Losing Confidence In The Dollar? US Investors Turn To Crypto

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Losing Confidence in the Dollar? US Investors Turn to Crypto

The US dollar's reign as the world's reserve currency is facing increasing scrutiny, prompting a significant shift in investment strategies among American investors. As inflation remains stubbornly high and geopolitical uncertainties mount, many are turning to cryptocurrencies as a hedge against potential dollar devaluation and economic instability. This flight to digital assets signals a growing distrust in traditional financial systems and a search for alternative stores of value.

The Dollar's Uncertain Future: Inflation and Geopolitical Risks

The US dollar has long enjoyed a dominant position in the global financial system. However, recent economic headwinds are eroding this confidence. Persistent inflation, fueled by factors such as supply chain disruptions and increased energy prices, is eroding the purchasing power of the dollar. Simultaneously, escalating geopolitical tensions, particularly the ongoing war in Ukraine, further contribute to economic uncertainty and investor anxiety. These factors are pushing investors to explore alternative asset classes perceived as less vulnerable to these risks.

Cryptocurrency: A Safe Haven or a Risky Gamble?

Cryptocurrencies, such as Bitcoin and Ethereum, are increasingly viewed as a potential hedge against inflation and dollar devaluation. Their decentralized nature and limited supply are attractive features for investors seeking to protect their wealth from potential currency fluctuations. Furthermore, the growing adoption of crypto by institutional investors adds to its perceived legitimacy and stability.

However, the cryptocurrency market is notoriously volatile. The value of cryptocurrencies can fluctuate dramatically in short periods, making them a risky investment for those with low risk tolerance. Regulatory uncertainty further complicates the landscape, with governments worldwide grappling with how to regulate this rapidly evolving asset class.

Why US Investors Are Choosing Crypto:

Several key factors are driving the influx of US investors into the cryptocurrency market:

- Inflation Hedge: Cryptocurrencies are often touted as an inflation hedge due to their limited supply. As the dollar's purchasing power declines, investors seek assets that retain or increase their value.

- Decentralization: Unlike traditional financial systems, cryptocurrencies are not controlled by central banks or governments, offering a degree of independence from potential political or economic instability.

- Technological Advancement: The underlying blockchain technology behind cryptocurrencies is seen as innovative and disruptive, attracting investors interested in the future of finance.

- Diversification: Many investors see crypto as a way to diversify their portfolios and reduce their reliance on traditional assets.

The Risks Remain Significant:

While the allure of cryptocurrencies is undeniable, it's crucial to acknowledge the significant risks involved:

- Volatility: The cryptocurrency market is notoriously volatile, with prices subject to sharp and unpredictable swings.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, creating uncertainty for investors.

- Security Risks: Cryptocurrencies are susceptible to hacking and theft, requiring robust security measures.

- Lack of Consumer Protection: Unlike traditional investments, cryptocurrency investments often lack the same level of consumer protection.

The Future of Crypto and the Dollar:

The increasing adoption of cryptocurrencies by US investors reflects a broader shift in investor sentiment. While the long-term implications remain uncertain, the trend is clear: the dominance of the US dollar is being challenged, and cryptocurrencies are playing an increasingly significant role in the global financial landscape. Investors must carefully weigh the potential rewards against the inherent risks before venturing into this volatile yet potentially lucrative asset class. Further research and professional financial advice are strongly recommended before making any investment decisions. The information provided here is for educational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Losing Confidence In The Dollar? US Investors Turn To Crypto. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ais Role In The Future Of Guide Dog Training And Selection

Apr 29, 2025

Ais Role In The Future Of Guide Dog Training And Selection

Apr 29, 2025 -

All Wordle Answers A Comprehensive List Date And Alphabetical Order

Apr 29, 2025

All Wordle Answers A Comprehensive List Date And Alphabetical Order

Apr 29, 2025 -

Afc Champions League Semi Finals Preview Five Things To Watch In Jeddah

Apr 29, 2025

Afc Champions League Semi Finals Preview Five Things To Watch In Jeddah

Apr 29, 2025 -

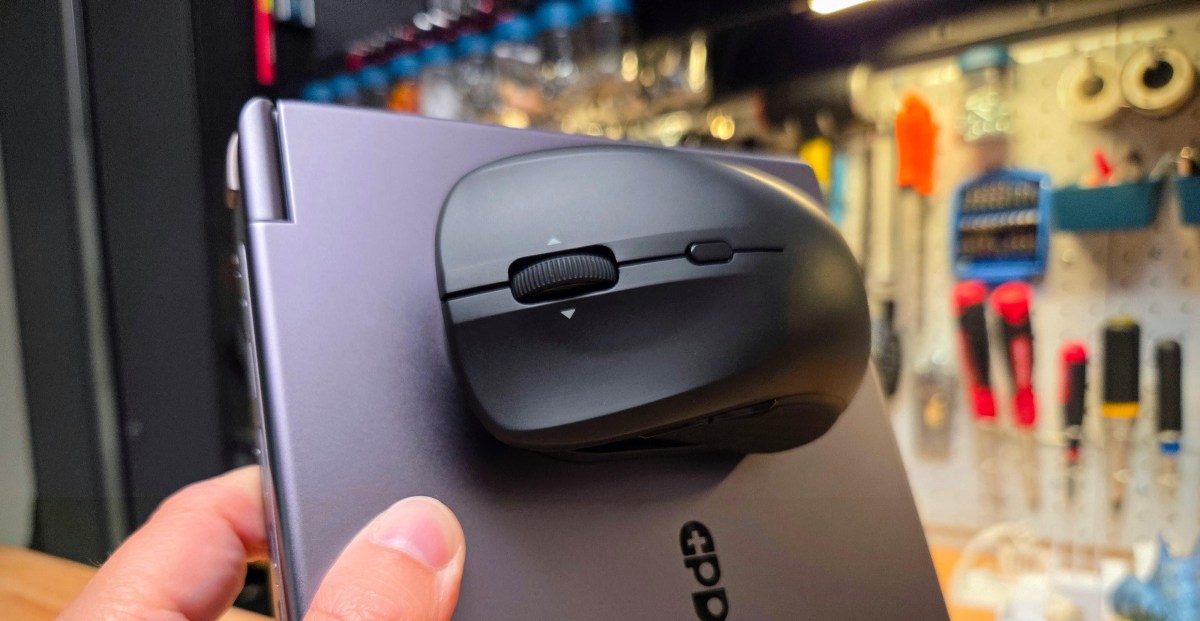

My Experience With A Magnetic Mouse And Its Unique Folding Usb C Cable

Apr 29, 2025

My Experience With A Magnetic Mouse And Its Unique Folding Usb C Cable

Apr 29, 2025 -

Preventing Gpu Sag The Asus Rog Astral Detector And Its Impact

Apr 29, 2025

Preventing Gpu Sag The Asus Rog Astral Detector And Its Impact

Apr 29, 2025

Latest Posts

-

Arsenal Manager Warns Of Psg Danger Ahead Of Crucial Emirates Match

Apr 30, 2025

Arsenal Manager Warns Of Psg Danger Ahead Of Crucial Emirates Match

Apr 30, 2025 -

Ligue Des Champions Arsenal Vs Psg Compositions Officielles Avec Doue Et Dembele

Apr 30, 2025

Ligue Des Champions Arsenal Vs Psg Compositions Officielles Avec Doue Et Dembele

Apr 30, 2025 -

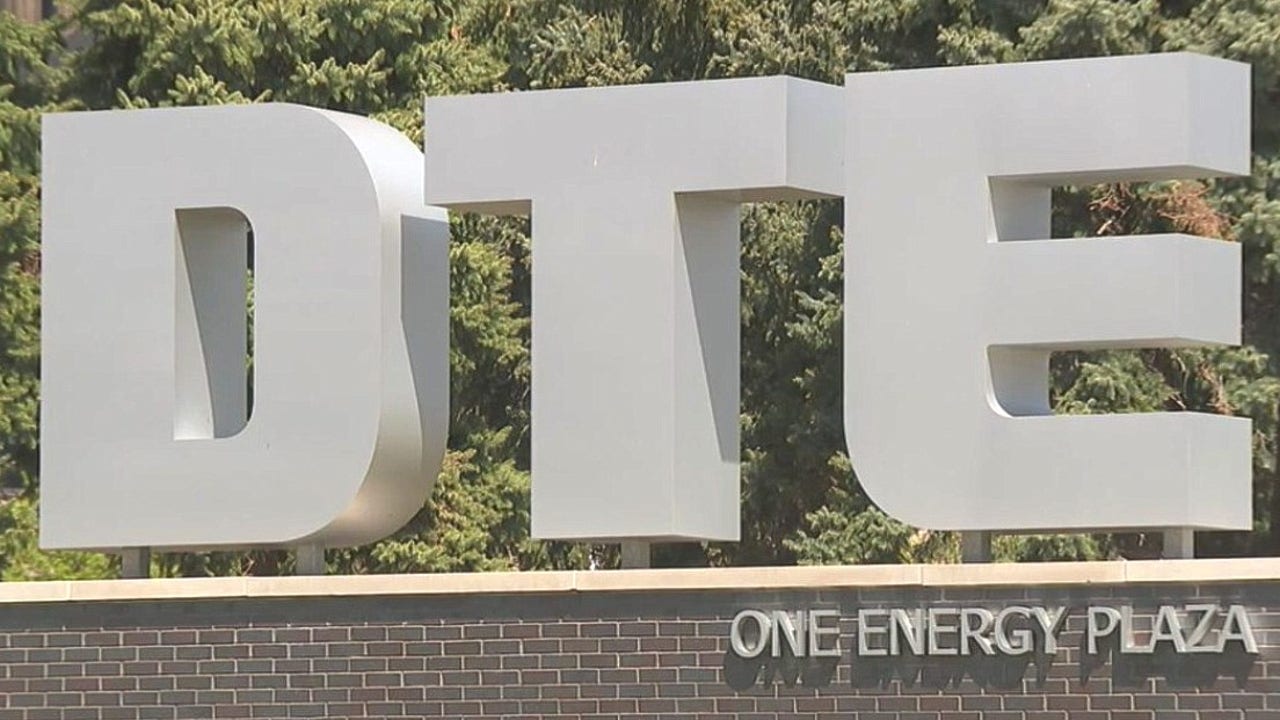

Dte Energy Proposes 574 Million Rate Hike For Michigan Customers

Apr 30, 2025

Dte Energy Proposes 574 Million Rate Hike For Michigan Customers

Apr 30, 2025 -

Ligue Des Champions Le Psg Et Arsenal S Affrontent A Londres

Apr 30, 2025

Ligue Des Champions Le Psg Et Arsenal S Affrontent A Londres

Apr 30, 2025 -

Data Breach Alert Medical Software Companys Database Compromised Exposing Patient Data

Apr 30, 2025

Data Breach Alert Medical Software Companys Database Compromised Exposing Patient Data

Apr 30, 2025