Macroeconomic Headwinds Prompt Analyst Predictions Of Q1 Guidance Revisions From DBS, OCBC, And UOB

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Macroeconomic Headwinds Force Singapore Banks to Revise Q1 Guidance: DBS, OCBC, and UOB in Focus

Singapore's banking giants, DBS, OCBC, and UOB, are bracing for potential revisions to their Q1 2024 guidance as macroeconomic headwinds intensify. Analysts predict a challenging quarter marked by slower-than-expected loan growth and increased provisions for non-performing loans (NPLs). This follows a period of robust growth fueled by rising interest rates and a strong regional economy. The shift signals a potential cooling of the Singaporean banking sector, prompting investors to closely monitor the upcoming earnings reports.

Weakening Global Economic Outlook: The primary driver behind these anticipated revisions is the increasingly uncertain global economic outlook. Factors such as persistent inflation, rising interest rates globally, and geopolitical instability are dampening economic activity worldwide. This directly impacts Singapore's export-oriented economy and, consequently, the performance of its major banks.

Impact on Loan Growth and NPLs: Analysts predict a slowdown in loan growth across various sectors. The anticipated reduction in corporate investments and consumer spending will likely lead to lower demand for loans. Simultaneously, the challenging economic climate increases the risk of defaults, forcing banks to set aside larger provisions for NPLs. This directly impacts profitability and could lead to downward revisions in earnings forecasts.

DBS, OCBC, and UOB: A Closer Look:

-

DBS: As Southeast Asia's largest bank, DBS is particularly exposed to regional economic fluctuations. Analysts anticipate a more conservative outlook from DBS due to its extensive international operations.

-

OCBC: OCBC, with a strong presence in the Singaporean market and significant regional exposure, is also expected to adjust its Q1 guidance to reflect the current macroeconomic realities.

-

UOB: UOB, known for its focus on the Asian market, is likely to experience similar pressures, albeit possibly to a lesser extent compared to DBS and OCBC, given its specific regional portfolio focus.

Analyst Predictions and Market Reactions: Several leading financial analysts have already voiced concerns, suggesting potential downward revisions in earnings per share (EPS) for all three banks. The market has reacted cautiously, with share prices of these banking giants experiencing some volatility in recent weeks. This underscores the level of investor concern regarding the impact of the macroeconomic headwinds.

What to Watch For: Investors and analysts will be keenly watching for the following key indicators in the upcoming Q1 earnings reports:

- Net Interest Income (NII): While rising interest rates initially boosted NII, the potential slowdown in loan growth could mitigate this positive effect.

- Non-Performing Loan (NPL) ratio: A rising NPL ratio will be a key indicator of the banks' ability to manage credit risk in the current economic climate.

- Loan growth across sectors: The pace of loan growth in various sectors, such as corporate lending and consumer lending, will provide crucial insights into the overall economic health.

- Management commentary: The tone and outlook provided by management during earnings calls will offer valuable clues regarding future expectations.

Conclusion: The confluence of global macroeconomic headwinds presents a significant challenge to Singapore's major banks. The anticipated Q1 guidance revisions from DBS, OCBC, and UOB highlight the need for a cautious outlook. Investors and analysts must closely monitor the upcoming earnings announcements for a clearer picture of the sector's performance and future prospects. The resilience and strategic response of these banking giants will be crucial in navigating these uncertain times.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Macroeconomic Headwinds Prompt Analyst Predictions Of Q1 Guidance Revisions From DBS, OCBC, And UOB. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

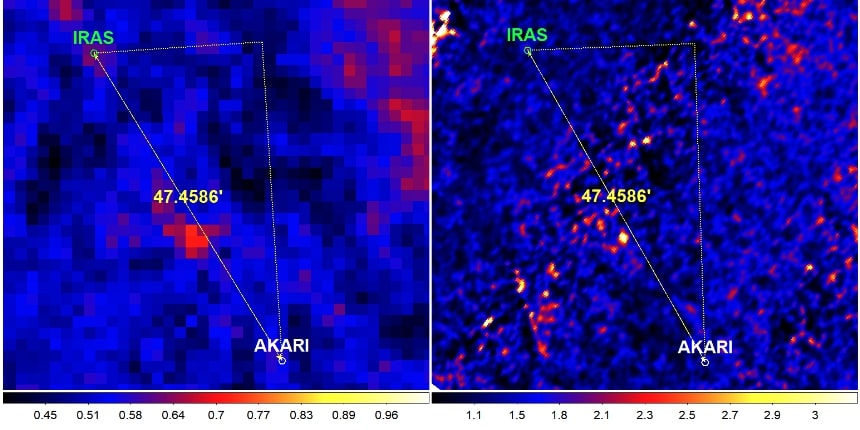

Iras And Akari Data Suggest Potential Location For Hypothetical Planet Nine

May 05, 2025

Iras And Akari Data Suggest Potential Location For Hypothetical Planet Nine

May 05, 2025 -

Alejandra Silva Announces Familys Relocation From Spain To The United States

May 05, 2025

Alejandra Silva Announces Familys Relocation From Spain To The United States

May 05, 2025 -

Nuggets Key Players Adelman Jokic Porter Westbrook Murray Analyzed

May 05, 2025

Nuggets Key Players Adelman Jokic Porter Westbrook Murray Analyzed

May 05, 2025 -

Alejandra Silva Confirms Richard Gere Familys Relocation To America

May 05, 2025

Alejandra Silva Confirms Richard Gere Familys Relocation To America

May 05, 2025 -

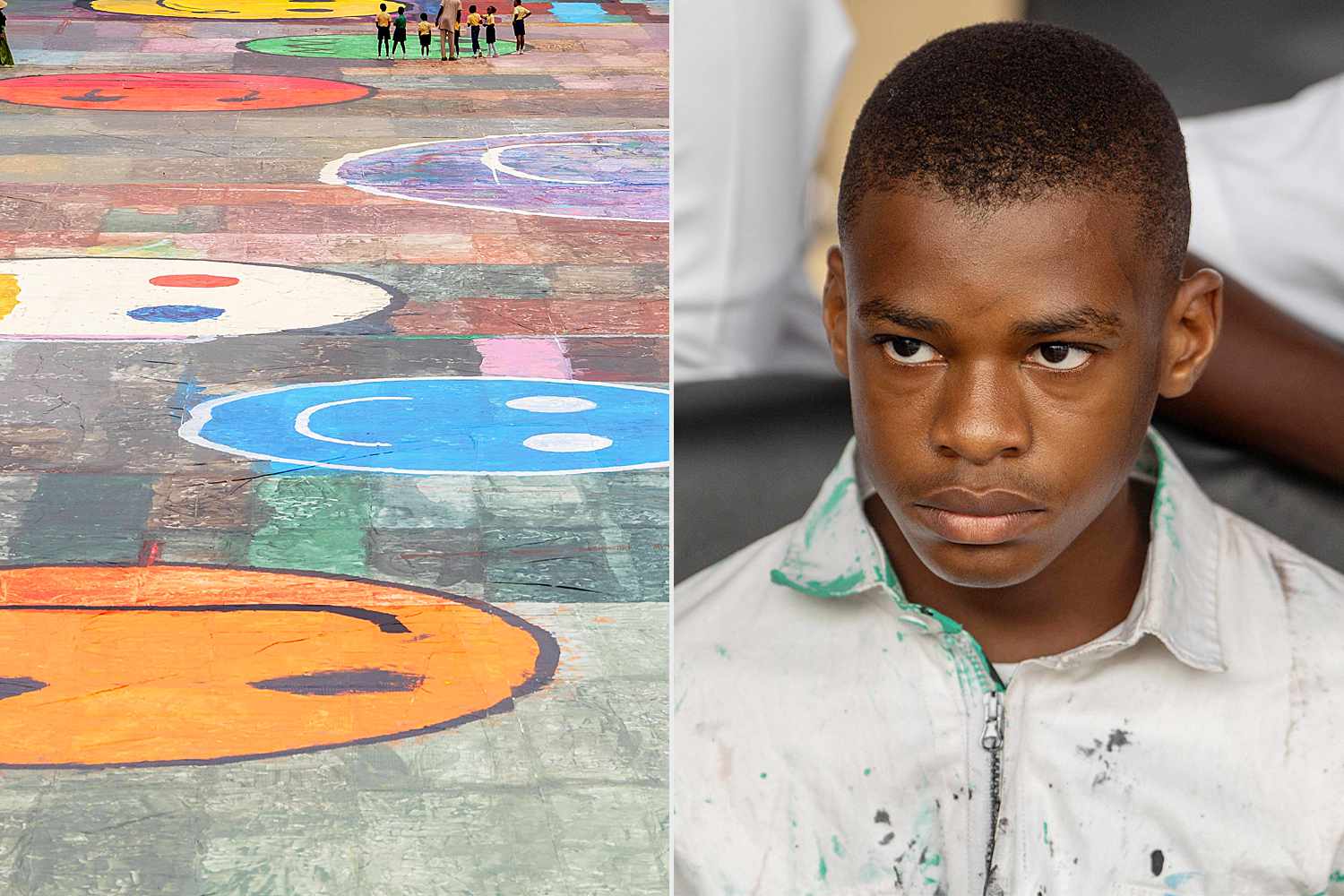

Teen With Autism Creates Record Breaking Masterpiece On Canvas

May 05, 2025

Teen With Autism Creates Record Breaking Masterpiece On Canvas

May 05, 2025