Long-Term Outlook For Amazon Stock: Investment Analysis And Predictions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Long-Term Outlook for Amazon Stock: Investment Analysis and Predictions

Amazon. The name conjures images of instant gratification, next-day delivery, and a seemingly unstoppable tech behemoth. But what does the future hold for this e-commerce giant, and is now the right time to invest? This in-depth analysis delves into the long-term outlook for Amazon stock (AMZN), exploring key factors influencing its potential and offering informed predictions.

Amazon's Dominance: A Multifaceted Empire

Amazon's success isn't solely reliant on online retail. Its sprawling empire encompasses cloud computing (AWS), digital streaming (Prime Video), advertising, and even grocery stores (Whole Foods). This diversification significantly reduces reliance on any single sector, enhancing its long-term resilience.

- AWS: The Cash Cow: Amazon Web Services consistently delivers robust profits, providing a crucial financial bedrock for the entire company. Its market leadership in cloud computing assures a steady stream of revenue for years to come.

- E-commerce Evolution: While facing increased competition, Amazon's scale and logistics network provide a significant competitive advantage in online retail. Continued innovation in areas like same-day delivery and personalized shopping experiences will be vital for maintaining market share.

- Expanding Beyond Retail: Amazon's strategic investments in areas like advertising, healthcare (Amazon Pharmacy), and smart home devices (Alexa) demonstrate a commitment to long-term growth beyond its core e-commerce business. This diversification mitigates risk and creates new avenues for profit.

Challenges and Risks: Navigating the Future

Despite its impressive track record, Amazon faces considerable challenges:

- Increased Competition: Fierce competition from established players and agile startups in various sectors necessitates constant innovation and adaptation. Maintaining its market leadership requires substantial investment in research and development.

- Regulatory Scrutiny: Antitrust concerns and ongoing investigations into Amazon's business practices pose a potential threat, potentially leading to regulatory changes that could impact its profitability.

- Economic Headwinds: Global economic uncertainty, inflation, and potential recessions can significantly affect consumer spending, impacting Amazon's sales and profitability.

Investment Analysis and Predictions:

Predicting the future of any stock is inherently speculative, but considering Amazon's current position and future potential, a long-term bullish outlook seems reasonable. However, investors should proceed with caution.

Factors Suggesting Long-Term Growth:

- Strong Brand Recognition and Loyalty: Amazon enjoys unparalleled brand recognition and customer loyalty, a crucial asset for sustained growth.

- Technological Innovation: Continuous investment in research and development positions Amazon to capitalize on emerging technologies and trends.

- Global Expansion Potential: Further expansion into international markets offers substantial growth opportunities.

Factors Suggesting Cautious Optimism:

- Market Volatility: The stock market is inherently volatile, and Amazon is no exception. Investors should be prepared for fluctuations in stock price.

- Competition and Disruption: The competitive landscape is dynamic, and new technologies or business models could disrupt Amazon's dominance.

- Economic Uncertainty: Macroeconomic factors can significantly influence Amazon's performance.

Conclusion:

Amazon's long-term outlook appears positive, driven by its diverse business model, strong brand recognition, and ongoing commitment to innovation. However, investors should remain mindful of the challenges and risks. A diversified investment portfolio, coupled with a long-term perspective, is advisable for those considering investing in Amazon stock. Consult with a financial advisor before making any investment decisions. The information provided here is for educational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Long-Term Outlook For Amazon Stock: Investment Analysis And Predictions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Livestock Import Ban Southern Border Closure In Response To Invasive Fly Threat

May 12, 2025

Us Livestock Import Ban Southern Border Closure In Response To Invasive Fly Threat

May 12, 2025 -

Malawi Mourns Death Of Singaporean Cricket Coach Arjun Menon

May 12, 2025

Malawi Mourns Death Of Singaporean Cricket Coach Arjun Menon

May 12, 2025 -

Ai Agent Browses And Fills Web Forms No Mouse Required

May 12, 2025

Ai Agent Browses And Fills Web Forms No Mouse Required

May 12, 2025 -

Teslas Robotaxi Scaling Plan Millions Of Vehicles In The Next Year

May 12, 2025

Teslas Robotaxi Scaling Plan Millions Of Vehicles In The Next Year

May 12, 2025 -

Pacers Dominate Game 4 Cavaliers Lose Mitchell To Ankle Injury

May 12, 2025

Pacers Dominate Game 4 Cavaliers Lose Mitchell To Ankle Injury

May 12, 2025

Latest Posts

-

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

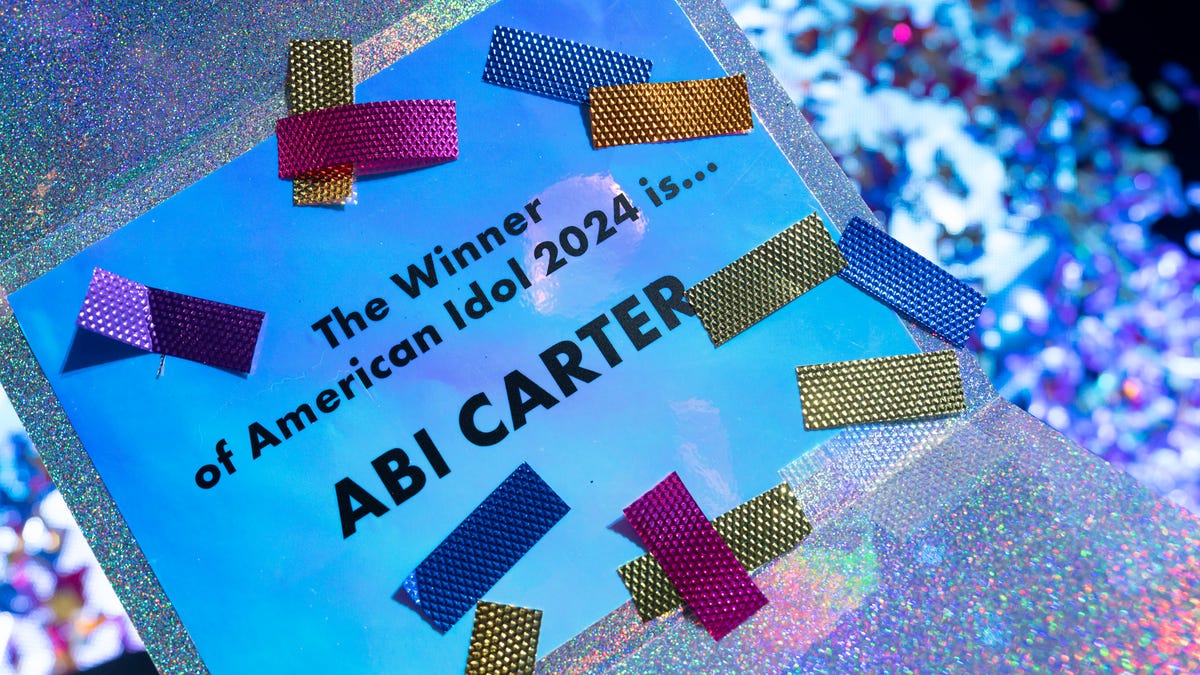

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025 -

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025