Lloyds, Halifax, Nationwide Outage Investigation: Is Legacy Technology To Blame?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>Lloyds, Halifax, Nationwide Outage Investigation: Is Legacy Technology to Blame?</h1>

Millions of customers across the UK faced banking disruption on [Date of Outage] as major lenders Lloyds Bank, Halifax, and Nationwide experienced significant outages. The widespread failure sparked immediate outrage and raised serious questions about the resilience of the UK's banking infrastructure, with many pointing fingers at outdated technology. Is legacy technology truly the culprit behind this widespread banking meltdown? Our investigation delves into the potential causes and the urgent need for modernization.

<h2>A Day of Banking Chaos</h2>

The outage, which lasted for [Duration of Outage], left customers unable to access online banking, mobile apps, and even in some cases, ATMs. Reports flooded social media platforms, with frustrated customers expressing concerns about missed payments, inability to access funds, and general disruption to their daily lives. The sheer scale of the disruption highlighted the vulnerability of the UK's financial system to widespread technological failures. The impact extended beyond individual inconvenience, affecting businesses relying on electronic transactions and highlighting potential systemic risks.

<h2>The Legacy Technology Suspicion</h2>

While official statements from the banks are still pending a full investigation, many experts suspect that outdated legacy systems are at least partially responsible for the widespread outage. These aging systems, often built on technologies decades old, are notoriously difficult to maintain, update, and integrate with newer, more robust technologies. Their complexity increases the risk of cascading failures, where a single point of failure can trigger a domino effect impacting the entire system.

<h3>The Challenges of Legacy Systems:</h3>

- Maintenance Costs: Maintaining legacy systems is expensive, often requiring specialized skills and knowledge that are increasingly difficult to find.

- Security Vulnerabilities: Older systems are often more vulnerable to cyberattacks and security breaches due to outdated security protocols.

- Scalability Issues: Legacy systems may struggle to cope with surges in demand, leading to outages during peak usage periods.

- Integration Difficulties: Integrating legacy systems with newer technologies can be complex and costly, hindering innovation and modernization efforts.

<h2>The Urgent Need for Modernization</h2>

This outage serves as a stark reminder of the urgent need for modernization within the UK banking sector. Banks must invest in robust, scalable, and secure technology infrastructure to prevent future disruptions. This includes:

- Cloud Migration: Moving critical banking systems to the cloud can enhance scalability, resilience, and security.

- Microservices Architecture: Breaking down monolithic systems into smaller, independent microservices can improve fault tolerance and reduce the impact of individual failures.

- Enhanced Cybersecurity Measures: Investing in advanced security protocols and threat detection systems is crucial to protect against cyberattacks.

- Regular System Testing and Disaster Recovery Planning: Rigorous testing and robust disaster recovery plans are essential to ensure business continuity in the event of an outage.

<h2>What Happens Next?</h2>

The investigation into the cause of the outage is ongoing. Expect official statements from Lloyds, Halifax, and Nationwide in the coming days and weeks, outlining the root cause of the failure and the steps being taken to prevent future occurrences. The Financial Conduct Authority (FCA) is also likely to scrutinize the events, potentially leading to regulatory action. This incident highlights a broader issue facing many industries – the challenge of balancing legacy systems with the demands of a modern digital world. The future of banking, and indeed many other sectors, depends on embracing modernization and prioritizing the resilience of critical infrastructure.

Keywords: Lloyds outage, Halifax outage, Nationwide outage, banking outage, UK banking, legacy technology, system failure, cybersecurity, cloud migration, microservices, financial technology, FCA, tech modernization.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lloyds, Halifax, Nationwide Outage Investigation: Is Legacy Technology To Blame?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hands On With Lenovo Tiko A Smaller Smarter Ai Companion Than You D Expect

Mar 04, 2025

Hands On With Lenovo Tiko A Smaller Smarter Ai Companion Than You D Expect

Mar 04, 2025 -

Greg Abel O Sucessor Escolhido Por Buffett Quem Toma As Decisoes De Investimento

Mar 04, 2025

Greg Abel O Sucessor Escolhido Por Buffett Quem Toma As Decisoes De Investimento

Mar 04, 2025 -

Were Stonehenges Three Ton Stones Recycled From Prehistoric Monuments New Research Suggests Yes

Mar 04, 2025

Were Stonehenges Three Ton Stones Recycled From Prehistoric Monuments New Research Suggests Yes

Mar 04, 2025 -

Altcoin Price Predictions 3 Coins Poised For Growth In March

Mar 04, 2025

Altcoin Price Predictions 3 Coins Poised For Growth In March

Mar 04, 2025 -

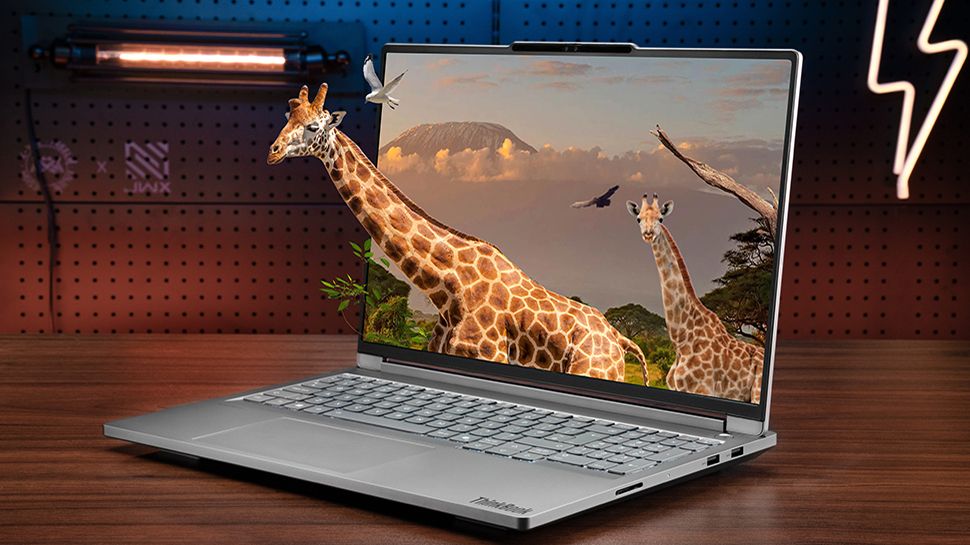

Lenovo Think Book 3 D Review Gorgeous Design But Can It Compete

Mar 04, 2025

Lenovo Think Book 3 D Review Gorgeous Design But Can It Compete

Mar 04, 2025