Klarna's Financial Performance Suffers: Impact Of Increased Loan Defaults

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Klarna's Financial Performance Suffers: The Impact of Increased Loan Defaults

Klarna, the Swedish buy now, pay later (BNPL) giant, has reported a significant downturn in its financial performance, largely attributed to a surge in loan defaults. The company, once a darling of the fintech world, is now grappling with the harsh realities of a tightening economic climate and shifting consumer spending habits. This news sends ripples through the BNPL sector, raising concerns about the long-term viability of this increasingly popular payment method.

Rising Defaults: A Key Driver of Klarna's Struggles

Klarna's recent financial reports paint a concerning picture. The company has seen a dramatic increase in the number of customers failing to repay their loans on time. This rise in loan defaults directly impacts Klarna's profitability, eating into its revenue and increasing its operational costs. Several factors contribute to this trend:

- Inflation and Cost of Living Crisis: Soaring inflation and the subsequent cost of living crisis have left many consumers struggling to manage their finances. This has resulted in a higher-than-anticipated default rate on BNPL loans, impacting Klarna's bottom line significantly.

- Reduced Consumer Spending: With inflation impacting purchasing power, consumers are becoming more cautious with their spending. This reduced spending directly translates to fewer transactions processed through Klarna, further impacting their revenue streams.

- Increased Competition: The BNPL market is becoming increasingly saturated, with new players entering the field and established companies expanding their offerings. This heightened competition puts pressure on Klarna to maintain its market share, potentially leading to more aggressive lending practices and consequently, higher default rates.

Klarna's Response to the Challenges

In response to these challenges, Klarna has announced several measures aimed at improving its financial health and mitigating future risks. These include:

- Stricter Credit Checks: The company is implementing more stringent credit checks to better assess the creditworthiness of potential borrowers, aiming to reduce the number of high-risk applications.

- Improved Risk Management: Klarna is investing heavily in enhancing its risk management systems to better predict and manage potential defaults. This involves leveraging advanced data analytics and machine learning to identify early warning signs of potential loan defaults.

- Cost-Cutting Measures: The company is undertaking various cost-cutting measures to streamline operations and improve efficiency. This includes potential layoffs and a reassessment of its operational expenditure.

Implications for the BNPL Industry

Klarna's struggles highlight the inherent risks associated with the BNPL business model, particularly in times of economic uncertainty. The increased loan defaults and resulting financial strain serve as a cautionary tale for other players in the BNPL sector. The industry is likely to see increased regulation and a greater focus on responsible lending practices in the coming years. Investors are also likely to scrutinize BNPL companies more carefully, demanding greater transparency and robust risk management strategies.

The Future of Klarna and BNPL

While the current situation presents significant challenges, Klarna remains a major player in the BNPL market. The success of their strategic response will be crucial in determining their future trajectory. The broader implications for the BNPL industry remain to be seen, but the current situation underscores the need for sustainable growth and responsible lending practices within this rapidly evolving sector. The coming months will be critical in observing how Klarna navigates these challenges and whether the BNPL model can withstand the pressures of a changing economic landscape. The ongoing performance of Klarna will undoubtedly shape the future of the entire buy now, pay later industry.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Klarna's Financial Performance Suffers: Impact Of Increased Loan Defaults. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

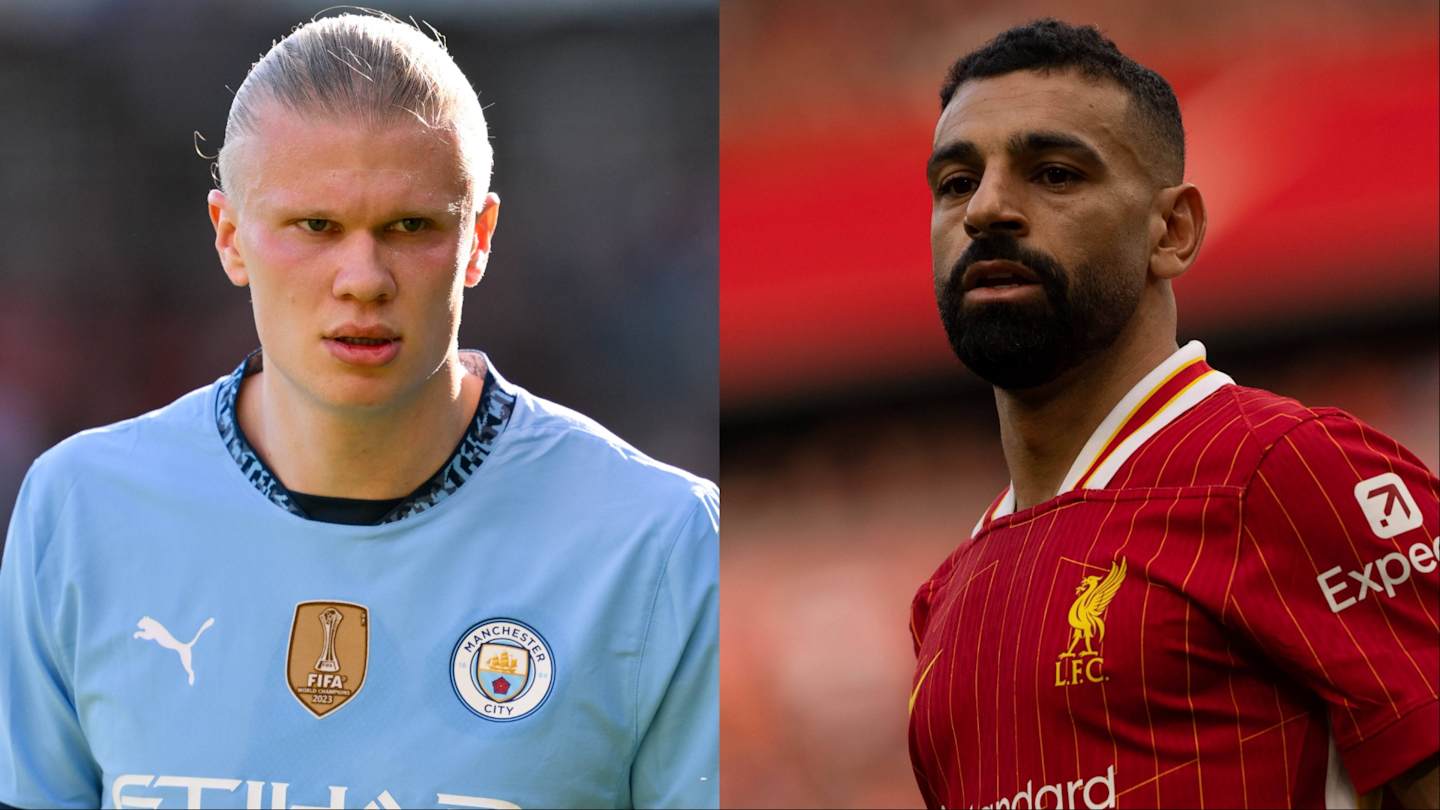

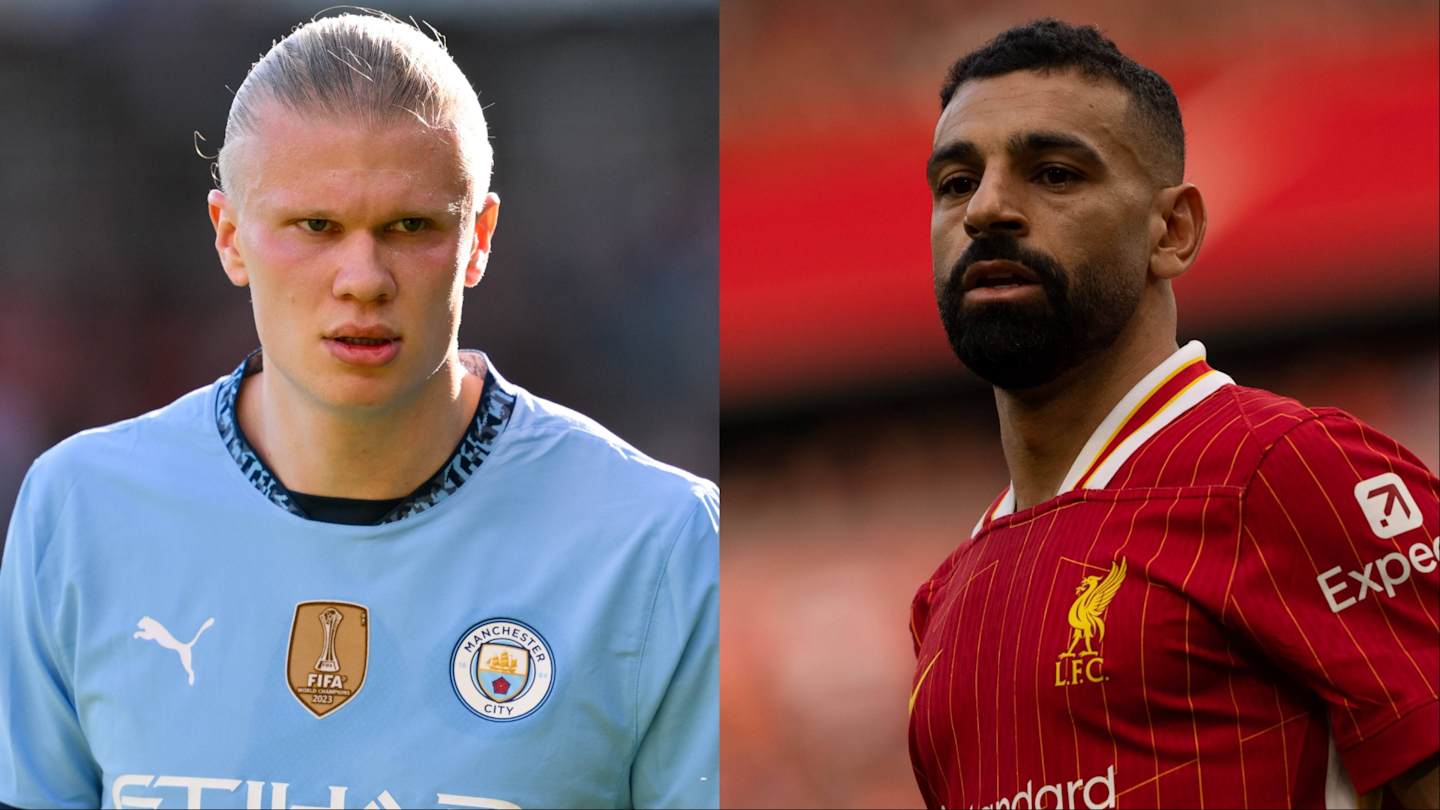

Premier League Golden Boot Standings Who Will Win This Season

May 21, 2025

Premier League Golden Boot Standings Who Will Win This Season

May 21, 2025 -

End Of An Era Lachlan Galvins Time At Wests Tigers Appears To Be Over

May 21, 2025

End Of An Era Lachlan Galvins Time At Wests Tigers Appears To Be Over

May 21, 2025 -

Chennai Super Kings Receive Major Player Update Ahead Of Ipl 2025

May 21, 2025

Chennai Super Kings Receive Major Player Update Ahead Of Ipl 2025

May 21, 2025 -

Premier League Top Goalscorers Complete Golden Boot Standings

May 21, 2025

Premier League Top Goalscorers Complete Golden Boot Standings

May 21, 2025 -

East Enders The Car Crash Aftermath Who Lived Who Died

May 21, 2025

East Enders The Car Crash Aftermath Who Lived Who Died

May 21, 2025