Last-Minute Tax Changes: IRS Announces Updates For 2024 Filing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Last-Minute Tax Changes: IRS Announces Updates for 2024 Filing

The IRS throws a curveball just before tax season! Significant changes impacting your 2024 tax return have been announced by the Internal Revenue Service, leaving many taxpayers scrambling to understand the implications. These eleventh-hour adjustments cover several key areas, potentially affecting your refund or tax liability. Don't get caught off guard – read on to understand these crucial updates and how they might impact your finances.

Key Changes Announced by the IRS for 2024 Tax Year:

The IRS recently unveiled several modifications to the tax code, effective immediately for the 2024 tax year. These changes, while seemingly minor on the surface, could have significant consequences for taxpayers. Here's a breakdown of the most important updates:

1. Adjusted Standard Deduction Increase

The standard deduction for the 2024 tax year has been increased. This means that many taxpayers will be able to deduct a larger amount from their gross income before calculating their taxable income. The exact figures for single, married filing jointly, and head-of-household filers are as follows:

- Single: Increased to $[Insert Updated Amount Here]

- Married Filing Jointly: Increased to $[Insert Updated Amount Here]

- Head of Household: Increased to $[Insert Updated Amount Here]

This adjustment could significantly impact low- to middle-income taxpayers, potentially resulting in lower tax bills or larger refunds. Remember to check the official IRS website for the most up-to-date figures.

2. Changes to Qualified Business Income (QBI) Deduction

The Qualified Business Income (QBI) deduction, designed to benefit small business owners, has seen some minor adjustments for 2024. These changes primarily involve clarifying certain aspects of the deduction's eligibility criteria and the calculation process. Specifically, the IRS has addressed ambiguities concerning the treatment of certain types of passive income and rental properties. Taxpayers claiming this deduction should carefully review the updated guidelines to ensure accurate reporting.

3. Updates to Tax Credits for Renewable Energy

Taxpayers investing in renewable energy technologies may also find changes affecting their eligibility for related tax credits. The IRS has announced modifications to the credit amounts and qualifying expenses for certain renewable energy sources. These updates could impact the overall value of these credits, making it crucial for those investing in solar panels, wind turbines, or other clean energy technologies to carefully consider the changes. Consult a tax professional for personalized advice.

4. New Reporting Requirements for Cryptocurrency Transactions

With the increasing popularity of cryptocurrency, the IRS has implemented stricter reporting requirements for transactions involving digital assets. For the 2024 tax year, taxpayers will be required to provide more detailed information regarding their cryptocurrency holdings and trading activities. Failure to comply with these new regulations can lead to significant penalties. Understanding these changes is essential to avoid costly mistakes.

What You Should Do Now:

These last-minute tax changes highlight the importance of staying informed throughout the year. Here's what you can do to prepare:

- Visit the official IRS website: The IRS website is the most reliable source for the latest information.

- Consult a tax professional: A qualified tax advisor can provide personalized guidance based on your specific circumstances.

- Keep meticulous records: Accurate record-keeping is vital for accurate tax filing.

- Stay updated: Subscribe to IRS newsletters and follow reputable financial news sources for timely updates.

The changes announced by the IRS underscore the need for vigilance and careful planning. By staying informed and taking proactive steps, you can navigate these updates effectively and ensure accurate tax filing for the 2024 tax year. Remember, seeking professional advice is always recommended when dealing with complex tax matters. Don't delay – prepare yourself for tax season now!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Last-Minute Tax Changes: IRS Announces Updates For 2024 Filing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

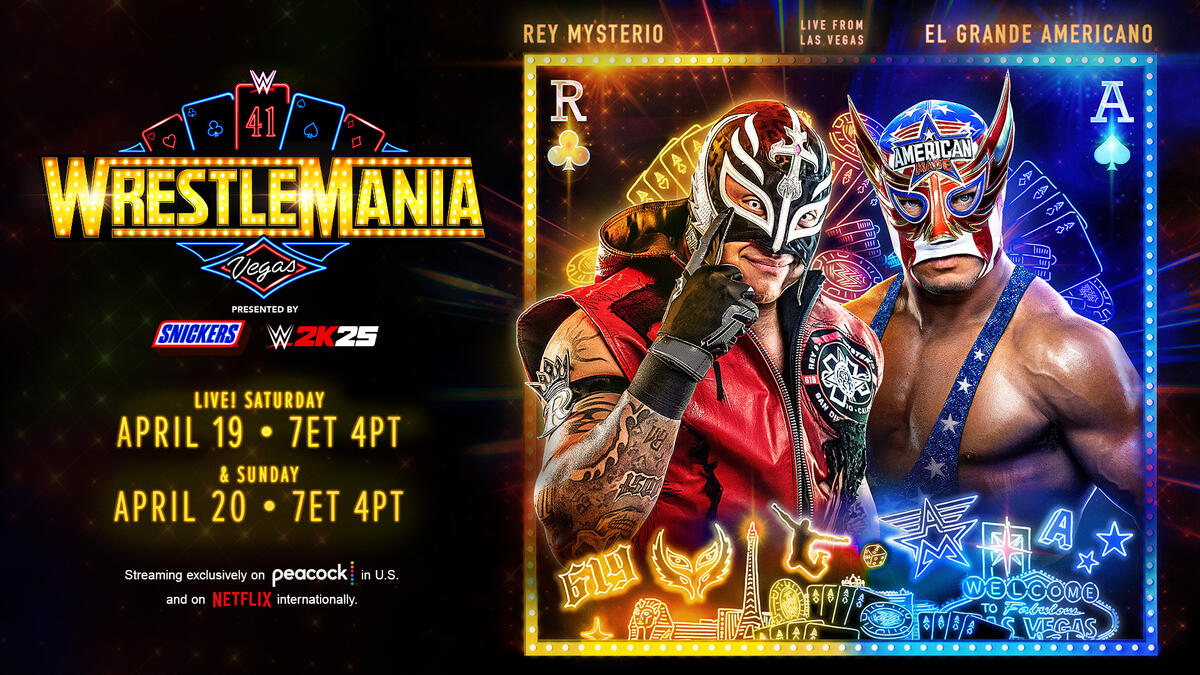

High Flying Action Rey Mysterio Takes On El Grande Americano

Apr 08, 2025

High Flying Action Rey Mysterio Takes On El Grande Americano

Apr 08, 2025 -

Todays Market Sse Composite Index Down 6 06 Expert Commentary

Apr 08, 2025

Todays Market Sse Composite Index Down 6 06 Expert Commentary

Apr 08, 2025 -

Kevin Owens Out Of Wrestle Mania 41 After Confirming Neck Surgery

Apr 08, 2025

Kevin Owens Out Of Wrestle Mania 41 After Confirming Neck Surgery

Apr 08, 2025 -

The Rachel Reeves Effect Examining The Uk Exodus To Italy

Apr 08, 2025

The Rachel Reeves Effect Examining The Uk Exodus To Italy

Apr 08, 2025 -

Space Xs Super Heavy Booster 14 A Second Chance For Flight 9

Apr 08, 2025

Space Xs Super Heavy Booster 14 A Second Chance For Flight 9

Apr 08, 2025