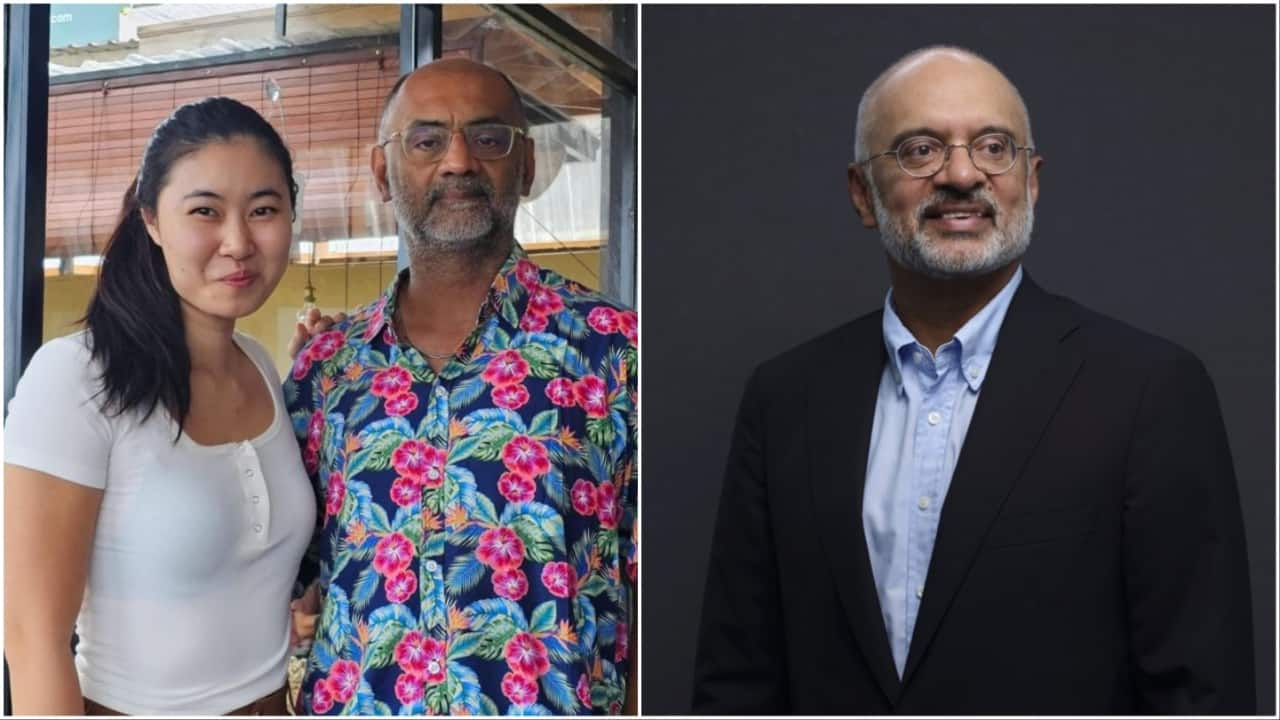

Bali Run In Ex Dbs Employees Comedy Of Errors Involving Ceo Piyush Gupta

May 24, 2025

Bali Run In Ex Dbs Employees Comedy Of Errors Involving Ceo Piyush Gupta

May 24, 2025