Losing Faith In The Dollar? US Investors Turn To Crypto For Stability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Losing Faith in the Dollar? US Investors Turn to Crypto for Stability

The US dollar's dominance in global finance is facing an unprecedented challenge. Inflation remains stubbornly high, eroding purchasing power and prompting a growing number of US investors to seek alternative assets for stability and potentially higher returns. Enter cryptocurrency, a volatile yet increasingly popular haven for those questioning the dollar's long-term strength.

This shift isn't driven solely by inflation. Concerns about geopolitical instability, rising interest rates, and the potential for further economic downturn are all contributing factors pushing investors towards the decentralized and arguably less susceptible world of crypto.

The Allure of Crypto Amidst Dollar Uncertainty

Several key factors explain the growing interest in cryptocurrency as a hedge against dollar devaluation:

-

Hedge Against Inflation: Cryptocurrencies like Bitcoin, often touted as "digital gold," are seen by some as a hedge against inflation. Their limited supply contrasts sharply with the potential for increased money supply leading to inflation in fiat currencies.

-

Decentralization: Unlike traditional financial systems, cryptocurrencies operate on decentralized networks, reducing reliance on central banks and government policies. This perceived independence is a significant draw for investors wary of centralized control.

-

Potential for Higher Returns: While notoriously volatile, the potential for significant returns in the crypto market attracts risk-tolerant investors seeking higher returns than traditional investments currently offer.

-

Global Accessibility: Crypto transcends geographical boundaries, offering accessibility to investors worldwide regardless of their location or banking restrictions.

Is Crypto Truly a Stable Alternative?

While the allure of crypto as a safe haven is understandable, it's crucial to acknowledge the inherent risks. The cryptocurrency market is notoriously volatile, subject to dramatic price swings driven by market sentiment, regulatory changes, and technological developments. This volatility can lead to substantial losses for investors.

Diversification: A Key Strategy

Experts caution against abandoning the dollar entirely in favor of crypto. Instead, diversification is often suggested as a more prudent strategy. Allocating a small portion of a portfolio to cryptocurrencies as a means of diversification can help mitigate risk. However, this allocation should reflect individual risk tolerance and financial goals.

Regulatory Landscape and Future Outlook

The regulatory landscape for cryptocurrencies is still evolving, posing both challenges and opportunities. Increased regulatory clarity could lead to greater institutional adoption and increased stability, but conversely, overly restrictive regulations could stifle growth. The long-term outlook for crypto's role in the global financial system remains uncertain, but its growing adoption by US investors is undeniable.

Conclusion: A Calculated Risk

The move by US investors towards cryptocurrency reflects a growing concern about the dollar's stability and the limitations of traditional investment vehicles. While crypto presents exciting opportunities, it's crucial to approach it with caution, understanding the inherent volatility and the need for thorough research and diversification. The future of finance may indeed incorporate a larger role for crypto, but for now, it remains a calculated risk for those seeking alternatives to the traditional financial system. Investors should seek professional financial advice before making any major investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Losing Faith In The Dollar? US Investors Turn To Crypto For Stability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

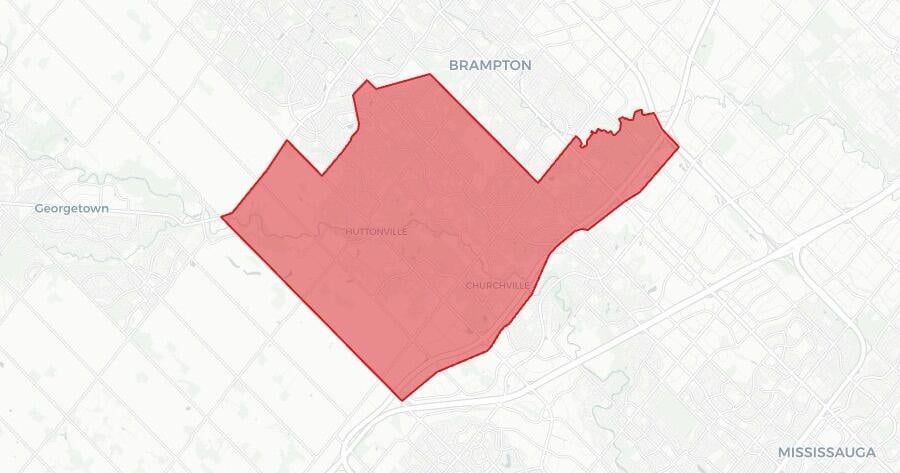

Federal Election Results Brampton South Constituency Breakdown And Analysis

Apr 30, 2025

Federal Election Results Brampton South Constituency Breakdown And Analysis

Apr 30, 2025 -

The Smashing Machine Trailer Johnsons Dramatic Turn Sparks Oscar Speculation

Apr 30, 2025

The Smashing Machine Trailer Johnsons Dramatic Turn Sparks Oscar Speculation

Apr 30, 2025 -

A24s The Smashing Machine Benny Safdie Directs Dwayne Johnson Biopic

Apr 30, 2025

A24s The Smashing Machine Benny Safdie Directs Dwayne Johnson Biopic

Apr 30, 2025 -

Gabriel Martinelli Open To Arsenal Competition A Fight For First Team Place

Apr 30, 2025

Gabriel Martinelli Open To Arsenal Competition A Fight For First Team Place

Apr 30, 2025 -

Singapore Politics Wps Stance On Potential Ministerial Loss Draws Sharp Rebuke From Pm Wong

Apr 30, 2025

Singapore Politics Wps Stance On Potential Ministerial Loss Draws Sharp Rebuke From Pm Wong

Apr 30, 2025

Latest Posts

-

Animoca Brands Coinbase And Fabric Ventures Fuel Uks Expanding Web3 Ecosystem

Apr 30, 2025

Animoca Brands Coinbase And Fabric Ventures Fuel Uks Expanding Web3 Ecosystem

Apr 30, 2025 -

Leeds United H Match Pack Form Team News And Potential Lineups

Apr 30, 2025

Leeds United H Match Pack Form Team News And Potential Lineups

Apr 30, 2025 -

Canadian Hockey Player Matt Petgrave Exonerated In Adam Johnson Death Case

Apr 30, 2025

Canadian Hockey Player Matt Petgrave Exonerated In Adam Johnson Death Case

Apr 30, 2025 -

Pace Students Research Viola Da Terra In The Azores Islands

Apr 30, 2025

Pace Students Research Viola Da Terra In The Azores Islands

Apr 30, 2025 -

Dramatic Conclusion Higgins Claims Victory After Intense Battle

Apr 30, 2025

Dramatic Conclusion Higgins Claims Victory After Intense Battle

Apr 30, 2025