Kraken's Onchain Revolution: Tokenized Equities Hit Wall Street

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Kraken's Onchain Revolution: Tokenized Equities Hit Wall Street

Kraken, a prominent cryptocurrency exchange, is making waves on Wall Street with its ambitious foray into tokenized equities. This move represents a significant step towards bridging the gap between traditional finance and the burgeoning world of blockchain technology, potentially revolutionizing how we trade and own assets. But what exactly does this mean, and what are the implications for investors and the financial markets?

The Dawn of Onchain Equities:

Kraken's platform now allows investors to buy and sell fractional ownership of publicly traded companies, represented as digital tokens on a blockchain. This "tokenization" process offers several key advantages over traditional brokerage accounts:

- Increased Accessibility: Fractional ownership eliminates the high barrier to entry associated with purchasing whole shares of expensive stocks, making investing more accessible to a wider range of individuals.

- 24/7 Trading: Unlike traditional stock markets with limited trading hours, tokenized equities can be traded around the clock, globally.

- Enhanced Transparency: Blockchain's inherent transparency offers greater visibility into ownership and trading activity, potentially reducing fraud and enhancing trust.

- Programmability: Tokenized assets can be programmed with specific functionalities, opening up possibilities for automated trading strategies and other innovative applications.

Challenges and Regulatory Hurdles:

While the potential benefits are significant, Kraken's initiative faces several challenges:

- Regulatory Uncertainty: The regulatory landscape for tokenized securities is still evolving, with varying interpretations and guidelines across different jurisdictions. Navigating this complexity is crucial for Kraken's continued success.

- Security Concerns: Blockchain security is paramount. Any vulnerability could lead to significant losses for investors. Kraken will need to demonstrate robust security measures to maintain investor confidence.

- Liquidity: The success of tokenized equities depends on sufficient liquidity. If trading volume is low, it could limit the practicality of this new asset class.

- Integration with Existing Systems: Seamless integration with existing financial infrastructure is essential for widespread adoption. This requires collaboration between traditional financial institutions and blockchain companies.

The Future of Finance?:

Kraken's move is a bold step towards a future where traditional assets are represented and traded on blockchain networks. While challenges remain, the potential benefits are immense. The increased accessibility, 24/7 trading, and enhanced transparency offered by tokenized equities could reshape the landscape of investment and potentially democratize access to financial markets. However, the success of this initiative hinges on addressing regulatory uncertainty, ensuring robust security, and fostering sufficient liquidity. The coming months and years will be critical in determining whether Kraken's onchain revolution truly transforms Wall Street.

Keywords: Kraken, tokenized equities, blockchain, cryptocurrency, Wall Street, fractional ownership, digital assets, regulatory compliance, onchain trading, financial technology, fintech, investment, stock market, security tokens, decentralized finance, DeFi.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Kraken's Onchain Revolution: Tokenized Equities Hit Wall Street. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

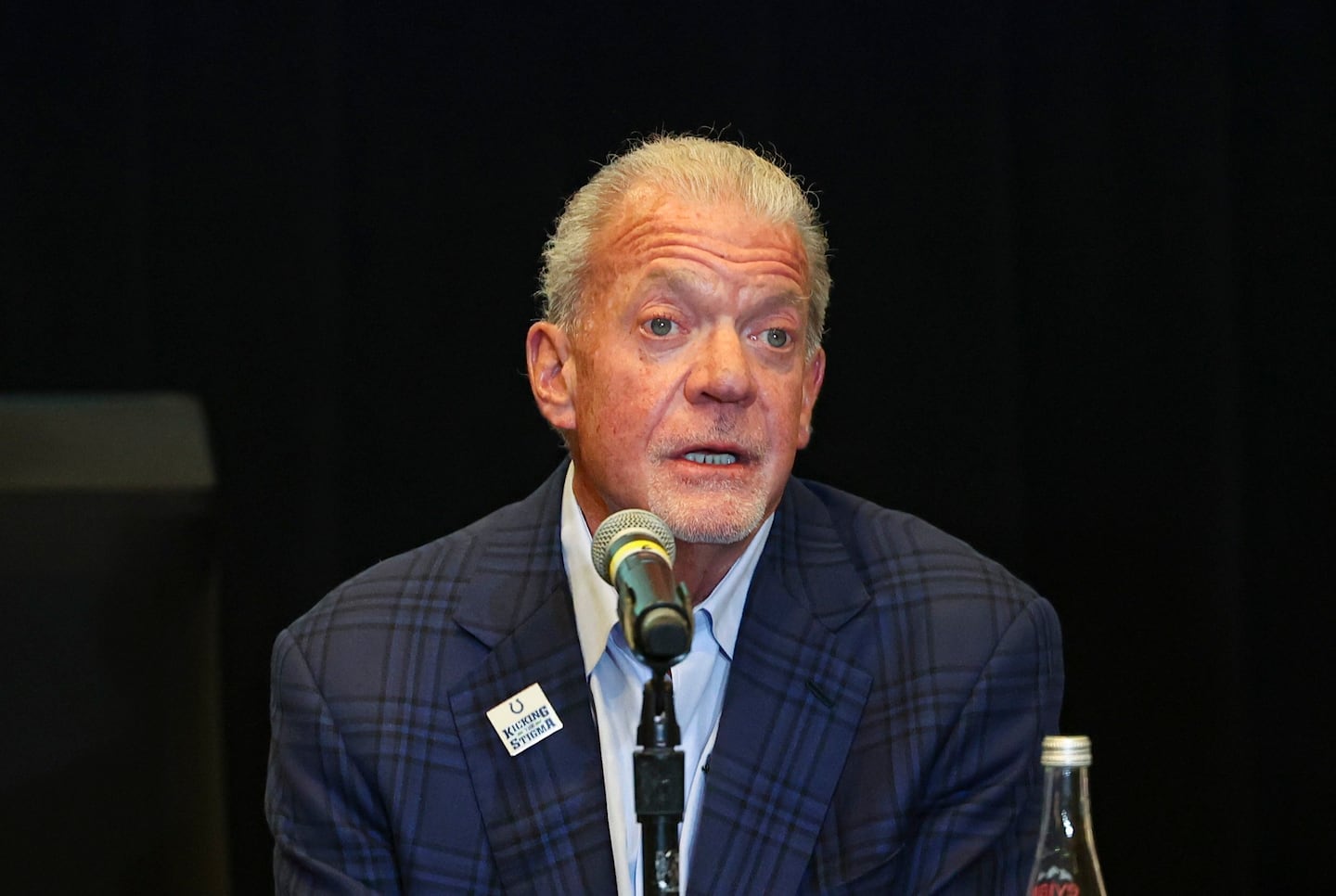

Jim Irsay 1957 2023 A Remembrance Of The Indianapolis Colts Owner

May 23, 2025

Jim Irsay 1957 2023 A Remembrance Of The Indianapolis Colts Owner

May 23, 2025 -

Geneva Open Novak Djokovic Reaches Semifinals On His Birthday

May 23, 2025

Geneva Open Novak Djokovic Reaches Semifinals On His Birthday

May 23, 2025 -

Game Of Thrones Kingsroad Review A Work In Progress

May 23, 2025

Game Of Thrones Kingsroad Review A Work In Progress

May 23, 2025 -

Exclusive Elle Fanning Confirmed For Hunger Games Sunrise On The Reaping

May 23, 2025

Exclusive Elle Fanning Confirmed For Hunger Games Sunrise On The Reaping

May 23, 2025 -

Bbc Announces New Adaptation Of The Scarecrows Wedding

May 23, 2025

Bbc Announces New Adaptation Of The Scarecrows Wedding

May 23, 2025

Latest Posts

-

Expect Delays Ica Issues June School Holiday Traffic Advisory For Woodlands And Tuas

May 23, 2025

Expect Delays Ica Issues June School Holiday Traffic Advisory For Woodlands And Tuas

May 23, 2025 -

Amazon Undercuts Google With Budget Friendly Echo Show Specs And Price Comparison

May 23, 2025

Amazon Undercuts Google With Budget Friendly Echo Show Specs And Price Comparison

May 23, 2025 -

150 000 Scratch Off Kentucky Couples Life Changing Lottery Win

May 23, 2025

150 000 Scratch Off Kentucky Couples Life Changing Lottery Win

May 23, 2025 -

Beyond Us Borders Kraken Enables Global Trading Of Apple Tesla And Nvidia Tokens

May 23, 2025

Beyond Us Borders Kraken Enables Global Trading Of Apple Tesla And Nvidia Tokens

May 23, 2025 -

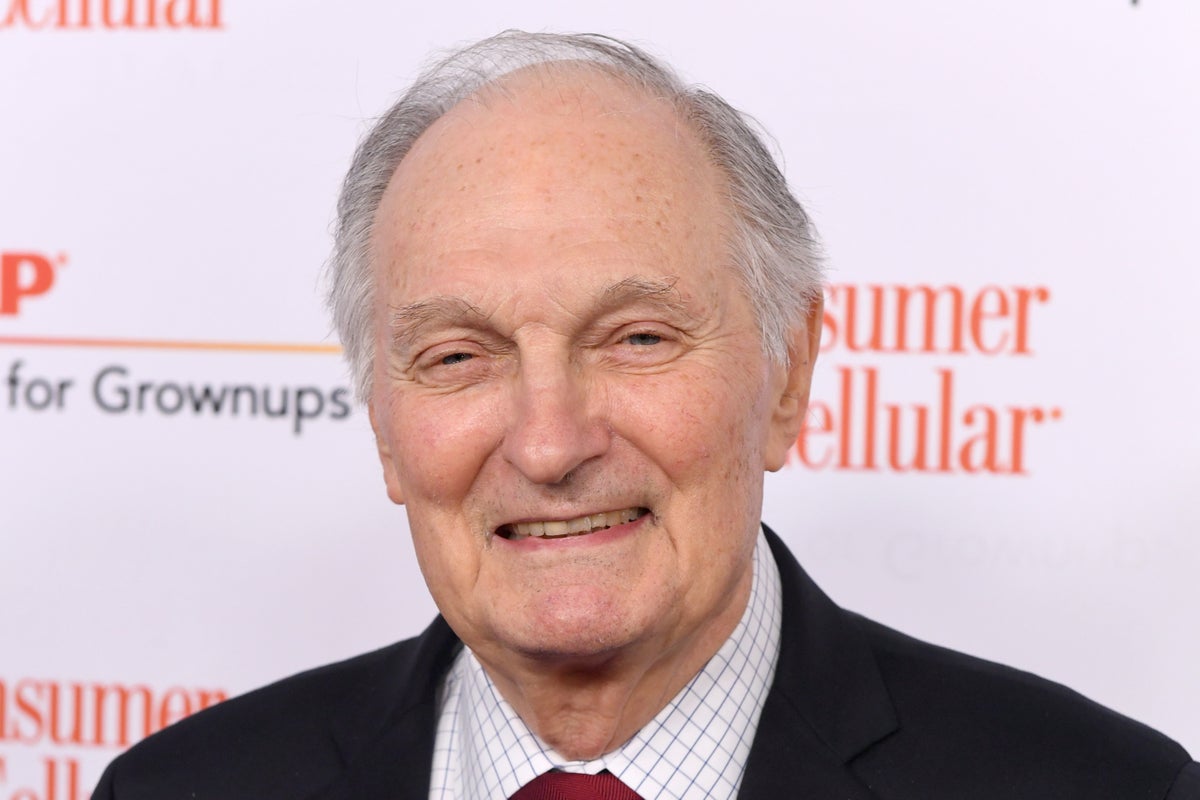

Actor Alan Alda Provides Health Update Following Parkinsons Diagnosis

May 23, 2025

Actor Alan Alda Provides Health Update Following Parkinsons Diagnosis

May 23, 2025