Lutnick Deal: Parliamentary Approval The Final Hurdle

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

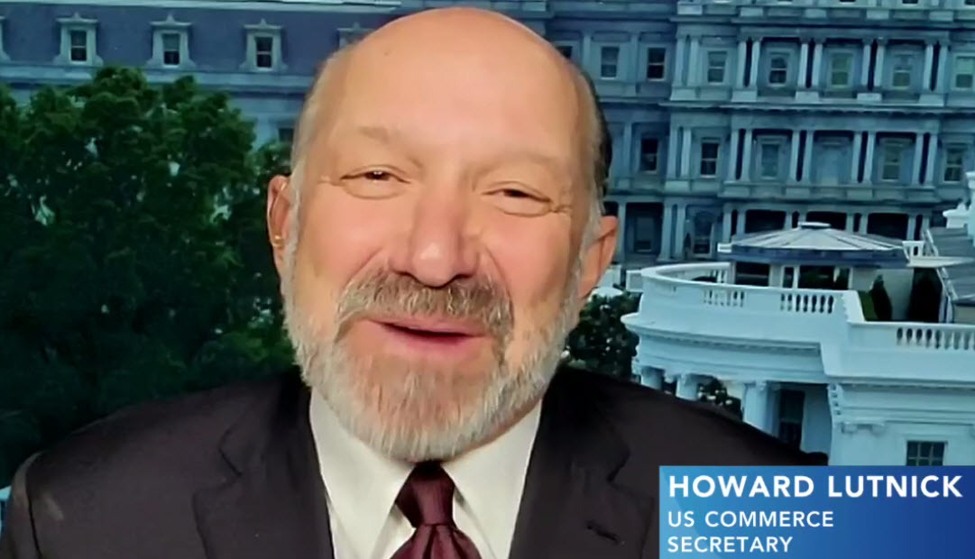

Lutnick Deal: Parliamentary Approval the Final Hurdle for Landmark Financial Restructuring

The proposed Lutnick deal, a landmark financial restructuring plan impacting thousands of investors and potentially reshaping the landscape of [mention specific sector, e.g., the global derivatives market], is on the cusp of finalization. Pending parliamentary approval, the deal, brokered by [mention broker/firm involved if known], could be implemented within weeks, marking a significant turning point in a protracted legal battle.

This complex restructuring, aimed at resolving the financial fallout from [mention the event that caused the financial crisis, e.g., the 2022 market crash], has been met with both fervent support and fierce opposition. While proponents argue the deal offers the best possible outcome for creditors, critics raise concerns about potential loopholes and the long-term implications for market stability.

What's at Stake?

The Lutnick deal involves [briefly explain the key components of the deal, e.g., a complex debt-for-equity swap, asset sales, and a restructuring of the company's debt obligations]. The success of the deal hinges on parliamentary approval, which is expected to be debated in the coming days. The stakes are high: failure could lead to [explain potential consequences of failure, e.g., liquidation of assets, significant losses for investors, and further market instability].

Arguments For and Against Parliamentary Approval

Proponents of the Lutnick deal argue that it offers the most viable path towards recovery, preventing a more catastrophic collapse and minimizing losses for all stakeholders. They highlight the deal's provisions for [mention positive aspects of the deal, e.g., a phased repayment plan for creditors, job preservation, and the continuation of essential services].

Opponents, however, express concerns about [mention concerns raised by opponents, e.g., insufficient protection for smaller investors, lack of transparency in the deal's negotiation, and the potential for future financial risks]. They are calling for a more thorough review process and greater scrutiny of the deal's details before parliamentary approval is granted.

The Parliamentary Process and Potential Outcomes

The parliamentary debate surrounding the Lutnick deal is expected to be intense and highly scrutinized. Lawmakers will carefully examine the deal's implications, considering arguments from both sides and assessing potential risks and rewards. The process could involve [mention specific parliamentary procedures, e.g., committee hearings, public consultations, and floor debates].

Three primary outcomes are possible:

-

Full Parliamentary Approval: This would pave the way for the immediate implementation of the Lutnick deal, potentially stabilizing the market and offering a degree of closure for investors and creditors.

-

Rejection of the Deal: Rejection would likely lead to further uncertainty and potential legal battles, potentially resulting in a far more unfavorable outcome for all parties involved.

-

Amendments and Revised Deal: Parliament may suggest amendments to the existing deal, necessitating further negotiations and potentially delaying implementation.

The Road Ahead

The coming weeks will be crucial in determining the future of this significant financial restructuring. The parliamentary process will be closely watched by investors, market analysts, and regulators alike. The ultimate outcome will have far-reaching consequences, impacting not only the immediate parties involved but potentially reshaping the regulatory landscape and investor confidence in [mention relevant sector] for years to come. The resolution of the Lutnick deal will serve as a critical case study in financial crisis management and regulatory oversight.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lutnick Deal: Parliamentary Approval The Final Hurdle. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Greves No Setor Publico Um Relatorio Sobre O Custo Para Empresas E Industrias

Apr 30, 2025

Greves No Setor Publico Um Relatorio Sobre O Custo Para Empresas E Industrias

Apr 30, 2025 -

What Trumps Auto Tariff Relief Means For Consumers And The Economy

Apr 30, 2025

What Trumps Auto Tariff Relief Means For Consumers And The Economy

Apr 30, 2025 -

Smashing Machine Trailer Dwayne The Rock Johnsons Ufc Fight Revealed

Apr 30, 2025

Smashing Machine Trailer Dwayne The Rock Johnsons Ufc Fight Revealed

Apr 30, 2025 -

Your Guide To Selecting A Pap Team For East Coast Grc Compliance

Apr 30, 2025

Your Guide To Selecting A Pap Team For East Coast Grc Compliance

Apr 30, 2025 -

Android Gamers Rejoice Flappy Birds Epic Games Store Debut

Apr 30, 2025

Android Gamers Rejoice Flappy Birds Epic Games Store Debut

Apr 30, 2025

Latest Posts

-

Authorities Decline To File Charges In The Death Of Hockey Player Adam Johnson

Apr 30, 2025

Authorities Decline To File Charges In The Death Of Hockey Player Adam Johnson

Apr 30, 2025 -

Cardano Ada Price Analysis Will Support Hold Or Trigger Further Decline

Apr 30, 2025

Cardano Ada Price Analysis Will Support Hold Or Trigger Further Decline

Apr 30, 2025 -

Preview Key Battles To Watch In Leeds Uniteds Home Match

Apr 30, 2025

Preview Key Battles To Watch In Leeds Uniteds Home Match

Apr 30, 2025 -

Swiateks Madrid Run Continues Narrow Victory Over Shnaider

Apr 30, 2025

Swiateks Madrid Run Continues Narrow Victory Over Shnaider

Apr 30, 2025 -

Trump Furious At Amazons Tariff Strategy Details Of The Phone Call

Apr 30, 2025

Trump Furious At Amazons Tariff Strategy Details Of The Phone Call

Apr 30, 2025