Klarna's Buy Now Pay Later Plans: Your Guide To Financing TVs & AirPods

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Klarna's Buy Now Pay Later Plans: Your Guide to Financing TVs & AirPods

Snag that dream TV or those coveted AirPods without breaking the bank! Klarna, the popular Buy Now Pay Later (BNPL) service, is making high-ticket purchases more accessible. But understanding how Klarna works, especially for electronics like TVs and AirPods, is crucial before you click "buy." This comprehensive guide will walk you through everything you need to know about financing your next tech purchase with Klarna.

What is Klarna?

Klarna is a global payment network that allows you to split the cost of your purchases into interest-free installments. Instead of paying the full price upfront, you can choose a payment plan that suits your budget. This makes larger purchases, like a new 4K TV or the latest AirPods Pro, much more manageable. Klarna partners with thousands of retailers, offering flexibility at checkout.

Financing TVs with Klarna: A Smart Choice?

For many, a new television is a significant investment. Klarna can alleviate the financial pressure, allowing you to spread the cost over several weeks or months. Here’s what to consider:

- Interest-free periods: Klarna often offers interest-free payment plans, meaning you only pay the original price of the TV, as long as you stick to the repayment schedule. This makes it a cost-effective option compared to high-interest credit cards.

- Payment options: Klarna typically offers several payment plans, giving you flexibility to choose the option that best fits your cash flow. You might opt for four interest-free payments, or a longer plan depending on retailer offers.

- Eligibility: Eligibility for Klarna depends on factors like your credit score and payment history. While it's generally easier to qualify than for a traditional loan, it's always a good idea to check your eligibility before adding items to your cart.

Getting Those AirPods with Klarna: A Seamless Experience?

AirPods, while not as expensive as a new television, can still be a considerable expense. Klarna's BNPL service makes purchasing these popular earbuds more accessible.

- Convenience: Klarna's integration with many online retailers makes adding it to your checkout process quick and easy. Simply select Klarna as your payment method and follow the on-screen instructions.

- Budget Management: Breaking down the cost of AirPods into smaller payments makes budgeting easier, preventing a large one-time hit to your finances.

- Potential drawbacks: Late payments can incur fees and negatively impact your credit score. Always ensure you can stick to the agreed-upon repayment schedule.

Understanding Klarna's Fees and Repayment Schedules

- Late payment fees: Always review Klarna’s terms and conditions. Missed payments can result in substantial fees.

- Interest charges: While many plans are interest-free, be aware that some may charge interest if payments aren't made on time or if you choose a longer repayment period. Read the fine print carefully.

- Impact on credit: Klarna reports payment activity to credit bureaus. Consistent on-time payments can positively impact your credit score, while late payments can have a negative effect.

Klarna Alternatives: Other BNPL Options

While Klarna is a popular choice, other Buy Now Pay Later services exist, such as Afterpay, Affirm, and PayPal Pay in 4. Comparing offers from different providers can help you find the best deal.

Conclusion: Weighing the Pros and Cons

Klarna offers a convenient way to finance purchases like TVs and AirPods, but responsible use is essential. Carefully review the terms and conditions, ensuring you can comfortably meet the repayment schedule before committing. By understanding the potential benefits and drawbacks, you can make informed decisions about using Klarna for your next tech purchase. Remember to always shop responsibly and only buy what you can afford.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Klarna's Buy Now Pay Later Plans: Your Guide To Financing TVs & AirPods. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

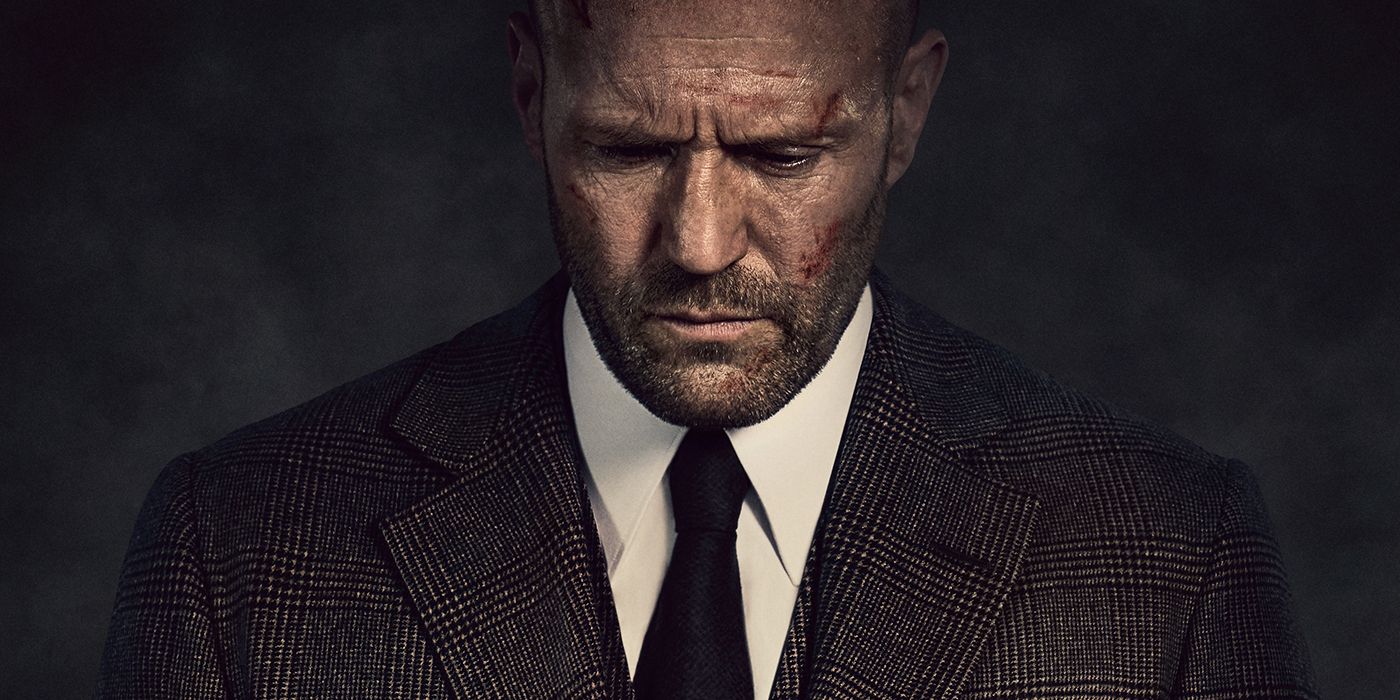

Jason Stathams Underdog Movie 90 Audience Score Fuels Streaming Popularity

May 22, 2025

Jason Stathams Underdog Movie 90 Audience Score Fuels Streaming Popularity

May 22, 2025 -

Dawn Richards Shocking Testimony Allegations Of Threats Against Singer By Sean Combs

May 22, 2025

Dawn Richards Shocking Testimony Allegations Of Threats Against Singer By Sean Combs

May 22, 2025 -

Peter De Boers Coaching Legacy Examining His Contributions To Professional Hockey

May 22, 2025

Peter De Boers Coaching Legacy Examining His Contributions To Professional Hockey

May 22, 2025 -

Man United Vs Spurs Europa League Final Result And Key Moments

May 22, 2025

Man United Vs Spurs Europa League Final Result And Key Moments

May 22, 2025 -

Nyt Wordle Game 1432 May 21 Solution And Helpful Hints

May 22, 2025

Nyt Wordle Game 1432 May 21 Solution And Helpful Hints

May 22, 2025