Lloyds, Halifax, Nationwide UK: Outdated Online Banking Fuels Widespread Outages

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lloyds, Halifax, Nationwide UK: Outdated Online Banking Fuels Widespread Outages

Frustration boils over as millions face banking disruption due to legacy systems.

Millions of UK customers across Lloyds Banking Group (including Lloyds Bank and Halifax) and Nationwide Building Society faced widespread online banking outages this week, sparking outrage and highlighting the urgent need for modernization of legacy IT systems within the financial sector. The outages, lasting several hours for many, left customers unable to access their accounts, make payments, or check balances, causing significant disruption to personal finances and businesses alike.

While the banks have offered apologies and attributed the problems to "technical issues," sources suggest the root cause lies in outdated online banking infrastructure. These legacy systems, built decades ago, struggle to cope with the demands of modern, high-volume online transactions, leaving them vulnerable to cascading failures.

The Fallout:

The outages caused a ripple effect, leading to:

- Widespread customer anger: Social media platforms erupted with complaints, with users expressing frustration over the lack of communication and the inconvenience caused. Many reported difficulties contacting customer service, adding to the overall negative experience.

- Business disruption: Businesses relying on online banking for transactions experienced significant delays and potential financial losses. The timing of the outages, during a busy period for many, exacerbated the impact.

- Reputational damage: The outages have undoubtedly damaged the reputation of the affected banks, raising questions about their investment in IT infrastructure and commitment to customer service.

Outdated Technology: A Ticking Time Bomb?

The incidents underscore a growing concern across the financial sector: the reliance on outdated technology. Many banks are still operating on systems that are decades old, making them vulnerable to outages, security breaches, and a lack of scalability to meet the demands of a digital age. This reliance on legacy systems represents a significant risk, not only to customer experience but also to financial stability.

The Need for Modernization:

Experts are calling for urgent investment in modernizing banking infrastructure. This includes:

- Cloud migration: Moving systems to the cloud can offer increased scalability, resilience, and security.

- Microservices architecture: Breaking down monolithic systems into smaller, independent services can improve resilience and allow for easier upgrades and maintenance.

- Increased investment in cybersecurity: Outdated systems are often more vulnerable to cyberattacks, necessitating significant investment in security measures.

Looking Ahead:

While the affected banks have pledged to investigate the cause of the outages and implement improvements, the incidents serve as a stark warning. The financial sector must prioritize modernization to ensure the resilience and stability of its online services. The cost of inaction is far greater than the cost of upgrading aging infrastructure. Customers deserve a reliable and secure online banking experience, and this requires a fundamental shift in how banks approach their IT investments. The future of banking depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lloyds, Halifax, Nationwide UK: Outdated Online Banking Fuels Widespread Outages. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

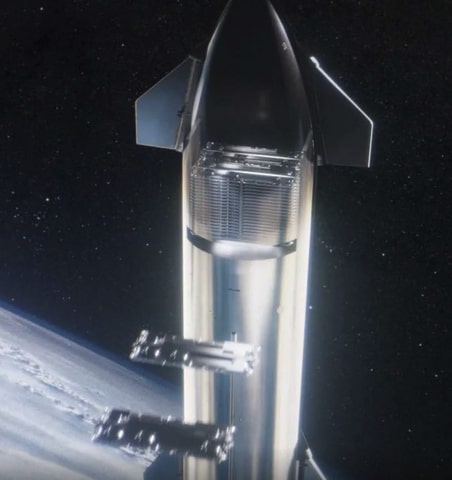

60 Days To Space X History Starship Orbital Mission And Starlink Satellite Network Growth

Mar 04, 2025

60 Days To Space X History Starship Orbital Mission And Starlink Satellite Network Growth

Mar 04, 2025 -

Unlock I Phone Screen Times Full Potential A Guide To Better Usage

Mar 04, 2025

Unlock I Phone Screen Times Full Potential A Guide To Better Usage

Mar 04, 2025 -

5 Million And Counting Space X Starlinks Growth V3 Satellites And Starship Reusability Roadmap

Mar 04, 2025

5 Million And Counting Space X Starlinks Growth V3 Satellites And Starship Reusability Roadmap

Mar 04, 2025 -

Space X Starships 60 Day Orbital Flight Target Implications For Starlink

Mar 04, 2025

Space X Starships 60 Day Orbital Flight Target Implications For Starlink

Mar 04, 2025 -

Weighing In At Under 2 Lbs Lenovo Launches Its Lightest Amd Ryzen Ai Laptop

Mar 04, 2025

Weighing In At Under 2 Lbs Lenovo Launches Its Lightest Amd Ryzen Ai Laptop

Mar 04, 2025