Klarna's "Buy Now, Pay Never" Model: Rising US Debt And Repayment Struggles

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Klarna's "Buy Now, Pay Never" Model: Rising US Debt and Repayment Struggles

Klarna, the Swedish fintech giant, has revolutionized online shopping with its "buy now, pay later" (BNPL) model. This seemingly convenient option, often marketed with alluring slogans suggesting effortless payment, is increasingly contributing to a worrying rise in US consumer debt and repayment struggles. While offering short-term financial flexibility, the long-term implications of Klarna's model and similar BNPL services are raising serious concerns among financial experts and consumers alike.

The Allure and the Danger of "Buy Now, Pay Later"

Klarna's success lies in its simplicity. Consumers can split purchases into interest-free installments, making larger purchases feel more manageable. This ease of access, particularly for younger generations and those with limited credit history, fuels its popularity. However, this very accessibility masks a significant danger: overspending and the subsequent struggle to repay these seemingly small debts.

The Growing Problem of BNPL Debt in the US

The rise of BNPL services like Klarna has coincided with a surge in consumer debt in the United States. While precise figures linking BNPL specifically to overall debt increases are still emerging, anecdotal evidence and numerous consumer reports paint a concerning picture. Many users find themselves juggling multiple BNPL accounts, losing track of due dates, and eventually facing late fees and negative impacts on their credit scores.

Hidden Costs and Unexpected Consequences

What initially appears as interest-free financing often comes with hidden costs. Missed payments can trigger significant late fees, rapidly escalating the total cost of a purchase. Furthermore, the impact on credit scores can be severe, hindering future borrowing opportunities and increasing the cost of credit in the long run. This can create a vicious cycle, trapping consumers in a spiral of debt.

Klarna's Response and Industry Regulations

Facing mounting criticism, Klarna and other BNPL providers are increasingly emphasizing responsible lending practices and financial literacy initiatives. However, the effectiveness of these measures remains to be seen. Regulatory bodies are also starting to scrutinize the industry, exploring potential reforms to protect consumers and ensure greater transparency in BNPL agreements. This includes stricter guidelines on late fees, clearer disclosure of terms and conditions, and potentially stricter credit checks before approving BNPL applications.

What Consumers Can Do to Avoid BNPL Pitfalls:

- Budget Carefully: Before using BNPL, create a detailed budget to ensure you can comfortably afford the repayments.

- Limit the Number of Accounts: Avoid spreading your payments across multiple BNPL providers to avoid losing track of due dates.

- Set Reminders: Use calendar reminders or budgeting apps to track payment deadlines.

- Prioritize Repayment: Make timely payments a priority to avoid late fees and protect your credit score.

- Consider Alternatives: If you struggle to manage repayments, explore alternative financing options, such as personal loans or credit cards with responsible spending habits.

The Future of BNPL: A Balancing Act

Klarna's "buy now, pay later" model, while offering convenience, presents a significant challenge in balancing consumer accessibility with responsible lending. The future of BNPL depends heavily on a combination of responsible business practices from providers, effective regulations from governing bodies, and informed consumer choices. Only through a multi-faceted approach can we mitigate the risks associated with this increasingly popular form of financing and prevent a further surge in US consumer debt. The ongoing debate surrounding BNPL highlights the need for ongoing vigilance and a proactive approach to financial literacy to safeguard consumers in this rapidly evolving financial landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Klarna's "Buy Now, Pay Never" Model: Rising US Debt And Repayment Struggles. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bitcoin Btc Or Micro Strategy Mstr Stock Which Is The Better Investment In February 2025

May 21, 2025

Bitcoin Btc Or Micro Strategy Mstr Stock Which Is The Better Investment In February 2025

May 21, 2025 -

Analisis Del Desempeno De Senga En Boston Talento Aislado

May 21, 2025

Analisis Del Desempeno De Senga En Boston Talento Aislado

May 21, 2025 -

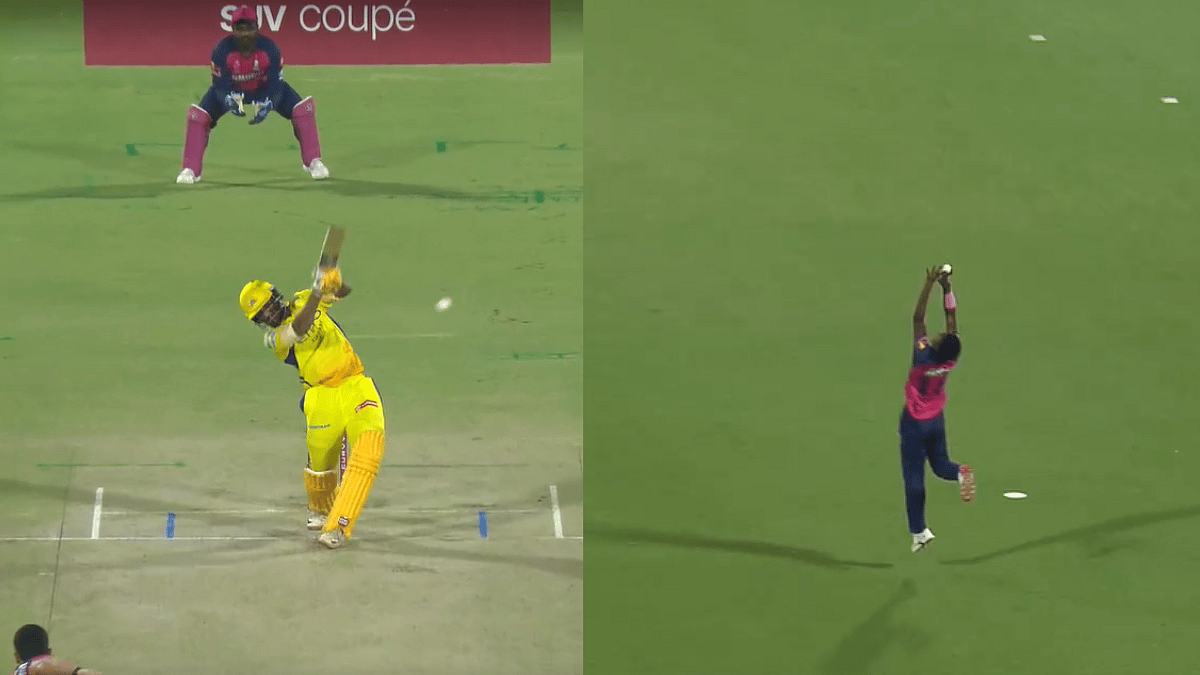

Ipl 2025 Kwena Maphakas Catch Of The Tournament Csk Vs Rr Match Highlights

May 21, 2025

Ipl 2025 Kwena Maphakas Catch Of The Tournament Csk Vs Rr Match Highlights

May 21, 2025 -

Protecting Yourself The Latest On My Gov And Ato Account Hacks

May 21, 2025

Protecting Yourself The Latest On My Gov And Ato Account Hacks

May 21, 2025 -

Dakota Johnson And Imogen Poots Best Dressed At Cannes Film Festival 2025

May 21, 2025

Dakota Johnson And Imogen Poots Best Dressed At Cannes Film Festival 2025

May 21, 2025