Macquarie Asset Management Units Sold To Nomura In Record-Breaking Deal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Macquarie Asset Management Sells Units to Nomura in Record-Breaking Infrastructure Deal

Macquarie Asset Management (MAM), a global leader in alternative asset management, has announced the sale of a significant stake in its infrastructure assets to Nomura, marking a record-breaking transaction in the infrastructure investment sector. The deal, the financial specifics of which remain undisclosed pending regulatory approvals, represents a major shift in the global infrastructure investment landscape and underscores the growing appetite for alternative assets.

This unprecedented sale highlights several key trends shaping the investment world. Firstly, it demonstrates the increasing institutional interest in infrastructure assets, seen as relatively stable and resilient investments even amidst economic volatility. Secondly, it underscores the consolidation occurring within the asset management industry, with larger players seeking to expand their portfolios and market share. Finally, it signals a significant confidence boost in the future prospects of global infrastructure development.

A Landmark Transaction in Infrastructure Investment

The sale involves a substantial portfolio of infrastructure assets managed by MAM, encompassing a diverse range of projects across various geographies. While the exact composition of the portfolio hasn't been publicly revealed, industry analysts speculate it likely includes stakes in energy, transportation, and utilities projects, reflecting MAM's established expertise in these sectors.

This deal surpasses previous records in terms of both the volume of assets transferred and the strategic implications for both Macquarie and Nomura. For MAM, it allows for strategic portfolio rebalancing and potentially frees up capital for future investment opportunities. For Nomura, it represents a significant expansion into the lucrative global infrastructure market, strengthening their position as a major player in alternative investments.

Implications for the Global Infrastructure Market

This transaction sends ripples throughout the global infrastructure investment market. It signals a period of significant growth and consolidation, likely prompting further large-scale deals in the coming months and years. Several key implications are worth considering:

- Increased Competition: The deal intensifies competition among global asset managers vying for a share of the burgeoning infrastructure investment market. We can expect to see increased activity and further consolidation in the sector.

- Higher Valuations: The record-breaking price likely reflects the high valuations currently placed on established infrastructure assets, driven by investor demand and the perceived long-term stability of these investments.

- Focus on Sustainable Infrastructure: With growing global concerns about climate change, the deal also suggests an increasing focus on sustainable infrastructure projects, attracting significant investment.

What's Next for Macquarie and Nomura?

Following the completion of the transaction, both MAM and Nomura are expected to continue their aggressive expansion strategies. MAM will likely focus on identifying new, high-growth investment opportunities, while Nomura will integrate the acquired assets into its existing portfolio and explore further acquisitions. This landmark deal sets a new benchmark for future transactions in the infrastructure investment space, promising a dynamic and evolving market landscape.

The long-term effects of this record-breaking sale will be keenly watched by investors and industry experts alike. As the global demand for infrastructure projects continues to grow, we can expect further strategic partnerships and significant capital flows into this crucial sector. This deal serves as a strong indicator of the ongoing evolution and growth within the global infrastructure investment landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Macquarie Asset Management Units Sold To Nomura In Record-Breaking Deal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

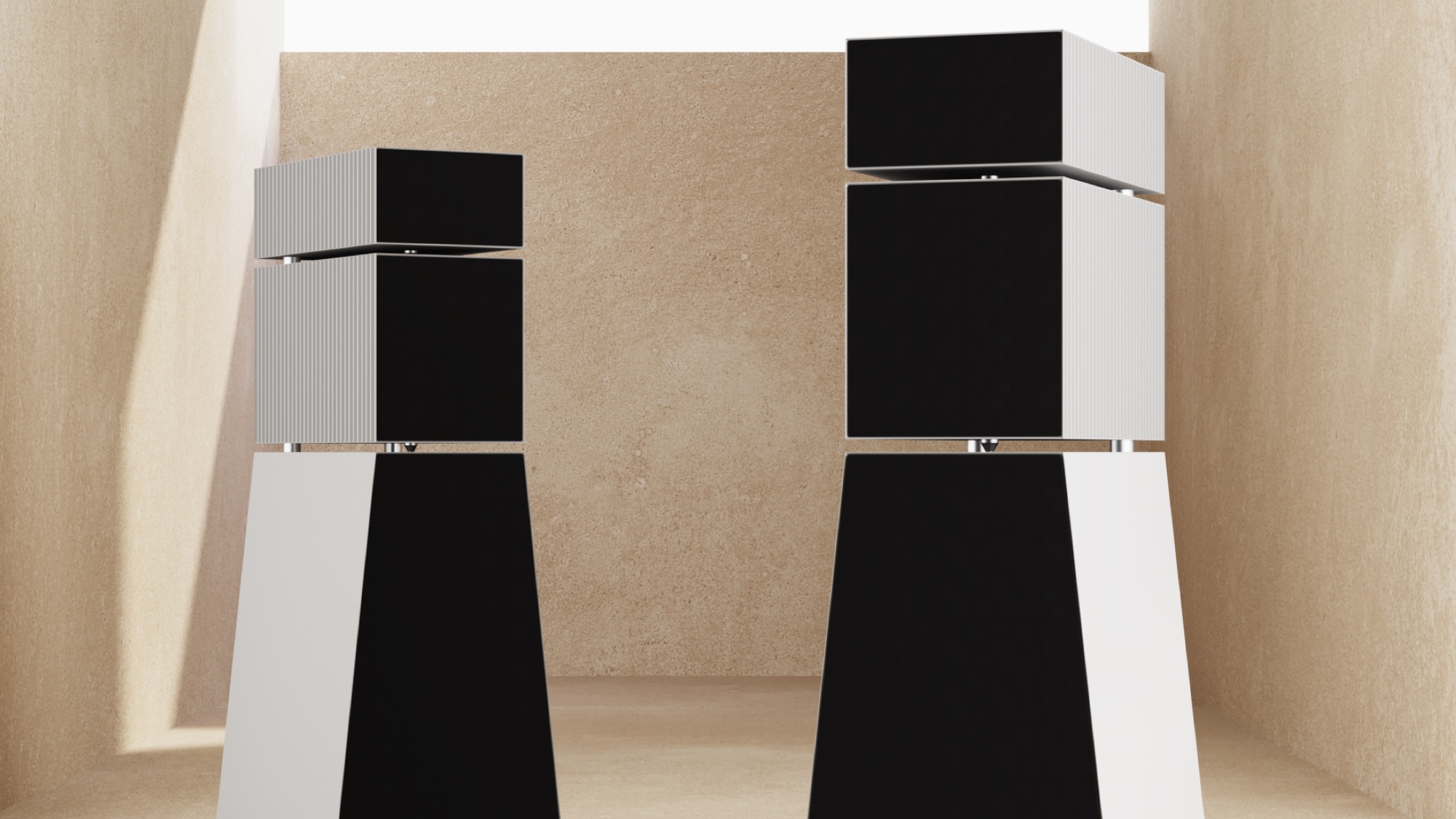

High End Audio The Design And Performance Of Unique Luxury Speakers

Apr 22, 2025

High End Audio The Design And Performance Of Unique Luxury Speakers

Apr 22, 2025 -

Game Changer Pedro Pascals Surprising Role In Hbos The Last Of Us

Apr 22, 2025

Game Changer Pedro Pascals Surprising Role In Hbos The Last Of Us

Apr 22, 2025 -

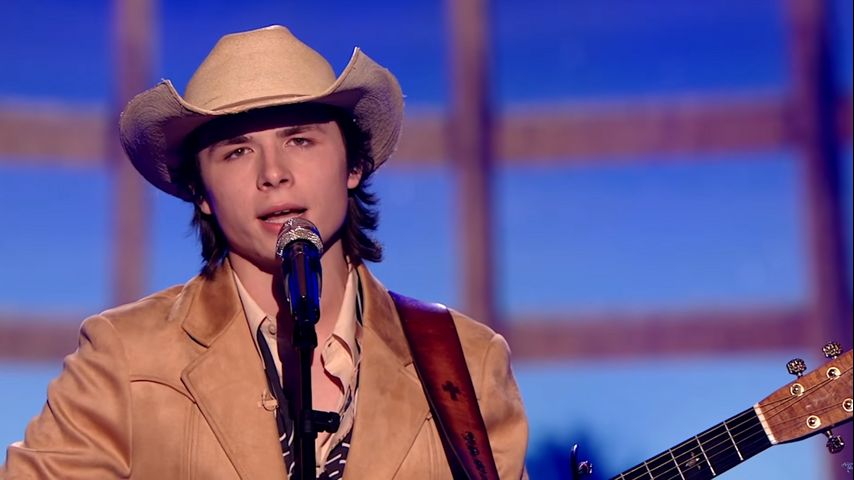

Addis Ababa American Idol Contestants Heartbreaking Tribute To Deceased Friend

Apr 22, 2025

Addis Ababa American Idol Contestants Heartbreaking Tribute To Deceased Friend

Apr 22, 2025 -

Ufc Insider Leaks Tom Aspinall And Jon Jones To Finally Clash

Apr 22, 2025

Ufc Insider Leaks Tom Aspinall And Jon Jones To Finally Clash

Apr 22, 2025 -

Tigers Contain Zimbabwe Mehidys 5 52 Crucial In Test Match

Apr 22, 2025

Tigers Contain Zimbabwe Mehidys 5 52 Crucial In Test Match

Apr 22, 2025